BeInCrypto takes a look at the price movement for seven different cryptocurrencies, including SHIBA INU (SHIB), which has broken out from its ascending parallel channel.

BTC

BTC is currently trading inside the $44,300 horizontal resistance area. Since Jan 10, this is the third attempt at breaking out. On Feb 15, BTC reached the highest close since the upward movement began.

Technical indicators are bullish, since both the RSI and MACD are increasing. Therefore, they both support the continuation of the upward movement.

If a breakout transpires, the next closest resistance would be at $51,100. This is the 0.5 Fib retracement resistance level and a horizontal resistance area.

ETH

On Feb 6, ETH broke out from a descending resistance line that had previously been in place since Dec 1. Afterwards, it returned to validate it as support on Feb 13 (green icon). The price has been moving upwards since.

The next closest resistance area is at $3,700. This is a horizontal area that previously acted as support.

Furthermore, it is found between the 0.5 and 0.618 Fib retracement resistance levels when measuring the entire downward movement.

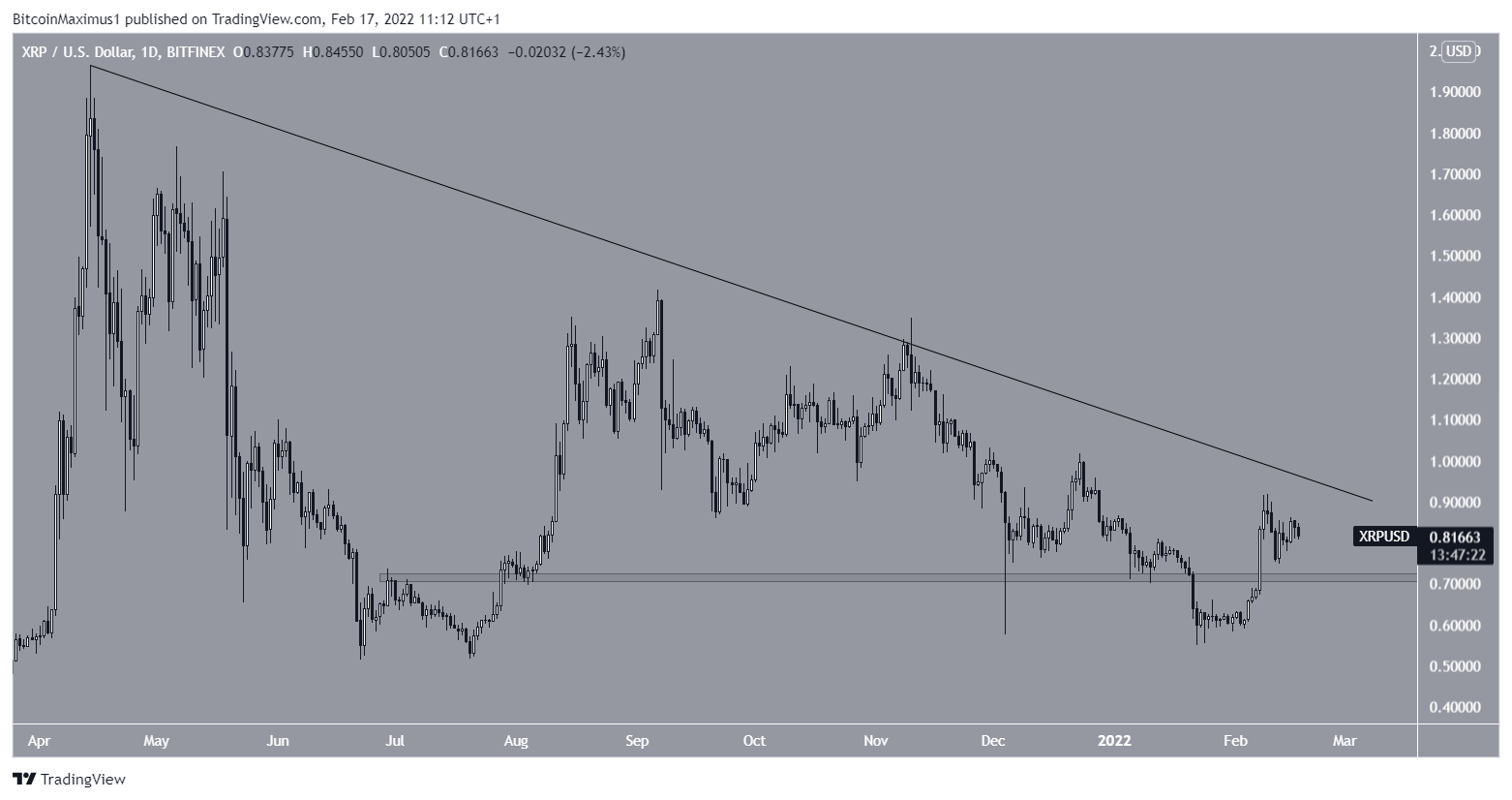

XRP

XRP has been decreasing alongside a descending resistance line since April 16, 2021. This downward movement initially caused a breakdown below the $0.72 horizontal area in the beginning of Jan 2022.

However, the price has been moving upwards since and reclaimed the area shortly afterwards. It is now approaching the descending resistance line once more.

