The United States Securities and Exchange Commission (SEC) has postponed announcing the outcomes for seven leading applicants seeking to launch a Bitcoin exchange-traded fund (ETF) in the US.

“The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein,” the filing states.

SEC Extends Bitcoin ETF Decision Period Another 45 Days

On August 31, in seven separate filings, the SEC stated that it requires extra time to review the proposed rule change for allowing the listing of spot Bitcoin ETFs on the stock exchange.

This delay impacts seven applicants, including the world’s largest asset manager, BlackRock. Additionally, it affects VanEck, WiseOrigin, Invesco Galaxy, WisdomTree, Bitwise, and Valkyrie Digital Assets.

Although the proposed rule change was published on July 19 for public input, the SEC has stayed within the 45-day response period. Opting for an additional 45-day extension, the SEC has shifted the decision date for five applications to October 17.

Interestingly, among the applicants, two have distinct deadlines—one a day earlier and the other a day later. Bitwise’s deadline falls on October 17, while Valkyrie Digital Assets’ cutoff point falls on October 19.

Despite the differing dates, the wording in all the filings remains similar. They outline that the proposed dates are when the SEC expects to “either approve or disapprove, or institute proceedings to determine whether to disapprove, the proposed rule change.”

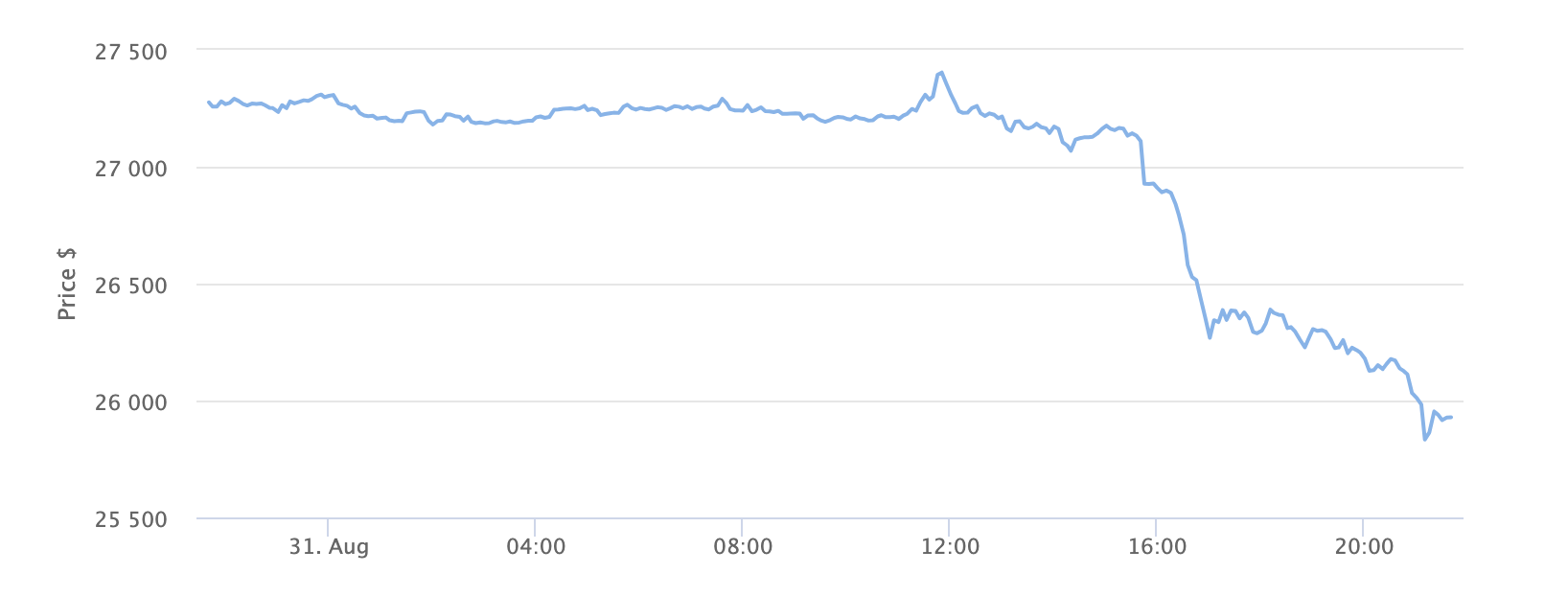

Over the past 24 hours, Bitcoin’s price has experienced a decline of approximately 4.67%. At the time of publication, the price is $25,994.

To learn more about where to buy Bitcoin, read BeInCrypto’s guide: 4 Best Crypto Brokers for Buying and Selling Bitcoin in 2023

SEC Enforcement in Recent Times

The delay emerged just two days after Grayscale Investments succeeded in its appeal to reverse an SEC decision that initially rejected the listing of its spot Bitcoin ETF.

On August 29, The United States Court of Appeals for the D.C. Circuit invalidated the SEC’s rejection decision, mandating a reevaluation of Grayscale’s application.

Grayscale’s triumph led two Bloomberg analysts to express heightened certainty regarding the launch of spot Bitcoin ETFs in 2023. The pair raised their probability assessment to 75%, anticipating a stronger likelihood of the product being introduced this year.

Recently, the SEC added another setback to the joint Bitcoin ETF from Ark Invest and 21 Shares, Ark 21Shares Bitcoin ETF.

On August 11, the product faced its third setback in terms of an outcome date. Initially rejected in 2021, it had another rejection earlier this year.