“Sell in May and Go Away” is a popular saying in the business and finance industry that suggests a strategy for investing in stocks but can also be used in the cryptocurrency market. The idea behind this strategy is that the stock market tends to perform poorly during the six months between May and October.

The “Sell in May and Go Away” strategy entails selling stocks at the beginning of May or late spring and holding the proceeds in cash until November or late autumn when investors would reinvest in the stock market. The rationale behind this approach is to avoid holding stocks during the summer months.

In this article, the previous performance of the crypto market cap in the months of May – October will be analyzed with a special emphasis placed in May.

Historical Crypto Market Cap (TOTALCAP) Performance in May

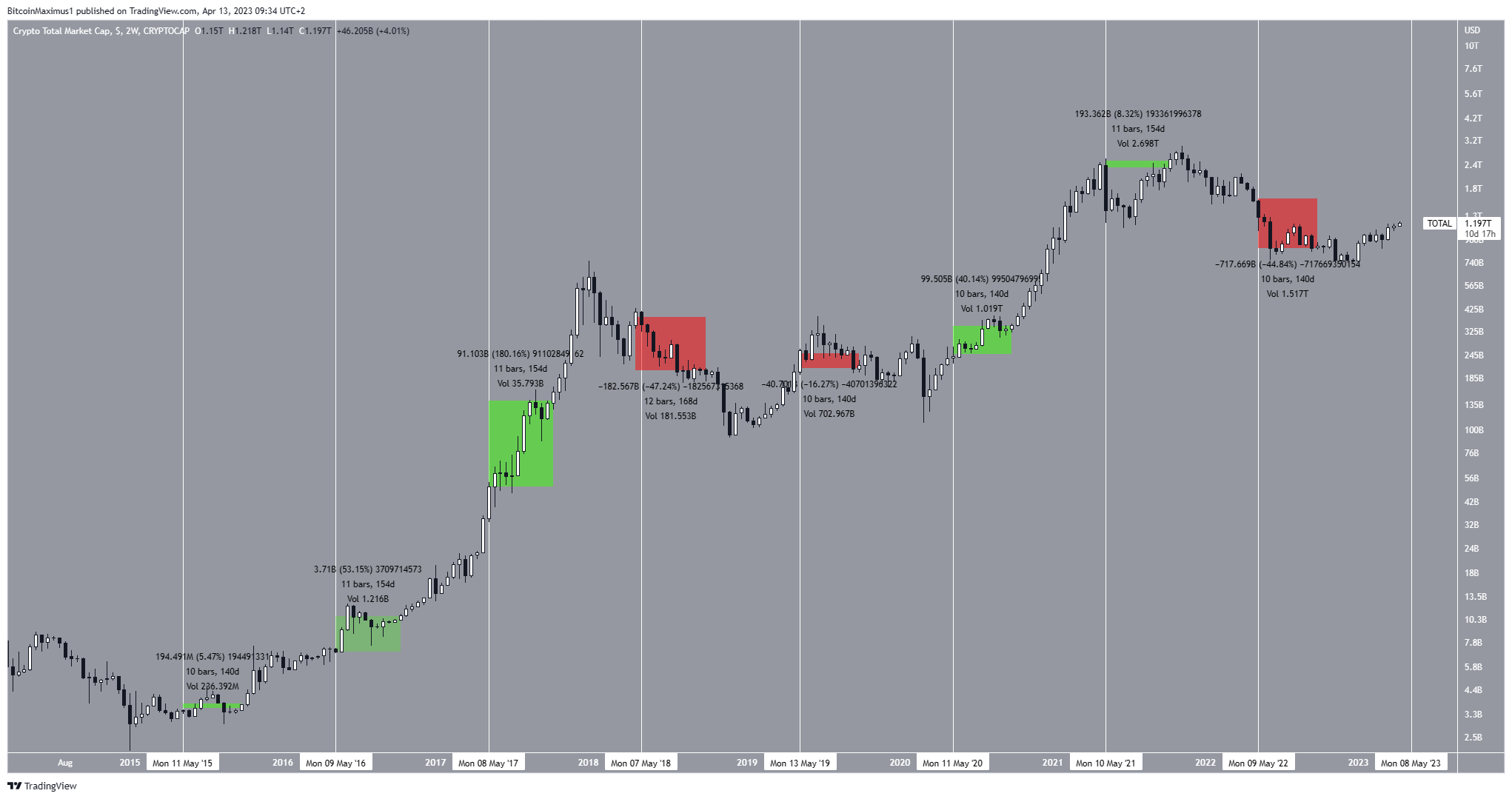

A look at the technical analysis for TOTALCAP in the two-week time frame shows that the cryptocurrency market cap has actually increased in the period between May (white line) and October most of the time. But does it mean you should sell in May?

