The Jihan Wu-backed crypto asset platform Matrixport will reportedly abandon its Solana (SOL) and SOL-U products before the end of the year. This comes amid prolonged declines in its price and total value locked.

The company will not only halt offering the asset and dual-currency investment products, according to blockchain journalist Colin Wu, but it will also refrain from introducing any new Solana products in the future.

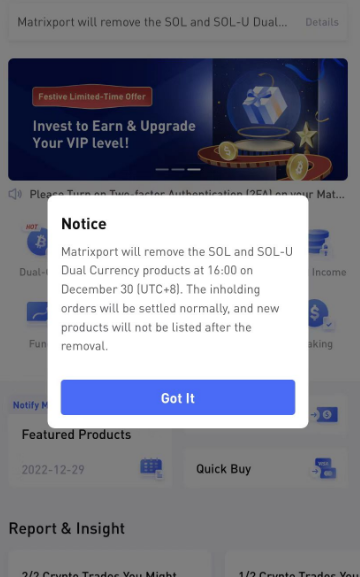

Matrixport confirmed the announcement on its mobile app.

In June, the crypto financial services platform extended its flagship Dual-Currency Product to Solana (SOL).

Matrixport’s announcement came days after two top-ranking Solana-based NFTs revealed that they would leave the blockchain. DeGods and y00ts will soon be migrating to Ethereum and Polygon, respectively.

The decision also becomes crucial as Matrixport targets $100 million in funding, as Bloomberg reported in November. Since the FTX collapse, the market has been struggling with a liquidity crisis. The report suggests that the Singaporean lender has commitments from lead investors for $50 million at a valuation of $1.5 billion.

Solana Struggles to Recover

In the last year, Solana is down over 94% on CoinGecko. Furthermore, per DeFiLlama data, Solana’s total value locked has sunk to $225 million. This marks a massive spiral down from a $10 billion TVL that it clocked in November 2021.

In a recent report, Bloomberg mentioned there are worries that large holders may be poised to sell the asset. Given its tight ties to FTX and co-founder Sam Bankman-Fried, it was noted by Martin Lee, a data journalist at Nansen, that general trust in Solana’s prospects has taken a hit.

Crunchbase indicated that Solana has cumulatively raised $315.8 million in investments via 9 rounds—the most recent being a corporate round on Aug. 19, 2021. That said, 38 investors are funding Solana, including brands like Buck Stash and Tor Kenz Capital, per the platform.

Arthur Hayes: SOL Is a ‘Sh*tcoin’

Amid its price action struggles, Arthur Hayes, co-founder and former CEO of BitMEX, took to Twitter to call Solana a ‘sh*tcoin.’ However, he suggested it could be a candidate altcoin to trade as an inverse play.

He argued, “Nothing ever goes up or down in a straight line.”

Notably, the network has had multiple disruptions in 2022 that have delayed the settlement of transactions. Since its launch in March 2020, Solana has crashed eight times as a result of either memory overflow, bugs, or power outages. The blockchain went offline for several hours back in May and then again in June. In October, the network was offline due to another validator problem.

Meanwhile, Solana co-founder and COO Raj Gokal took it as a second awakening for the project. He expressed optimism on Twitter, stating, “every bad actor washing out of this ecosystem makes it more decentralized.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.