The Solana (SOL) price has been falling since it was rejected by a long-term resistance line in April, suggesting that the trend is bearish.

While a short-term breakout has transpired, the long-term trend is considered bearish until SOL manages to move above the long-term resistance line.

Solana Falls After Long-Term Rejection

The value of SOL has dropped below a descending resistance line that has been in place since its all-time high in November 2021. This long-term pattern indicates a negative outlook as long as SOL continues to trade below the line.

Learn more about Solana:

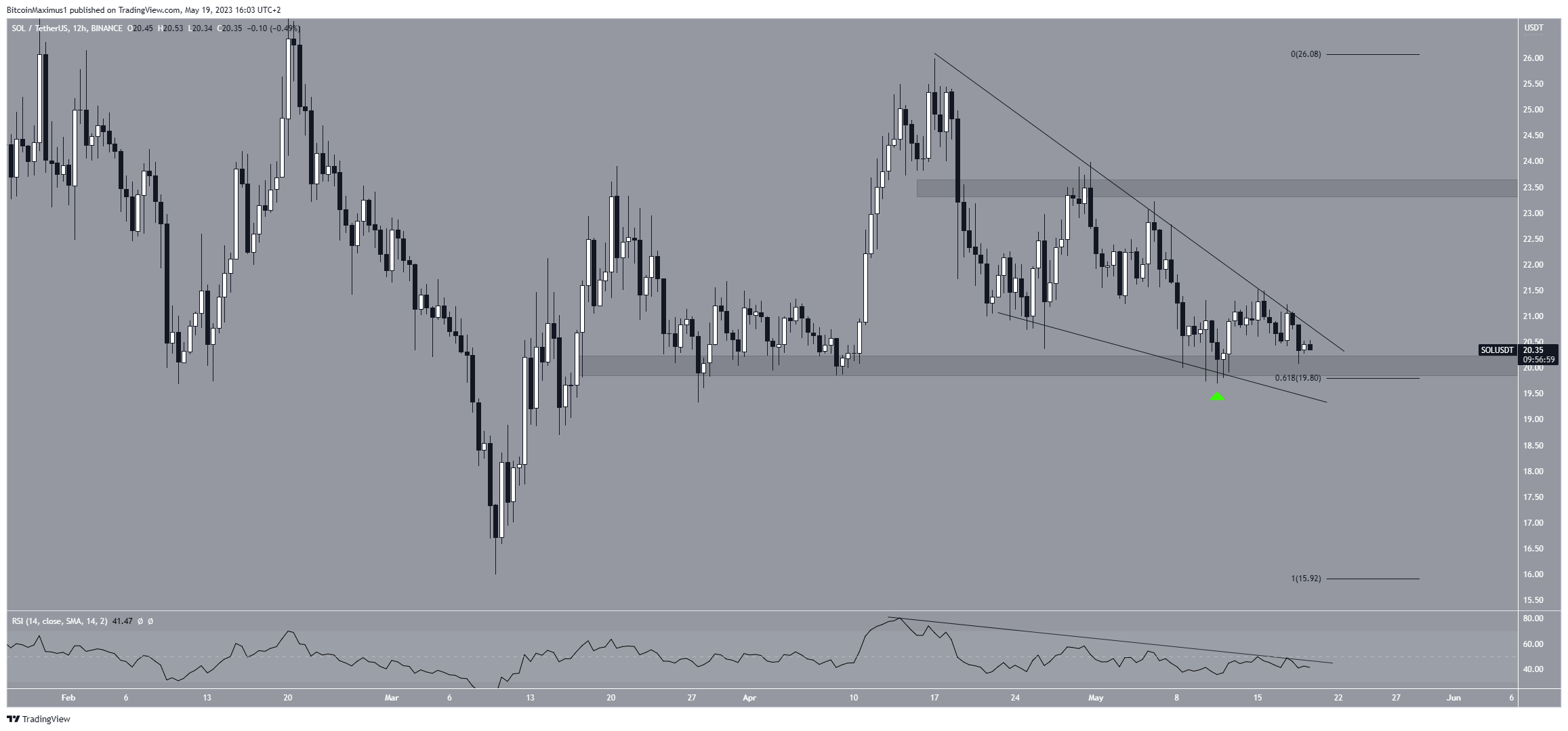

In April 2023, the price was rejected by the $26 resistance area and the descending resistance line (red circle). Due to this confluence, the importance of the level becomes more noticeable.

The SOL price has fallen since, creating several bearish weekly candlesticks.

Additionally, the RSI provides a bearish reading. Traders utilize the RSI as a momentum indicator to assess whether a market is overbought or oversold, and to determine whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. The 50 line (red icon) rejected the indicator at the same time the resistance line rejected the price.

So, the RSI now gives a bearish reading.

SOL Price Prediction: Will Bullish Pattern Lead to Breakout?

The technical analysis from the short-term daily time frame is more bullish than the weekly one. The main reason for this is the breakout from a descending wedge that had been in place since April 17.

The descending wedge is considered a bullish pattern. As a result, a breakout from it is the most likely scenario.

Aligning with the price breakout, the RSI also broke out from its own descending resistance line. Since the indicator is now above 50, the trend is considered bullish.

However, the breakout is insufficient to invalidate the entire bearish readings from the weekly time frame.

Read More:

As a result, the most likely SOL price prediction states that the price will increase to the 0.618 Fib retracement resistance level at $23. The level now coincides with the long-term resistance line.

However, a weekly close above the $23 level and the long-term resistance line will mean that the SOL price trend is bullish.

In that case, another upward movement to $30 could follow.

For BeInCrypto’s latest crypto market analysis, click here.