The CTO of Ripple Labs, David Schwarz, criticized the actions of the US Securities and Exchange Commission (SEC) in the Debt Box crypto case. Legal action by the agency affected defendants and their families in a profound way that the court can’t afford to ignore.

The SEC has also been criticized by crypto lawyer John Deaton, who called the case a “gross overreach” by the government.

SEC Causes Losses in Debt Box Crypto Case

The SEC sued Debt Box last July for offering so-called “node licenses” as unregistered securities since 2021. It also claimed that Debt Box relocated to Dubai to flee US jurisdictions, claims that were found to be materially false. It used these claims to influence the court to issue a temporary restraining order, which affected the defendants profoundly.

Read more: Everything You Need To Know About Ripple vs SEC

The SEC’s actions made one defendant, Roy Nelson, unable to pay suppliers and defendants. Some employees decided to steal equipment worth $125,000 because they were not paid.

Nelson’s banking relationships were adversely affected by the SEC’s temporary restraining order. A loan Nelson took to refinance his house was canceled, and his home is now under the threat of foreclosure. Nelson has also suffered emotional strain from ostracization by family and friends.

Before the defendants’ filing, a judge asked the SEC to explain why it should not be held responsible for making false claims. The defendants’ response could increase the chances of a defeat, having revealed what crypto lawyer John Deaton calls government overreach.

“The impact of gross government overreach can’t be overstated. And the lawyers …claim this was not intentional. @SECEnfDirector has already misled Congress. These lawyers were following SEC leadership,” Deaton explained.

In October, a court ruled that the Commission could not use market manipulation as the basis for prohibiting a Bitcoin exchange-traded fund. Before that, a US judge ruled that sales of the XRP crypto asset were only unregistered securities if sold to institutions instead of retail buyers.

Nevertheless, the court ruled against the SEC’s allegations that sales to retail investors were unregistered securities. The SEC has requested financial statements from Ripple Labs.

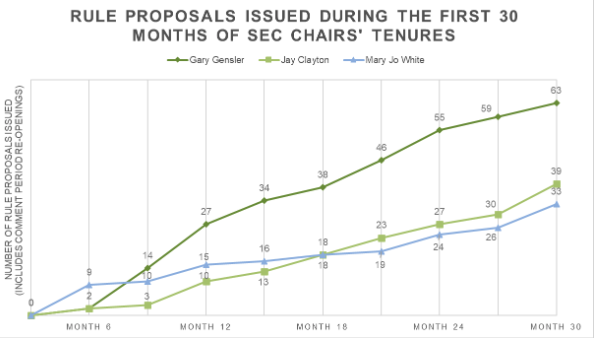

How the SEC’s Rulemaking May Pan Out in 2024

The Debt Box and Ripple cases are two high-profile crypto cases in which the SEC is still involved. However, the agency’s rulemaking agenda for 2024 could see it affect the industry in other ways.

The agency wants to advance a proposal to regulate the custodians of customer assets, including crypto. The original proposal was drafted in February 2023.

Read more: What Does It Mean To Receive a Wells Notice From the SEC?

Assets must be kept with a broker-dealer, bank, or another unspecified “qualified custodian.” The move will impact the burgeoning tokenization industry, which is set to take off in 2024. A rule that could take effect in the Spring of 2024 is for custodians to calculate their reserve obligations daily.