Over the past eight years, TOTALCAP posted a positive performance (highlighted in green) in five of them, with the amount of increase being:

- 5.47%

- 53.15

- 180.16%

- 40.14%

- 8.32%

The highest increase was in 2017, amounting to 180%. On the other hand, the three years with a negative performance (highlighted in red) amounted to decreases of:

- 47.24%

- 16.27%

- 44.24%

The highest decrease was in 2018, amounting to 47.24%. As a result, looking at both the total amount of increase/decrease and the number of years in which TOTALCAP increased or decreased shows that the May – October period is actually profitable.

What Will Happen This Year?

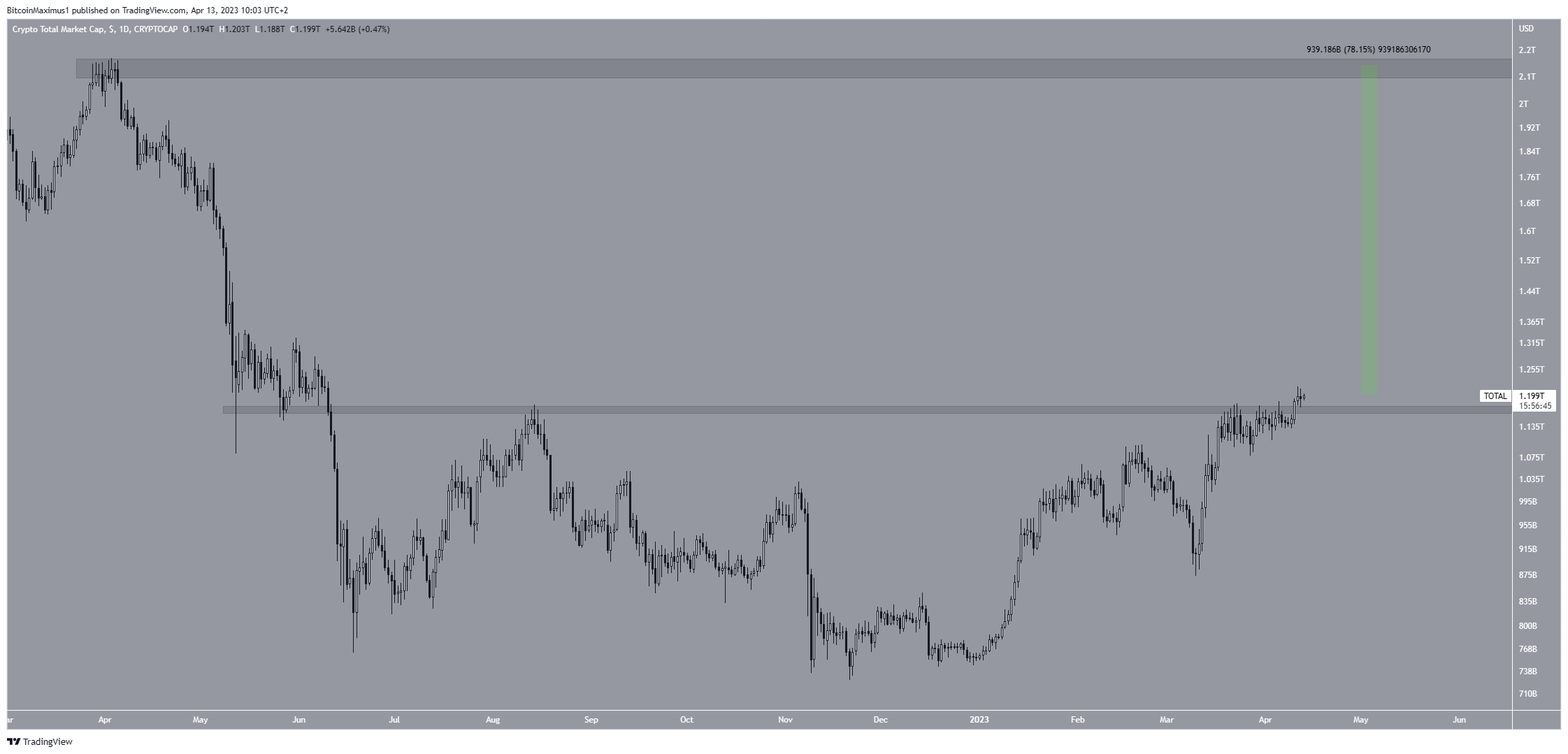

The technical analysis from the daily time frame shows that TOTALCAP broke out from the $1.17 trillion resistance area. This is a crucial area that has been in place since June 2022. Therefore, a breakout from it could catalyze a sharp increase.

Moreover, the lack of resistance until $2.14 trillion will make it easier for TOTALCAP to increase if the breakout is confirmed. The area is 78% away from the current price.

Finally, the daily RSI broke out from its bearish divergence trendline and is above 50, another sign of a bullish trend.

Therefore, the most likely outlook for May – October is an increase toward the $2.14 trillion resistance area.

To conclude, the most likely TOTALCAP price forecast for May to October is an increase toward the $2.14 trillion resistance area. This would be invalidated with a close below $1.17 trillion. In that case, TOTALCAP could drop to $900 billion. The latter would ideally be suited to the mantra of “sell in May and go away.”

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.