The central bank of Singapore has announced it will be investing approximately $112 million to invest in technological innovation in finance. Those resources will include funding for Web3 solutions.

On Monday, the Monetary Authority of Singapore (MAS) confirmed the allocation of three years of funding for the Financial Sector Technology and Innovation Scheme (FSTI). Its stated aim is to support projects on the “cutting edge” of finance.

The Third Iteration of Singapore’s FSTI

The MAS’s statement also explicitly mentions “Web 3.0,” a term used to describe the next iteration of the internet. Its definition usually encompasses a decentralized web, cryptocurrencies, self-sovereignty of data, and interoperability across platforms. In essence, a digital world that is not controlled by a handful of tech giants.

The announcement also confirms that MAS will conduct open calls for projects. Allowing Singaporean and international firms to apply for grant funding. According to the statement, the funds will be used to support “actual trial and commercialization.”

Ravi Menon, Managing Director, MAS, believes that Singapore has not been lax when it comes to fostering innovation and competing with other tech hubs. In the official statement, Menon claimed:

“Since 2015, the Financial Sector Development Fund (FSDF) has awarded $340 million as part of the FSTI programme to drive the adoption of technology and innovation in the financial sector.… With FSTI 3.0, we look forward to continued collaboration with the industry to advance purposeful financial innovation.”

Announcement Includes Boost for AI and RegTech

Also included in the package is support for corporate venture capital (CVC) entities. The Enhanced Center of Excellence track, formerly the Innovation Labs track, will now provide grant funding to larger firms to invest in the start-ups of the future.

The funding will cover up to 50% of qualifying expenses, with a maximum cap of S$2 million per project. Although this will include manpower and rental costs.

Stay on the cutting-edge of technology with these Machine Learning tips: Top 7 Machine Learning Applications in 2023

The FTSI will also feature help for Artificial Intelligence and Data Analytics (AIDA), and Regulation Technology (RegTech), and a boost for Environmental, Social, and Governance (ESG) Fintech solutions.

This third iteration of the FTSI was first announced by Lawrence Wong, deputy prime minister, minister for finance, and deputy chairman of the Monetary Authority of Singapore, at the Singapore FinTech Festival on November 2, 2022.

The city-state has long been on the cutting edge of technological change. It currently ranks as the seventh most innovative nation in the world in the latest Global Innovation Index (GII) 2022 released by the World Intellectual Property Organization (WIPO). Singapore moved one place up the ranking compared to the previous year.

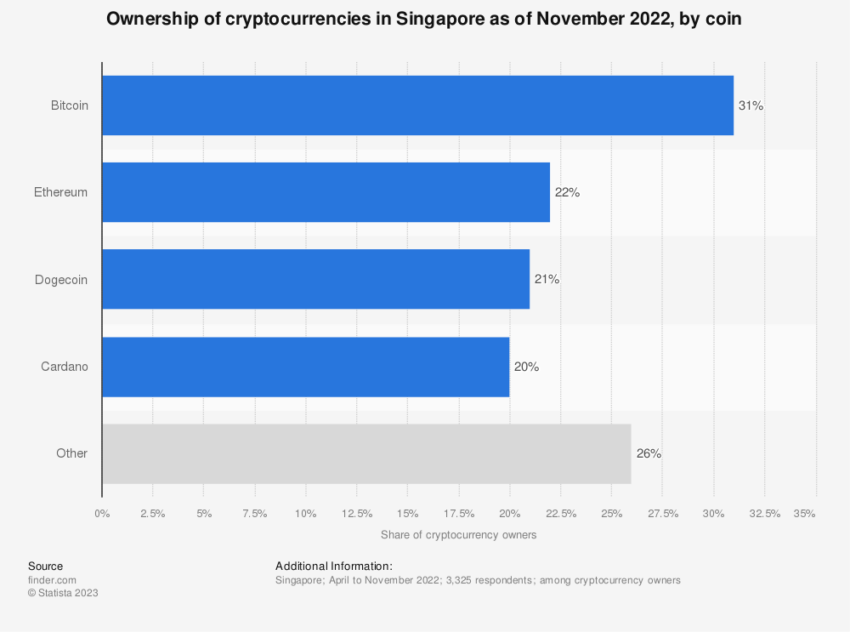

However, while Singapore is a tech-friendly society more broadly, it ranked only 63rd on Chainalysis’s latest Crypto Adoption Index. Although the jurisdiction is still making legal and regulatory strides in the area.

On July 26, a Singaporean judge ruled that crypto assets were property able to be “held in trust.” The groundbreaking court judgment sets a precedent for the treatment of cryptocurrencies. From now on, courts can treat crypto assets as subject matter in enforcement orders.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.