Rocket Pool’s RPL token shot up in price after Binance announced it would list the token in its Innovation Zone. The ETH liquid staking solution project has been making a name for itself, though it lags behind Lido.

Ethereum liquid staking project Rocket Pool’s RPL token has skyrocketed following a Binance announcement that it would be listed. The exchange stated that it would list the token in the Innovation Zone, opening trading for the token on Jan. 18. Besides being available for trading using BTC, BUSD, and USDT, the token is also listed for margin trading.

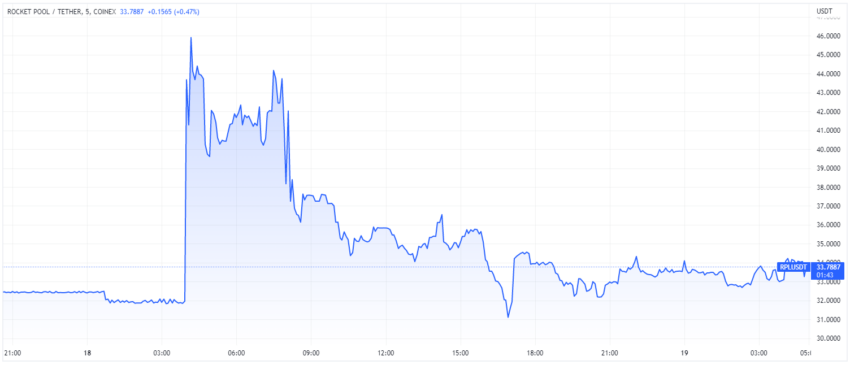

Rocket Pool saw a price bump of over 50% following the news, though it has since dropped by about 20%. The token is now trading at around $33.70. The trading volume for RPL has also experienced a massive increase, up by about 180% to $90 million. Predictably, a lot of that volume comes from Binance.

Binance’s Innovation Zone is a hub for traders to work with newer tokens with some safeguards that mitigate the risk that comes from these assets. Volatility is a good example of these tokens, and the Binance team checks if the traders understand the risks involved with these new tokens.

The Innovation Zone is intended for traders who want to be able to get in on new projects early. It comes with a set of risks, but the reward can also be higher if it is a truly successful project.

Rocket Pool’s Liquid Staking Growing

Rocket Pool is a project that has been making a name for itself as a decentralized ETH liquid staking derivative provider. It offers easier entry into Ethereum staking, reducing the amount of capital needed for the process. Users can stake their ETH to wards node operators, granting them rETH, which represents their stake. The RPL token is used for network insurance collateral and governance purposes.

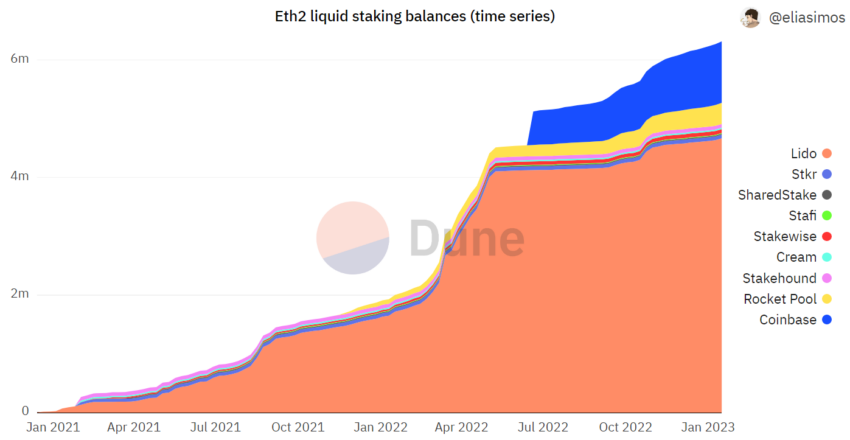

Rocket Pool is third behind Lido and Coinbase as a liquid staking solution provider. The latter holds the biggest market share in this niche, with 75.6% of all staked ETH. Rocket Pool holds 3.5% of the pool, far behind the top two.

Shanghai Upgrade Has Stakers Excited

Liquid staking is becoming a hot topic as the Ethereum Shanghai upgrade approaches. The upgrade will be out in March, allowing stakers to unstake their ETH. It’s a significant move for the network, which has not allowed validators to unstake their holdings. Stakers will be happy that they can withdraw the 32 ETH they put in, which is a hefty sum.

Meanwhile, MetaMask is also offering liquid staking features as it now features integration with Lido and Rocket Pool. This will surely see more ETH come onto the network for staking, as the integration makes participating much more convenient.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.