According to Bitwise’s Chief Investment Officer, Matt Hougan, the Securities and Exchange Commission (SEC) is considering a delay in approving highly anticipated Ethereum exchange-traded funds (ETFs).

This development comes on the heels of Bitwise Asset Management’s intention to list a spot Ethereum ETF.

Potential Ethereum ETF Approval Delay

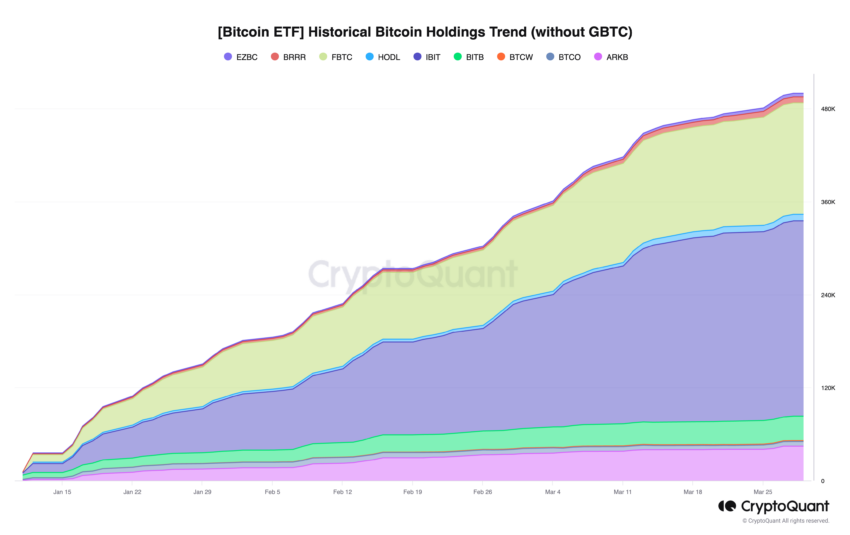

Bitwise launched its spot Bitcoin ETF, the Bitwise Bitcoin ETF (BITB), on January 11. Since then, the ETF has seen a meteoric rise, amassing over $2 billion in assets and ranking fifth in the so-called “Cointucky Derby.”

Hougan shared insights into the explosive growth of BITB and other spot ETFs, underscoring their unprecedented acceleration compared to historical ETF launches.

“These [spot Bitcoin ETFs] are the fastest growing ETFs of all time by a large fraction. I believe the fastest growing ETF prior to these was the Nasdaq 100 ETF (QQQM), which went from zero to $5 billion in one year. These ETFs have pulled in net $10-plus billion in under two months,” Hougan emphasized.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Despite the sucess spot Bitcoin ETFs have seen, Hougan warned about the potential delay in the Ethereum ETF’s approval. This may stem from regulatory caution, given the growing interest in cryptocurrency investments and the complex dynamics of the market.

Hougan expressed confidence in the eventual launch of an Ethereum ETF. Still, he anticipated that a delay until later in the year might actually benefit the market by allowing traditional finance (TradFi) more time to understand and embrace crypto.

“We think that’s a natural pathway that crypto investors have followed for 15 years. They start with Bitcoin and then they want exposure to other things. I think Ethereum will be very attractive. I think the [Ethereum] ETFs will be more successful if they launch in 12 months than if they launch in May. I know that sounds goofy, but I think TradFi is still digesting Bitcoin and if you give TradFi time to get comfortable with Bitcoin and crypto, they will be ready for the next thing,” Hougan explained.

This strategic patience could pave the way for a more robust and informed entry of institutional and retail investors into Ethereum, following the overwhelming success of Bitcoin ETFs.

Read more: Ethereum ETF Explained: What It Is and How It Works

Hougan’s insights reveal a significant shift in the perception of cryptocurrencies, from skepticism to a recognized potential for substantial returns on investment. As the SEC weighs its decision, the cryptocurrency community remains on edge, hopeful for a green light that could further legitimize and catalyze investments in Ethereum and beyond.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.