Ripple (XRP) price might have to wait a while longer before a breakout, and a sharp price increase can be observed.

This is because the investors are not certain about HODLing for gains but are instead looking to sell.

Ripple Investors Are Not Optimistic

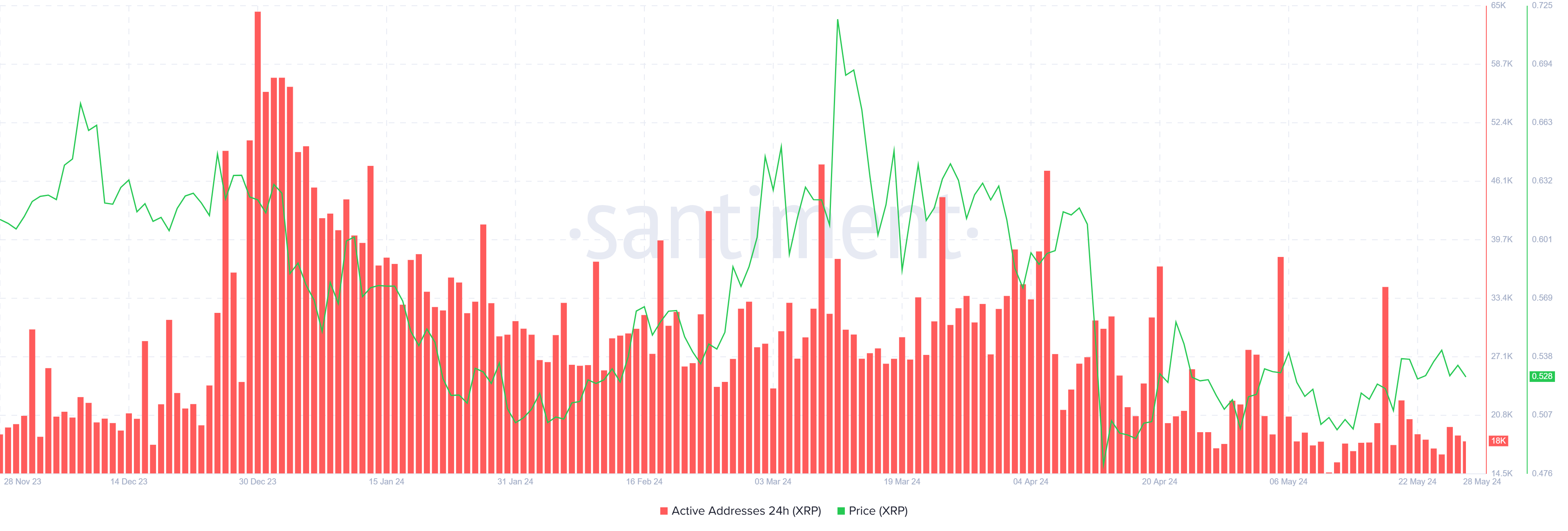

XRP price could bear the brunt of the skepticism among the altcoin’s investors since they have been exhibiting considerable bearishness. The active addresses that have been on a decline since December 2023 continue to fall.

Declining participation and rising prices tend to create a bearish deviation in the market. This deviation flashes a sell signal, which is not a good sign for the price action. Such is the case with XRP as well, given that the price is anticipating a breakout, but the investors conducting transactions on the network are not.

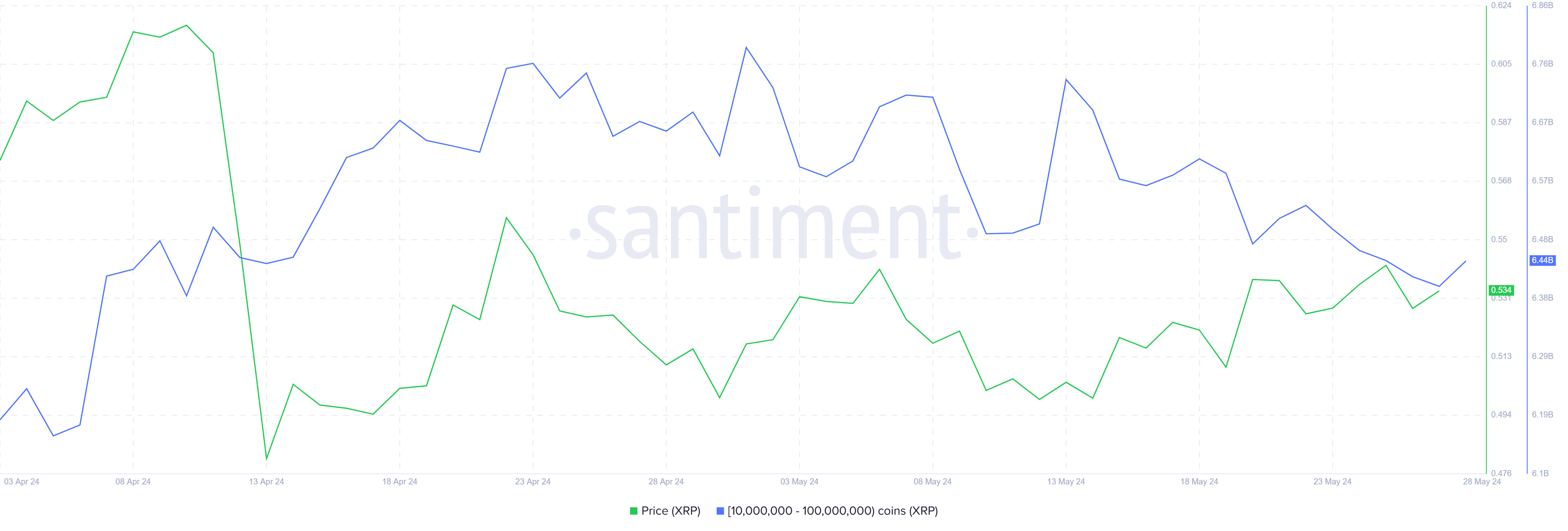

Further signs of this sentiment can also be seen among the whale holders, who have been explicitly bearish for nearly two weeks. These large wallet holders are known to be highly influential regarding price and their behavior.