A breakout above this line would be expected to accelerate the rate of increase.

BNB

Similarly to ETH, BNB had been decreasing alongside a descending resistance line since the beginning of Dec. This downward movement led to a low of $336 on Jan 24 (green icon).

The ensuing bounce served to validate the $335 horizontal area as support. Afterwards, BNB managed to break out from the descending resistance line on Feb 15.

If the upward movement continues, the next closest resistance area would be at $500.

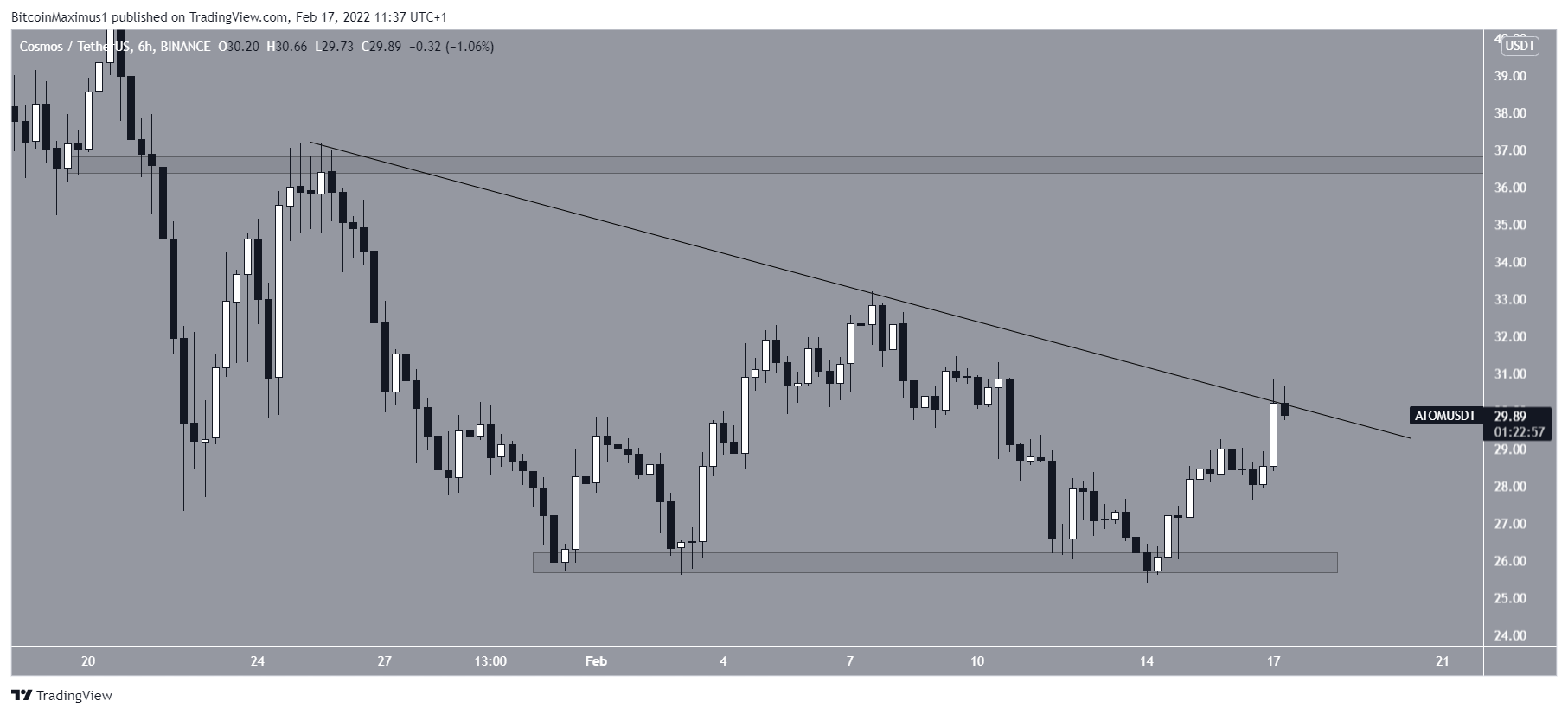

ATOM

On Jan 31, ATOM reached a low of $31.50. After drooping to this level again, it initiated an upward movement which led to a high of $33.19 on Feb 7.

Afterwards, ATOM decreased again and reached the $26 level once more, doing so on Feb 14. This effectively created a triple bottom pattern. ATOM has been increasing since.

Currently, it is making its third attempt at breaking out from a descending resistance line.

If successful, the next resistance would be at $36.60.

SHIB

SHIB has been moving upwards since Jan 22, when it reached a low of $0.000017. So far, it has reached a high of $0.000035 doing so on Feb 7.

Afterwards, SHIB decreased and validated the resistance line of the channel as support (green icon).

As long as the price is trading above this channel, the trend remains bullish.

NEAR

NEAR has been moving downwards since Feb 7. The downward movement caused a breakdown from an ascending support line on Feb 10.

Since then, NEAR has initiated a bounce. However, it was rejected by the ascending support line (red icon) on Feb 17.

Until NEAR reclaims it, the trend cannot be considered bullish.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.