Slovakia’s National Council has voted to reduce taxes on profits from crypto sales and taxation on payments under $2,600.

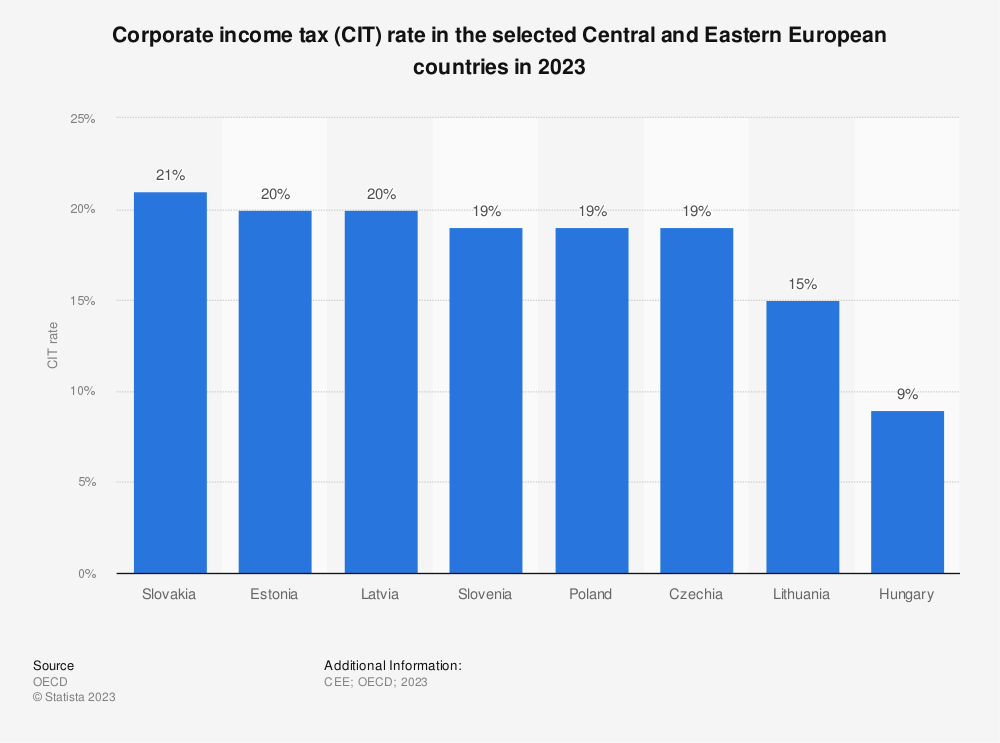

The government cut crypto taxes to 7% from a sliding scale of 19% to 25% in a move that could cost the government millions.

MiCA Doesn’t Address Tax

Companies will not have to pay taxes on receipts of €2,400 ($2,600) or less. Citizens will not have to contribute 14% towards health insurance from crypto income.

The latest tax measures will reduce annual income the government collects by €30 million, the country’s finance ministry said on Wednesday.

Additionally, the government will expand the pool of investors authorized to dabble in products. The aim is to “reduce the tax burden in connection with the sale of virtual currencies, thereby simplifying their use in everyday life,” says the Slovak National Council.

Portugal, also an EU state, charges no value-added tax for cryptocurrency payments. However, companies offering crypto-related services must pay 28 and 35% in capital gains tax. Those earning their primary income from Bitcoin trading must file tax returns.

Conversely, a non-EU member, Switzerland, charges no tax on capital gains or income. However, it charges 0.5-0.8% in wealth taxes on assets, including crypto.

EU Laws Impose Stiffer Tax Rules to Close Loopholes

Slovakia is a member of the European Union, which recently passed the Markets in Crypto-Assets bill. The bill, due to come into force in 2024, mainly handles crypto asset disclosure and exchange registration requirements. It does not specify tax brackets for cryptocurrency transactions or income.

However, EU finance ministers from member states agreed on new DAC8 reporting rules for crypto service providers in May.

Local and foreign companies must report on transactions annually to help tax authorities populate income tax forms. Citizens must confirm their crypto trading information is correct when filing returns.

US lawmaker Brad Sherman recently co-penned a letter demanding the US Treasury finalize rules on crypto taxation. The Internal Revenue Service (IRS) uses cybersecurity firm AnChain.ai’s tools to track fund flows associated with tax evasion.

Get the full lowdown on filing crypto taxes here.

IRS rules treat crypto as property for taxation purposes.

Got something to say about Slovakia crypto taxes or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.