Despite the ongoing rise, Ripple (XRP) price is still susceptible to a drop since the broader market cues and participation are declining.

This could result in XRP failing to breach a crucial level, which, as a support level, could trigger a rise.

Ripple Investors Back Off

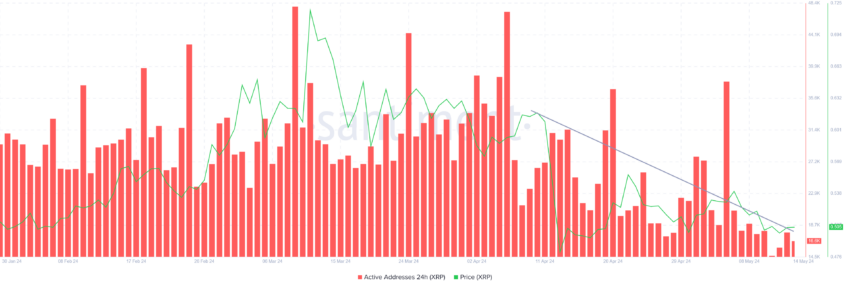

XRP price could potentially see the bearish effects of the investors taking a step back, given participation has taken a hit. The total number of investors conducting a transaction on the network has slid from an average of 25,120 to 18,760 in the span of a month.

Active addresses highlight the demand for the asset as more transactions on the network create liquidity. Higher liquidity leads to a surge in participation, aiding price action rise.

However, given that the XRP price and participation are falling, a sell signal can be seen flashing. This could cause further harm to the altcoin.

At the same time, declining bullishness is also observed in the broader market cues. The Relative Strength Index (RSI), which spiked into the bullish zone, has returned below the neutral line at 50.0.

Read More: Everything You Need To Know About Ripple vs SEC

The RSI gauges the velocity and magnitude of price changes, aiding in detecting overbought or oversold market conditions. Given that Ripple is struggling to test the neutral line as support, the outcome is bearish.

XRP Price Prediction: Will the Uptrend End?

XRP price on the daily timeframe is observing an uptrend that was initiated a month ago. Slowly, the uptrend has brought XRP above $0.50, which is crucial psychological support. The altcoin is now close to breaching and flipping the 23.6% Fibonacci Retracement into support.

However, considering the intensifying bearish cues, this breach may fail, and the XRP price could fall through the uptrend line. Consequently, the altcoin could fall to test $0.47 as support again.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

On the other hand, if the altcoin flips the 23.6% Fib Retracement into support, it could signal a recovery. This level is recognized as the bear market support floor, and securing it prevents further decline.

A breach of $0.55 could enable a rally for XRP price, invalidating the bearish thesis in the process.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.