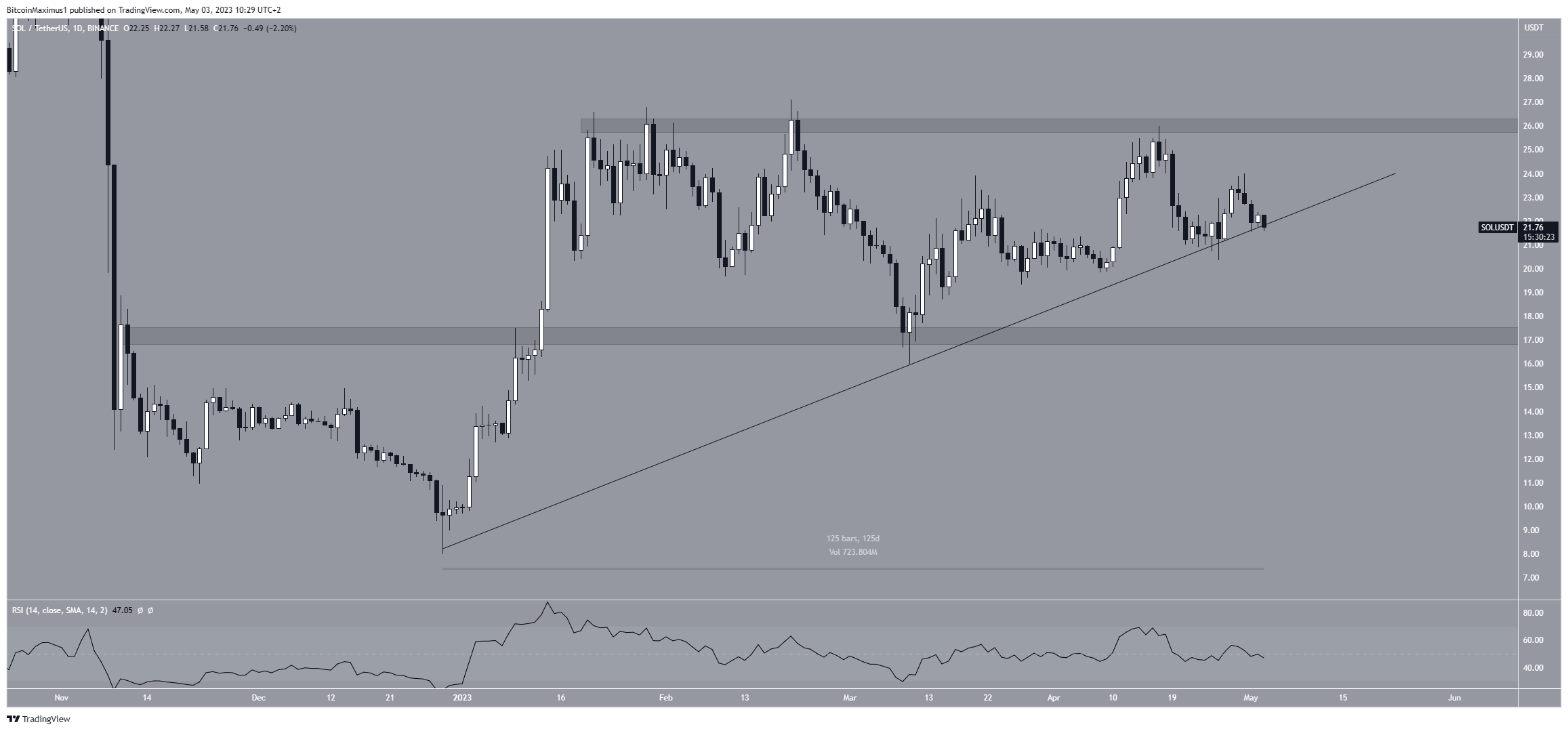

The Solana (SOL) price is at risk of breaking down from an ascending support line that has been in place since the start of the year.

Since the line has been in place for a long period of time, the breakdown below it would mean that the ongoing increase has ended. So, it could cause a sharp decrease toward the closest support.

Solana Price Risks Breakdown From Long-Term Structure

The SOL price has increased alongside an ascending support line since the start of 2023. While doing so, it reached a yearly high of $27.12.

However, the price has fallen since April 20 and is in the process of breaking down from the line. Since the line has been in place for 125 days, a breakdown from it would be a decisive bearish development.

The Relative Strength Index (RSI) gives a neutral reading. Traders utilize the RSI as a momentum indicator to assess whether a market is overbought or oversold, and to determine whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true.

SOL Price Prediction: Will Correction Continue?

