Shiba Inu (SHIB) price has dropped 10% since reaching the local high of $0.0000012 on April 15. But on-chain data suggest that bears are not done yet. How much further will SHIB price decline?

Shiba Inu ecosystem has faced challenges in recent weeks. Despite a flurry of product launches and partnerships, market capitalization’s 2nd largest meme coin has struggled to acquire new users. Could this hurt SHIB price performance in the coming weeks?

Shiba Inu Network Growth Has Hit a Steep Decline

Over the past two weeks, Shiba Inu has struggled to attract new network participants. According to data compiled by Santiment, Shiba Inu Network growth has reduced by 30%, from 1,624 on Apr. 16 to 1,147 at the close of Apr. 25.

Network Growth typically measures the number of new wallet addresses created on a blockchain. And when it decreases persistently, like observed above, it indicates that the underlying token could struggle to find new demand to help dispel the bearish momentum.

As a result, the SHIB price could enter a prolonged downswing in the coming days.

SHIB Appears Overvalued at Current Prices

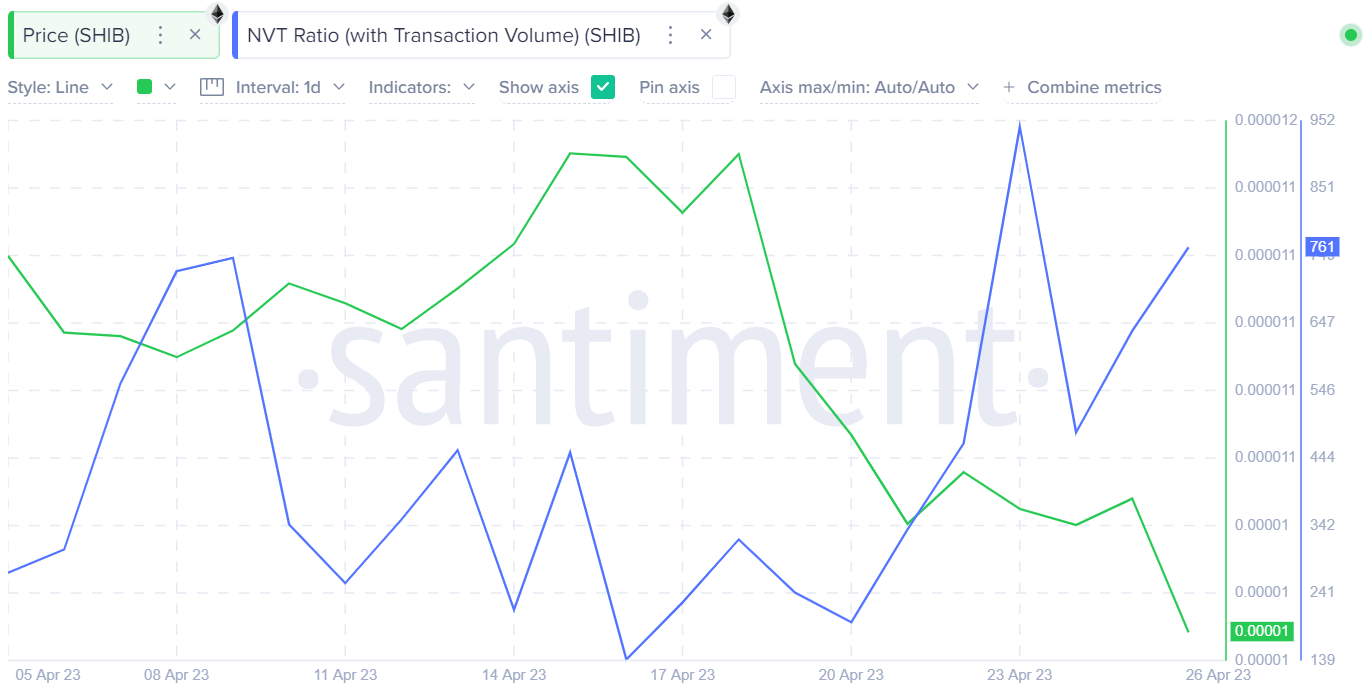

Looking at the Network Value to Transaction Volume (NVT) ratio on the Shiba Inu network, SHIB appears to be overbought around the current prices. The NVT ratio tracks the valuation of a blockchain network in relation to its transactional activity. It is calculated by dividing the total market capitalization by daily transaction volume.

