The total value of assets locked (TVL) on the Solana blockchain has reached a new yearly high on the back of SOL’s impressive price performance over the past week.

On October 22, Solana’s TVL reached a high of roughly $350 million, according to data from crypto data aggregator DeFiLlama.

Solana DeFi TVL Adds $20M in 24 Hours

Per DeFillama data, the Solana DeFi sector grew by around $20 million, equating to a 12.2% growth during the last 24 hours.

This places the network as the top gainer amongst the top 10 chains by TVL during the reporting period, outperforming storied rivals like BSC Chain, Ethereum, and others.

This growth continues a year-long trend that has seen Solana’s TVL increase by more than 40% from the $210.47 million recorded on January 1.

BeInCrypto previously reported that the blockchain network’s TVL had reached a yearly high of $337 million.

Meanwhile, the increasing TVL underscores the influx of investors and interest Solana’s DeFi ecosystem has generated. Over time, Solana has established numerous partnerships within the cryptocurrency industry and traditional sectors.

This year, Solana joined forces with Visa and Shopify. It also recently became the ecosystem partner to the Dubai Multi Commodities Centre, an economic free zone within the UAE.

However, it’s important to note that Solana’s current TVL remains below its all-time high of more than $10 billion recorded during the bull run of 2021.

SOL Price Performance Top Weekly Gainers

Solana has seen substantial gains in the past week in line with the broader cryptocurrency market trends. During the period, Bitcoin, the flagship digital asset, saw its value spike above $30,000 as investors anticipated the launch of a spot BTC exchange-traded fund (ETF).

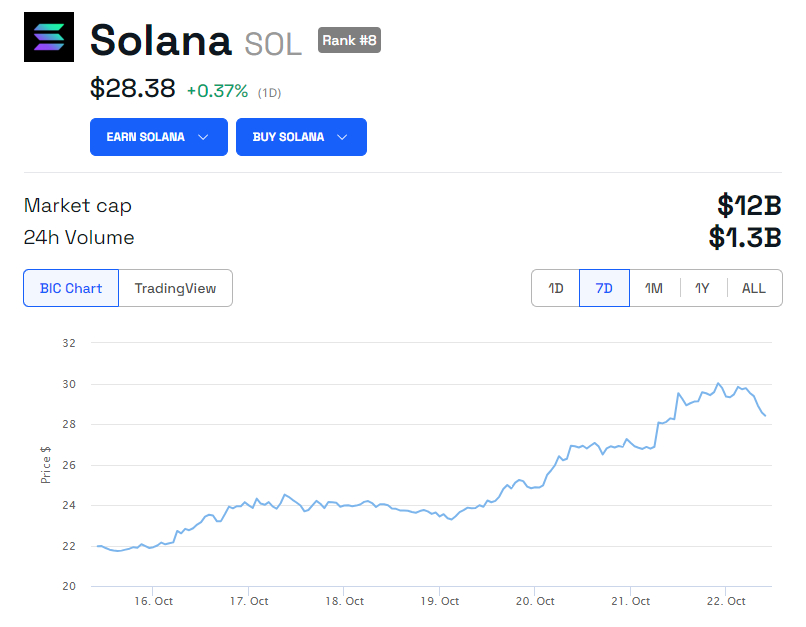

Data from BeInCrypto shows that the SOL coin has experienced a remarkable 33.9% price increase over the past seven days, nearing the $30 mark. However, the digital asset has slightly retraced to $28.38 as of press time.

Meanwhile, market observers note that SOL faces significant headwinds as bankrupt FTX and its sister company, Alameda Research, hold more than a billion worth of it. These holdings might negatively impact SOL’s price performance when the firms begin dumping as the Court orders.