According to data from Nansen, Binance, the world’s largest exchange by trading volume, saw withdrawals of $1.6 billion after it was sued by regulators.

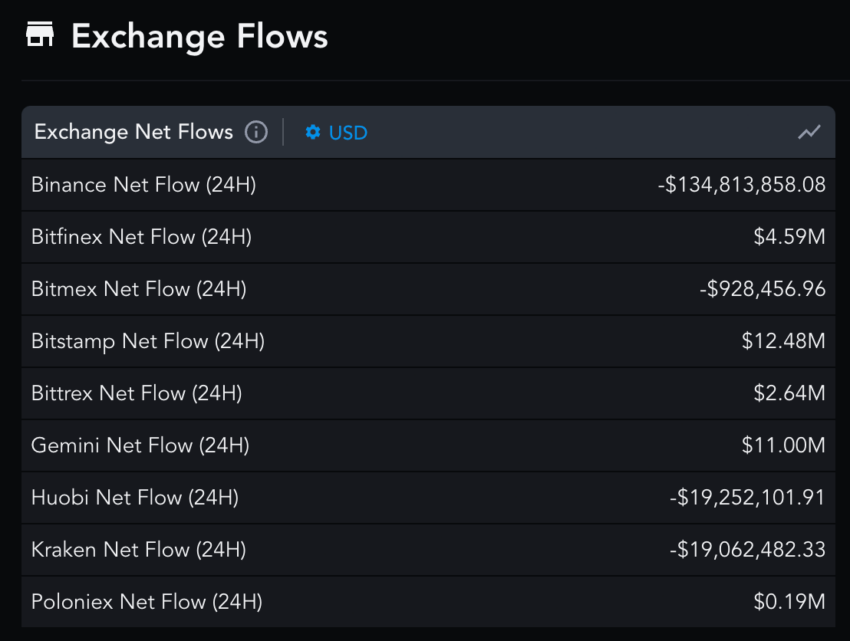

Reuters reported that investors withdrew $1.6 billion from Binance since Monday due to legal actions from the Commodity Futures Trading Commission (CTFC). According to the on-chain data provider Messari, investors withdrew over $134.8 million from Binance in the past 24 hours.

Binance Users Switching to Competitors?

While Binance had negative net flows in the past 24 hours, some of its competitors witnessed positive ones. Bitstamp had a deposit of $12.48 million, while $11 million were deposited in the Gemini exchange.

Notably, after the FTX collapse, Binance facilitated withdrawals of over $12 billion worth of assets in under two months. The single-day withdrawal went as high as $3 billion in mid-December.

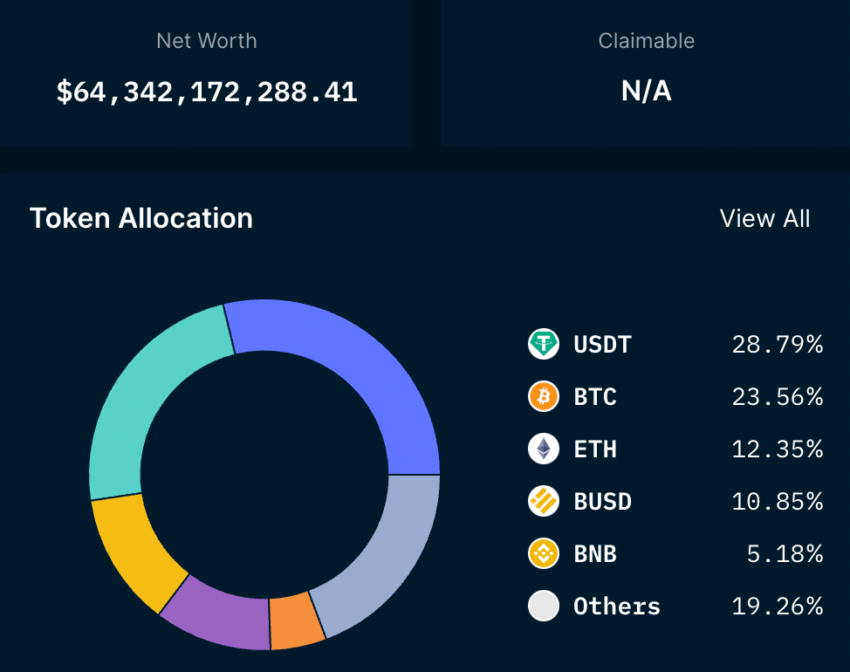

However, the exchange still has a balance of over $64 billion. USDT, Bitcoin (BTC), Ethereum (ETH), and BNB make up over 75% of Binance’s total reserves.

Both Binance and CZ Face Legal Action

On Monday, the exchange and its Chief Executive Officer (CEO) Changpeng “CZ” Zhao were sued by the CFTC for violating derivatives and trading rules. The authority also alleges that Binance violated anti-money laundering (AML) and know your customer (KYC) rules.

Zhao called the lawsuit an “unexpected and disappointing civil complaint.” He says, “The complaint appears to contain an incomplete recitation of facts, and we do not agree with the characterization of many of the issues alleged in the complaint.”

Got something to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.