In a bold assertion, Michael Sonnenshein, CEO of Grayscale Investments, predicts a bleak future for several other spot Bitcoin exchange-traded funds (ETFs).

During an interview with CNBC, Sonnenshein expressed his skepticism about the long-term viability of competitors’ spot Bitcoin ETFs.

How Grayscale CEO Justified High Fees of GBTC Spot Bitcoin ETF

Grayscale’s Bitcoin Trust ETF (GBTC) boasts over $25 billion in assets under management, making it the world’s largest Bitcoin fund. This prominence, Sonnenshein argues, is attributed to its decade-long track record of successful operation and a diverse investor base.

Read more: What Is a Bitcoin ETF?

Unlike its rivals, the Grayscale Bitcoin Trust ETF imposes a 1.5% fee, significantly higher than most approved ETFs that charge between 0.2% and 0.4%. According to Sonnenshein, the funds’ commitment and experience in the crypto field justifies the fees.

“Investors are weighing heavily things like liquidity and track record and who the actual issuer is behind the product. Grayscale is a crypto specialist. And it has really paved the way for a lot of these products coming through,” said Sonnenshein

The crux of Sonnenshein’s argument lies in the long-term sustainability of these competing ETFs. He postulates that only two to three of the spot Bitcoin ETFs might achieve a critical mass of assets under management. The others, he warns, risk being pulled from the market due to their inability to garner substantial interest or investment.

“I don’t ultimately think that the marketplace will have ultimately these 11 spot products we find ourselves having,” Sonnenshein said.

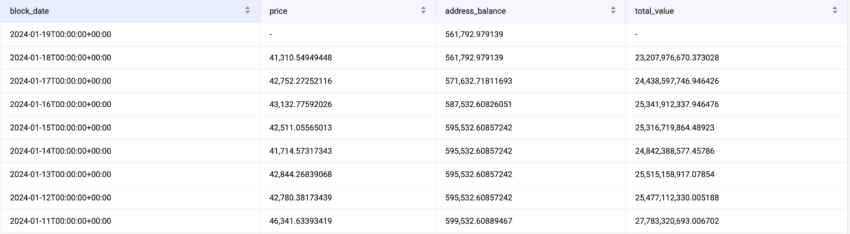

Despite Sonneshein’s argument, the GBTC ETF is losing appeal in the market due to its high fees. The screenshot below shows that Grayscale’s BTC reserves have declined by over 37,740 since the spot Bitcoin ETFs started trading.

The investors may have been possibly redeeming their GBTC holdings to switch to Grayscale’s competing ETFs. Moreover, the discounts to net asset value have declined significantly, from 47% in February 2023 to around 1% in 2024.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

Hence, some investors who purchased GBTC shares at a discount might be booking the profits.

Meanwhile, BlackRock’s iShares Bitcoin Trust has achieved the milestone of $1 billion in assets under management (AUM).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.