Ripple’s XRP token has seen a 9% price growth in the past 24 hours. However, this is a typical “dead cat bounce” often observed during a broader market downturn as traders continue to bet against an XRP short-term rally.

On-chain data shows a steady decline in the demand for altcoin and the likelihood of XRP holders selling for profit.

Ripple‘s Brief Rally Does Not Offer Any Relief

A “dead cat bounce” refers to a temporary recovery in the price of an asset after a significant decline. XRP plummeted to a 30-day low of $0.43 during Monday’s market downturn.

As the market begins to rebound, XRP has witnessed a dead cat bounce with a 12% surge in its price in the past 24 hours. However, readings on-chain and on the daily price chart highlight the possibility that the altcoin will resume its downtrend.

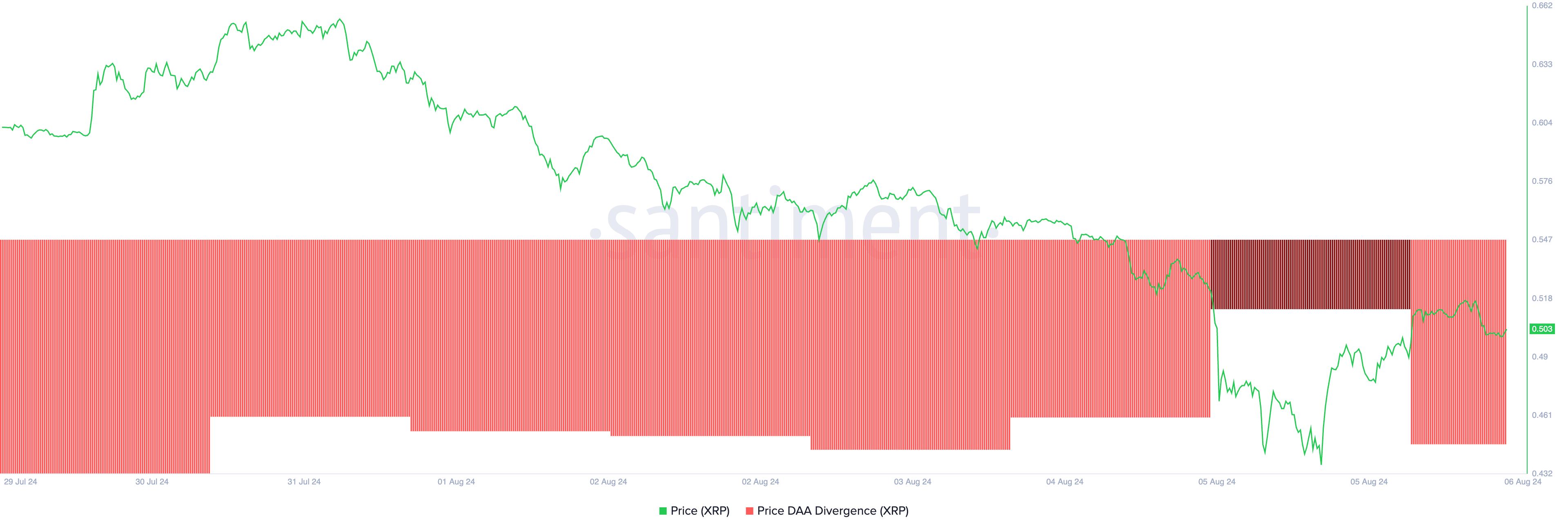

BeinCrypto observes a negative price-daily active address (DAA) divergence. This metric compares an asset’s price movements with the changes in its number of daily active addresses. Investors track it to see if corresponding network activity supports the price movements.

As of this writing, XRP’s price DAA divergence stands at -51.65%. A negative price DAA divergence during a price climb indicates that user activity or network engagement does not support the rally. This divergence always signals a weak and unsustainable rally.

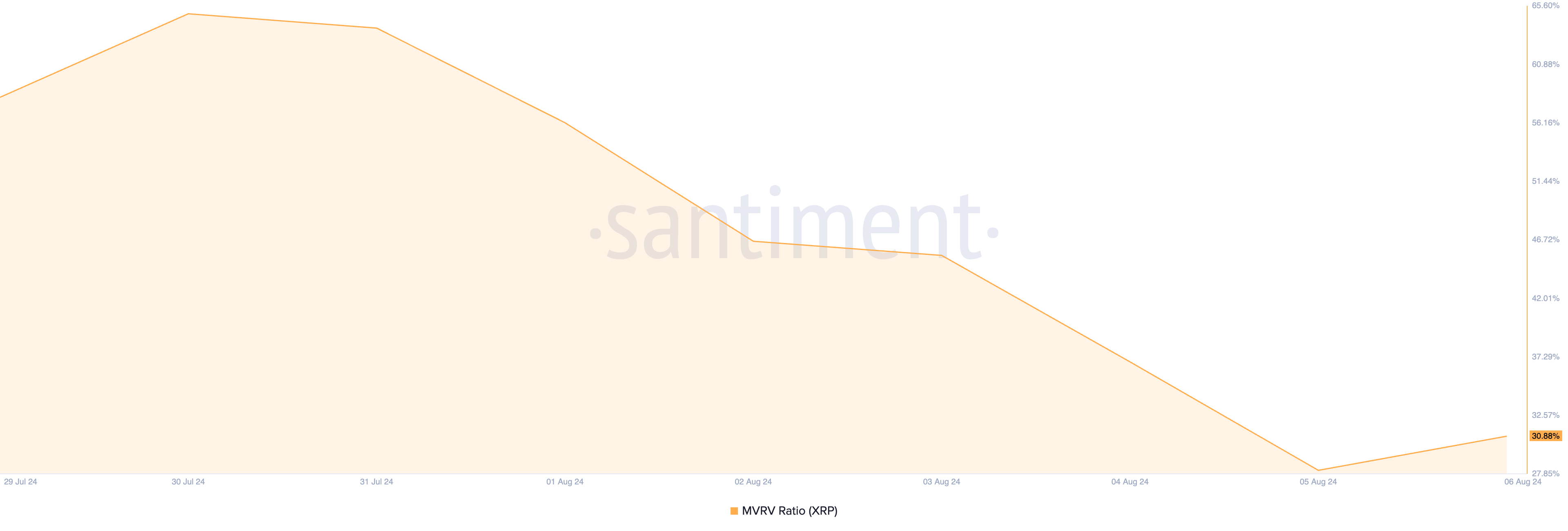

Further, XRP’s positive market value to realized value (MVRV) ratio puts selling pressure on it. As of this writing, the altcoin’s MVRV ratio is 30.88.

Read More: How To Buy XRP and Everything You Need To Know

An asset’s MVRV ratio measures the ratio between its current price and the average price at which all its tokens in circulation were acquired. When its value is above one, the asset trades at a price higher than the cost basis for many investors.

At 30.88, XRP’s MVRV ratio suggests that the altcoin is significantly overvalued. Its holders may sell for profit, especially as bearish sentiments gain momentum. This will put pressure on its price, preventing any uptrend in the short term.

XRP Price Prediction: Fall Below $0.50 is Imminent

If selling pressure mounts, XRP will shed its most recent gains and resume its downtrend. Its price may fall to $0.46 if this happens.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if buying activity resumes and enough demand backs the current rally, XRP’s price may rise to $0.52.