Their accumulation pushed the price up, whereas selling caused a price drop. Currently, XRP whales are selling, having dumped more than 300,000 XRP in the last two weeks.

This supply, worth over $156 million, represents more than 4% of their entire 6.44 billion XRP holding.

Read More: Everything You Need To Know About Ripple vs SEC

Such selling is a highly bearish sign for XRP price and the altcoin could suffer the consequences.

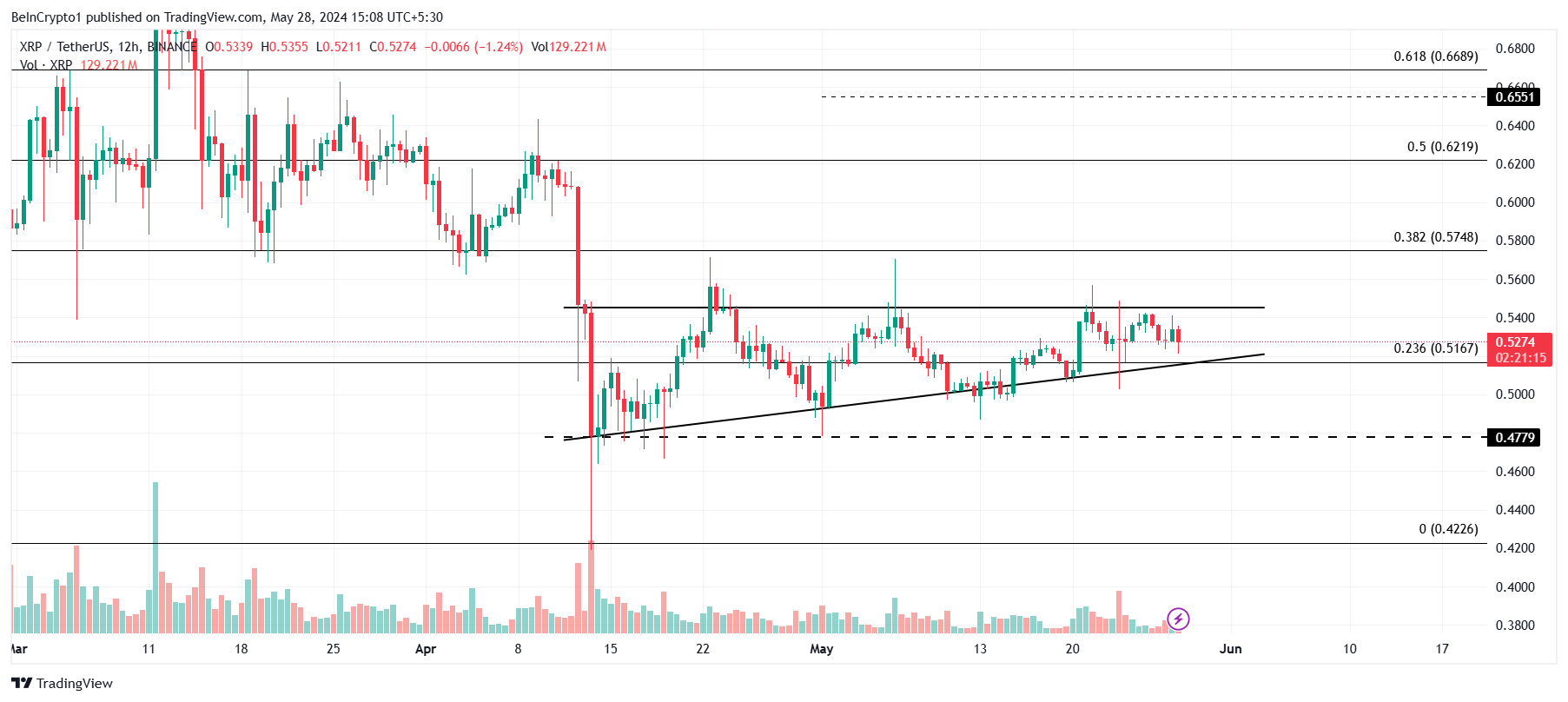

XRP Price Prediction: Difficulty Ahead

At the time of writing, XRP trades at $0.53, above the 23.6% Fibonacci Retracement at $0.51. Moving within the ascending triangle, the altcoin aims for a 12% rise should it break out. This could send the Ripple native token above the 38.2% Fibonacci Retracement line.

However, considering the aforementioned factors, the likely outcome will be bearish. The XRP price could dip to the lower trend line of the pattern, and a test of the 23.6% Fib level is also likely.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

But if a breakout does occur, the bullish outcome noted above could also affect the future of the XRP price. This is crucial because it would enable XRP to rally further and recover the recent losses.

At the same time, this would invalidate the bearish thesis as well.