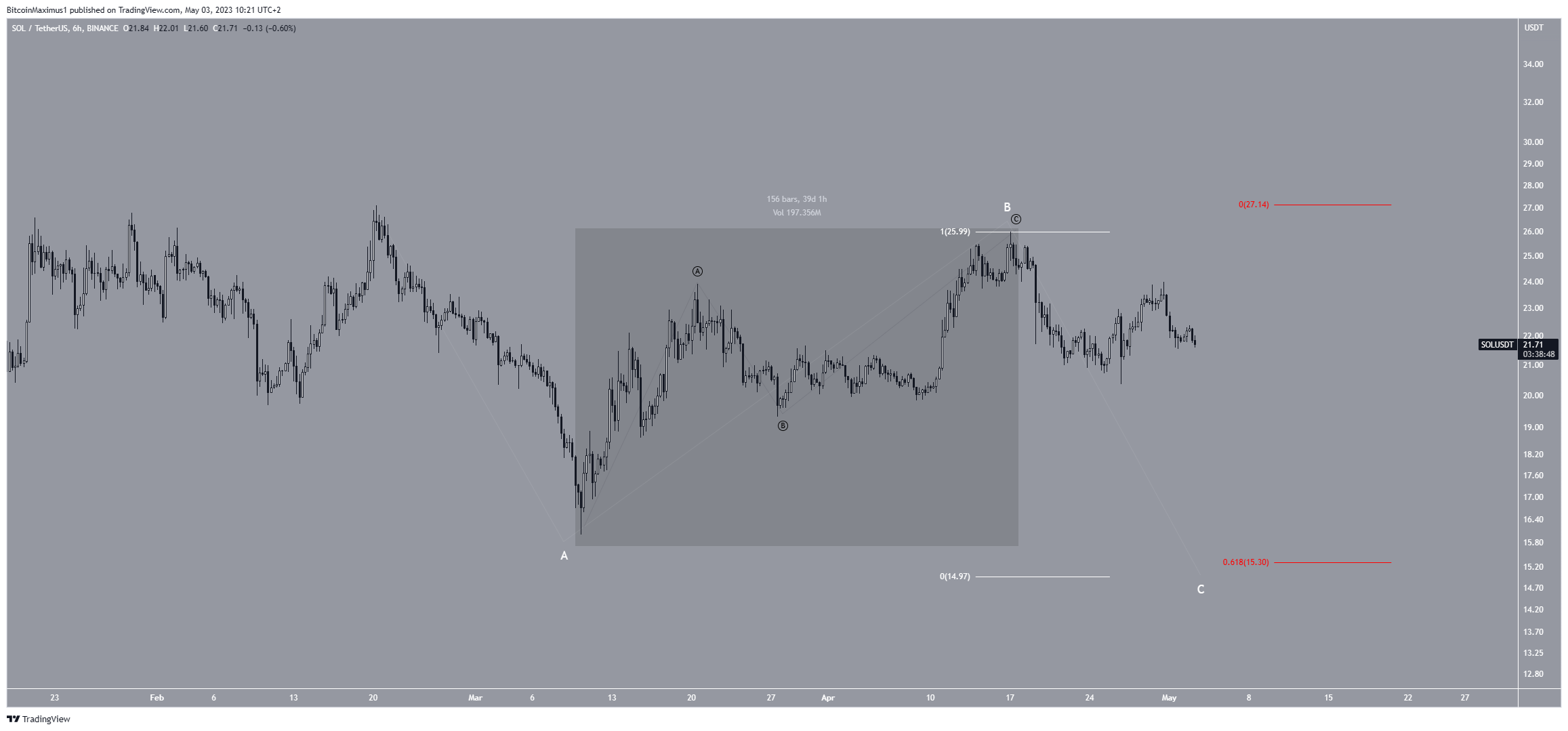

According to technical analysis and price action from the six-hour time frame, the ongoing downward movement in Solana is expected to continue, leading to a bearish SOL price prediction.

This is mainly due to the wave count. Technical analysts use the Elliott Wave theory to determine the trend’s direction by studying long-term price patterns and investor psychology.

The movement in March and April (highlighted) appears to be a corrective structure, resembling a short-term A-B-C pattern. Since the movement is upward, the Elliott Wave theory suggests that the dominant trend is likely to be downward.

The decrease since the yearly high may also be another larger A-B-C corrective structure, with a low of $15 predicted if waves A:C have a 1:1 ratio (white).

Although this price level is below the previously identified horizontal support area, it coincides with the 0.618 Fib retracement support level (red).

Fibonacci retracement levels suggest that after a significant price change in one direction, the price will retrace or revisit a previous price level before resuming its original direction. As a result, this area is likely to act as a bottom for the price.

Looking at the above, it can be derived that The closest support area is at $17. While the next resistance is at $26.

If the SOL price increases above $26, it will indicate that the trend is still bullish. Therefore, the price may continue to rise toward at least $32.

For BeInCrypto’s latest crypto market analysis, click here.