The central bank of Russia claims that its alternative to the SWIFT payment network is ready, though it’s unlikely to see much participation from foreign entities.

Russia’s central bank has claimed that its alternative to the SWIFT network is ready. Russian state-controlled media Tass reported that the Financial Message Transfer System of the Bank of Russia (SPFS) was ready for foreign participation.

However, it’s unlikely that the development will have much of an impact on Russia and its failing economy. Besides not having the importance and reach of SWIFT, the Russian government is now almost universally seen as an aggressor, and brands are pulling out of the country.

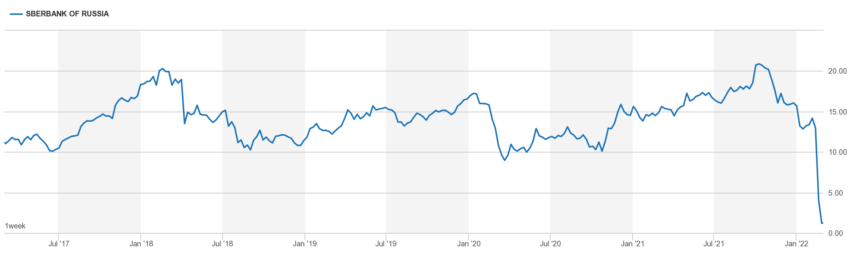

Shares of the largest Russian bank, Sberbank, have dropped by a staggering 74%, in what is the biggest slump it has ever experienced. The ECB also notes that the bank is nearing failure or will reach failure soon. It is experiencing significant deposit outflows, while the Deutsche Boerse said that it would suspend trading of Sberbank, as well as several other Russian securities.

Meanwhile, the Russia Rouble has also experienced a precipitous drop and is now worth less than one cent. There are fears that this might lead to hyperinflation, and in any case, a strong inflation trend is all but certain in the months to come.

The economic pain for Russia only just starting

The moves taken by western nations to punish Russia for its invasion of Ukraine is unprecedented, as are their effects. Analysts believe that the worst of the impact will only be seen in the coming weeks and months. Others don’t think that Russia will see crypto as a solution.

To stem the bleeding, the Russian government has raised interest rates to 20% while mandating that the Moscow Stock Exchange be closed until March 5. However, this will do little, and the interest rates will only mean that consumers could pay double for such things as mortgages.

The U.S. also does not want Russia to avoid the sanctions by using crypto. Crypto entities have blocked or limited their crypto services in Russia, at the behest of Ukraine Vice Prime Minister Mykhailo Fedorov. Binance has frozen the accounts of those sanctioned by Russia, though not all users.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.