Render (RNDR) price has surged 12% since dropping below $1.63 on Apr. 22. But despite the rebound, on-chain data shows multiple red signals indicating an imminent bearish turn of events.

Despite the recent price bounce between Apr. 22 and 25, the Render network has struggled to attract the attention of large investors. With Daily traction also taking a downturn, is RNDR on the verge of a major price retracement?

Render is Struggling to Attract Large Investors

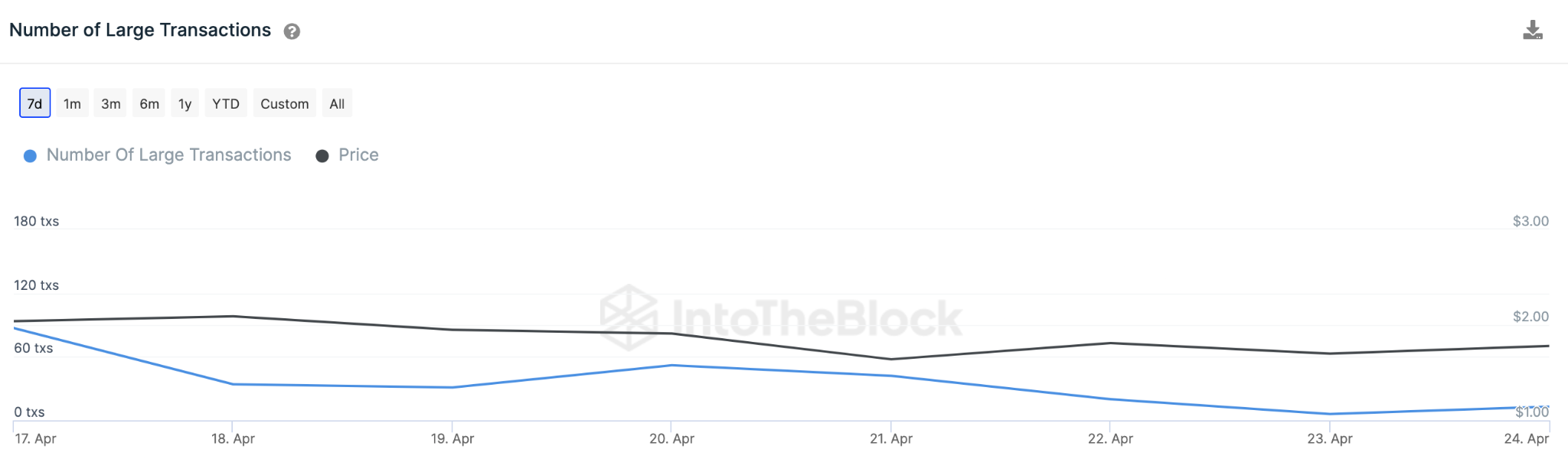

According to the underlying on-chain data, crypto whales appear to be shying away from the Render network in the past week, despite the recent price bounce.

IntoTheBlock’s chart below shows a steady decline in the number of Large Transactions worth $100,000 and above involving RNDR. Between recording the recent high of 87 transactions on April 17, it has dwindled to 13 large transactions involving RNDR at the close of April 24.

It is a bearish signal when there is a decline in large transactions occurring within a network. Typically, it suggests that crypto whales may lose interest in the asset or move their funds elsewhere.

Unless the Render network experiences considerable growth in the number of whale transactions, holders can expect a price downswing in the coming days.

Render Daily Traction is Dwindling

On a more bearish note, Render has also struggled to sustain the interest of its core users in the past week. Since the recent local high of 1,074 on Apr. 17, the number of daily active users has declined 65% to 373 at the close of Apr. 24.

Daily Active Addresses (DAA) measures the number of unique wallet addresses that send or receive transactions on a particular blockchain network within a day.

A persistent decline in DAA may indicate that users are losing interest in the underlying project. As observed above, this could decrease demand and heap downward pressure on the price of RNDR.

RNDR Price Prediction: Bearish Reversal to $1.58

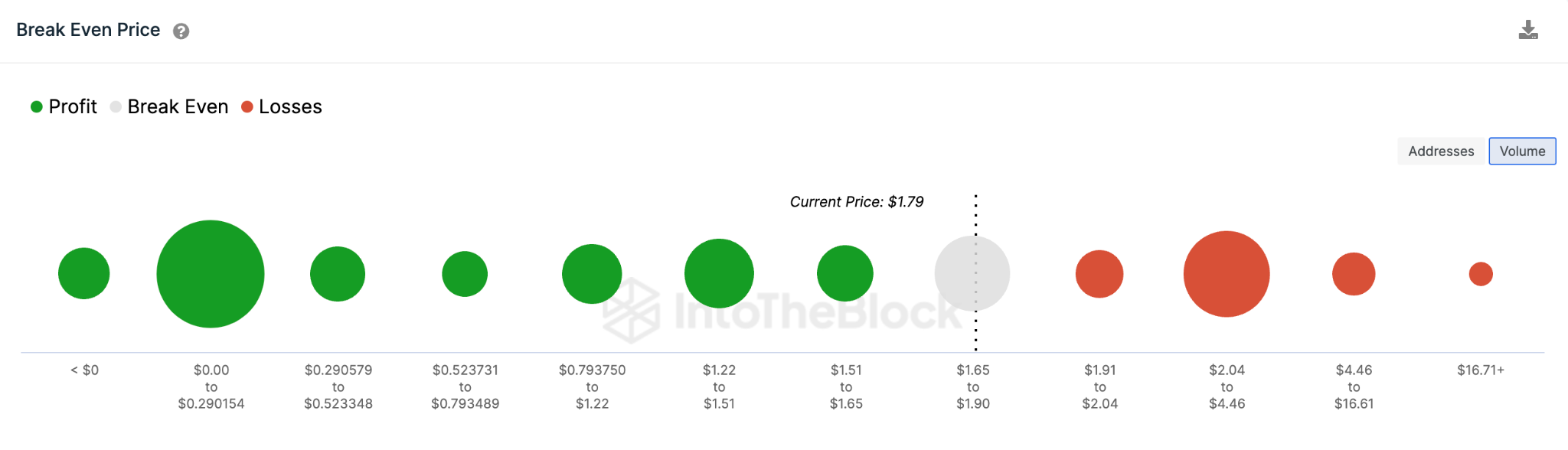

According to IntoTheBlock’s Break-Even Price distribution data, Render bears will likely force a downsizing to $1.58. Currently, the 1,860 addresses that bought 65 million RNDR are expected to offer some support in the $1.65 break-even zone.

If that support folds as expected, the Render price will likely decline to $1.58. At this support level, however, bullish pressure from the 1,300 break-even addresses holding 25 million RNDR, could prevent a further slump.

Still, the bulls can negative this pessimistic narrative if RNDR price can break above $1.90. But as stated above, the 1,860 addresses holding 65 million tokens at that price range could pose some resistance. But if that resistance level fails to hold, the bulls can anticipate an upswing toward $2.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.