Binance, the world’s largest crypto exchange by trading volume, has recently faced considerable regulatory pressure that has left investors questioning the risks of keeping funds on the platform.

The crypto exchange’s market share has dramatically dropped from 70% to 54% in just two weeks. It reached its lowest sustained level since August, according to the research platform Kaiko.

Binance Market Share Drops Amid Regulatory Pressure

The sudden decline in market share comes after the U.S. Commodity Futures Trading Commission (CFTC) sued Binance and its founder, Changpeng Zhao, for allegedly offering unregistered crypto derivatives products in the U.S., violating federal law.

Adding to the concerns, Binance recorded its lowest Bitcoin (BTC) trading volume since July 2022. This comes after discontinuing its no-fee trading promotion for 13 Bitcoin spot trading pairs.

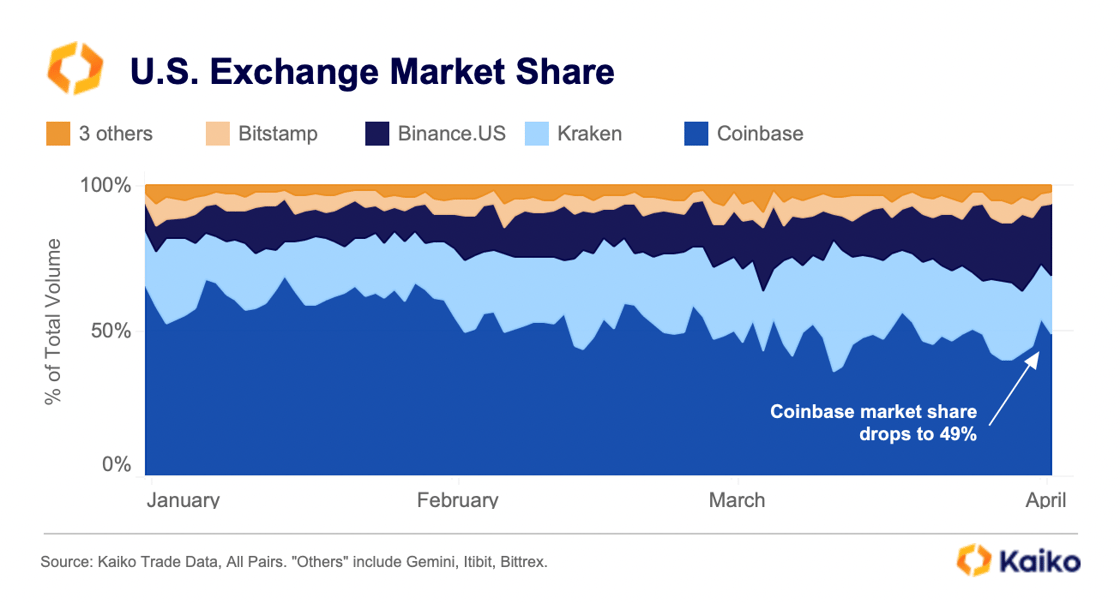

Kaiko’s report highlights that the end of zero-fee trading resulted in a more even distribution of market share among other crypto exchanges.

As global crypto exchanges face mounting regulatory scrutiny, particularly in the U.S., the market’s landscape is becoming increasingly fragile, causing some investors to reconsider the safety of keeping funds on Binance.

Is It Risky to Keep Funds on the Crypto Exchange?

A game theory analysis presents four possible scenarios regarding the withdrawal of funds from Binance. It takes into account potential consequences and weighs the expected value (EV) of each action:

- You withdraw funds, and Binance faces no trouble (-1): A small loss is incurred for the withdrawal, but your funds are secure.

- You withdraw funds, and Binance later restricts withdrawals (+100): Successfully withdrawing funds before any restrictions is a positive outcome.

- You don’t withdraw funds, and Binance faces no trouble (-0): No loss or gain occurs, but your funds remain on the exchange.

- You don’t withdraw funds, and Binance later restricts withdrawals (-100): Inability to access funds results in a significant loss.

According to this analysis, withdrawing funds from Binance is the only positive EV action. Meanwhile, leaving funds on the exchange carries a substantial negative EV risk.

The potential difficulties in recovering funds if Binance faces issues are underscored. Particularly given the company’s international status and the complexities of navigating regulatory landscapes in jurisdictions like China and Dubai.

In the U.S., other exchanges like Coinbase have also experienced a drop in market share. Meanwhile, Binance.US has seen growth, indicating a shifting landscape for crypto exchanges amid increasing regulatory pressures.

As the regulatory pressure unfolds, investors must carefully weigh the risks and decide whether keeping funds on Binance or withdrawing them is the most prudent course of action.