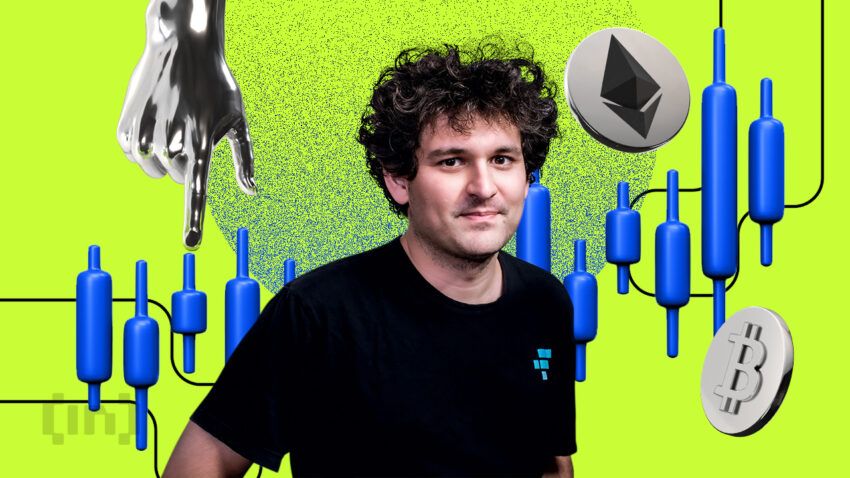

On Friday, Robinhood struck a deal to buy back shares lost in the implosion of Sam Bankman-Fried’s cryptocurrency exchange FTX. The $605.7 million agreement with the US Marshals Service allows Robinhood to recover its investment in FTX and Bankman-Fried’s holding company Emergent Fidelity Technologies.

The Marshals Service took custody of 55.3 million Robinhood shares after FTX declared bankruptcy last November. On Friday, Robinhood announced that it will repurchase the shares for $10.96 each. The US District Court for the Southern District of New York has given its approval.

Robinhood Buys Back Shares, Stock Price Sees an Immediate Boost

The repurchase covers all HOOD shares bought in May 2022 by Emergent Fidelity Technologies, which represents over 7% of Robinhood’s outstanding shares. Emergent Fidelity Technologies was founded by FTX’s founder, Sam-Bankman Fried, along with executive Gary Wang. However, the company declared bankruptcy in February of this year.

Robinhood’s stock climbed over 3% on the news. Buying back the shares will allow the online brokerage to regain the equity it had invested in FTX and Emergent.

Just months before FTX’s collapse, Bankman-Fried had revealed a 7.6% stake in Robinhood through Emergent. At the time, he claimed no intention of taking control of Robinhood and spoke of potential partnerships between their companies.

But Bankman-Fried’s net worth soon evaporated as allegations of fraud led FTX into bankruptcy. Bankman-Fried had previously tried to protect his Robinhood shares from FTX creditors.

Now detained and awaiting an October trial on criminal charges, the disgraced former billionaire will watch his former Robinhood shares transferred back through the share repurchase deal. Prosecutors allege that Bankman-Fried tampered with witnesses while out on bail, leading a judge to imprison him before the trial begins.

Robinhood likely aims to distance itself from the FTX debacle through this share buyback. The company has fortunately also avoided the solvency issues that plagued its rival, which has now collapsed in disgrace.

The $605 million share repurchase presents an opportunity for Robinhood to reclaim losses from the FTX implosion, and turn a page on an unfortunate chapter for the company.

Robinhood Recently Revealed as Fifth-Largest Holder of ETH

The news the same week Arkham Intelligence revealed that Robinhood is the world’s fifth-largest holder of Ether (ETH). Their wallet also held a number of other cryptocurrencies, such as SHIB ($163 million), LINK ($14.23 million), and AVAX ($10.4 million).

Only a day prior, Arkham had outed Robinhood as the third-largest holder of Bitcoin (BTC). A wallet screenshot disclosed by Arkham displayed 122,567 BTC, equating to around $3.43 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.