The US Securities and Exchange Commission (SEC) is likely to appeal against the court’s July 13 decision in the Ripple case.

As it happened, Federal Court Judge Analisa Torres determined that the XRP token is only a security when sold to institutional investors.

Experts Weigh In: Will SEC Appeal Ripple XRP Ruling by October 7?

Fox Business reporter Eleanor Terrett, citing a former SEC lawyer, said the securities regulator could appeal Judge Torres’s ruling, which had granted Ripple Labs a partial victory.

“Everyone over there [at the SEC] truly believes that the decision is wrong, that it’s not good law, and should be appealed,” read the report.

BeInCrypto recently reported that the SEC dropped claims against Ripple executives Chris Larsen and Brad Garlinghouse. This sparked speculation of an appeal focused on programmatic sales.

Several legal experts have commented on this speculation, including XRP advocate and Massachusetts Senate candidate John Deaton.

John Deaton

Deaton says Judge Torres’s ruling was very fact-specific, relying on the submitted XRP holder affidavits. Further, the SEC failed to establish a “common enterprise.” This is the second condition of the Howey Test, and appealing the ruling would not make sense.

“An appellate court could say, just as Judge Torres acknowledged, there could be a scenario where secondary sales could qualify as investment contracts because the facts meet all the Howey factors. But in the Ripple XRP case, the facts presented just don’t satisfy it. Thus, the case gets affirmed on appeal but it doesn’t prevent the SEC from arguing secondary sales constitute investment contracts in other cases,” Deaton noted.

Read more: Everything You Need To Know About Ripple vs. SEC

The Howey Test outlines four criteria that must be met for an investment contract to qualify as a security. First, there must be an investment of money. Second, the investment must be in a common enterprise. Third, there should be an expectation of profits. Finally, these profits should result from the efforts of others.

Judge Torres’s key finding in the Ripple case hinged on the third requirement. Specifically, the court determined that XRP’s sale on exchanges did not meet the expectation of profits based on the efforts of others. The ruling concluded that selling XRP on exchanges, where buyers purchased through an order book rather than directly from Ripple in an ICO or IEO, did not violate securities law.

John Deaton, who played a significant role in the case, submitted an Amicus Brief on behalf of XRP holders. His efforts contributed to the court’s ruling, with Judge Torres citing his submission of 3,800 affidavits from XRP holders as part of the decision.

Fred Rispoli

Another legal expert and XRP advocate, attorney Fred Rispoli, also weighed in. He articulated that the court explicitly said “programmatic sales” and not “secondary sales.” Per Rispoli, if an appeal does happen, it would be against the loss on programmatic sales.

This is because secondary sales on exchanges were excluded from the Court’s consideration and were not decided. Therefore, it cannot be an appellate issue.

“The difference is Ripple selling on an exchange as opposed to others selling on an exchange to each other. Page 23, n.16 of the 7/13/23 order addresses this,” Rispoli explained.

Looking ahead, Rispoli says XRP could surpass its peak price of $1.96 in 2021 and set a new all-time high.

Jeremy Hogan

Attorney Jeremy Hogan, who has garnered a huge following across social media, lending his expertise on legal matters in the cryptocurrency space, also commented. The partner at Hogan & Hogan law firm said the SEC had lost the plot. In his opinion, the securities regulator should consider what an appeal would mean for its mandate of investor protection and capital formation.

Meanwhile, investigative journalist Jungle Inc Crypto on X urges the SEC to appeal if it thinks the ruling on programmatic sales is wrong. This stance is based on the assumption that the secondary market needs more protection, as it comprises less knowledgeable investors. Nevertheless, the journalist insists that the SEC should first reflect on its real motive.

“The real question is whether the ruling was truly incorrect, or if the SEC simply doesn’t like the outcome. As Gary Gensler often says, disliking a law is different from not understanding it. If the SEC just does not agree with the current law, they should not appeal but should push Congress for updated regulations,” Jungle Inc Crypto wrote.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

As a result, the case remains unresolved, and the XRP community eagerly awaits further updates. The deadline for an appeal is set for October 7.

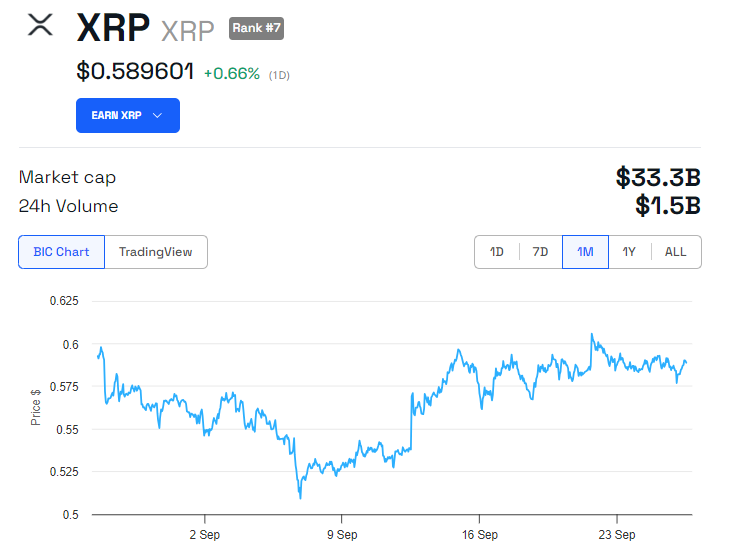

According to data from BeInCrypto, XRP is currently trading at $0.59, reflecting a modest 0.66% increase since the market opened on Friday.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.