The chart below shows that, between April 16 and April 26, the SHIB NVT ratio surged by more than 400%, from 141.16 to 772.57.

A high NVT ratio indicates that the market capitalization of the cryptocurrency is not supported by its underlying transactional activity. This bearish signal suggests that the SHIB may currently be overvalued and due for a further price correction.

SHIB Price Prediction: Reversal to $0.000008 is on the Cards

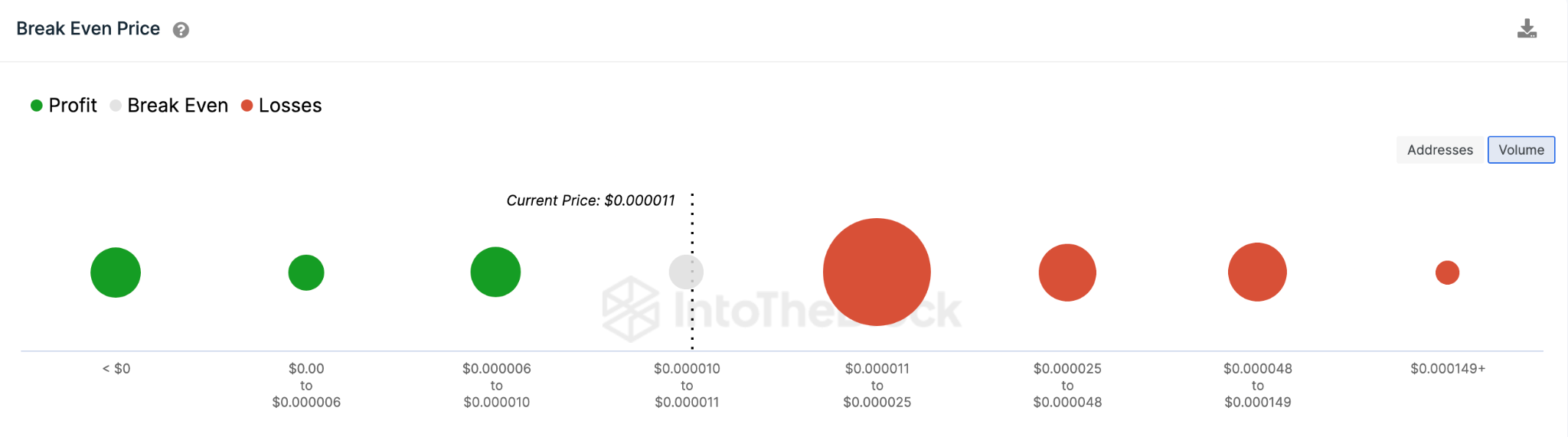

According to IntoTheBlock’s Break-Even Price distribution data, Shiba Inu bears will likely force a downsizing to $0.000008.

Currently, the 36,000 addresses that bought 10.64 trillion SHIB tokens are expected to offer considerable support when the price approaches its break-even zone at $0.000010.

But that support folds as expected, then the Shiba Inu price will likely decline toward $0.000008. At this support level, however, bullish pressure from another cohort of break-even 252,000 addresses holding 60 trillion tokens could prevent a further slump.

Still, the bulls can negate this pessimistic narrative if SHIB price can rise beyond $0.000010. But as seen above, some of the 36,000 addresses holding 10.64 trillion tokens at that price range could pose some resistance.

But if that resistance level fails to hold, the Shiba Inu bulls can ride the rally toward $0.000016.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.