Despite high weekly gains, the MATIC price has flatlined on the daily chart. On-chain metrics suggest that bears could take control from here.

After the MATIC price charted notable early December gains, investor and trader anticipation for the asset heightened. MATIC is currently in the tenth-ranked spot in terms of market cap and was showing a strong 8.5% gain in the past seven days. But can it keep the good times going?

MATIC Network Growth Drops

Daily active addresses and new MATIC addresses have both been falling. New addresses dropped by 15.94%, while active addresses saw a 10.69% pullback in the last week.

Between Nov. 27 and Dec. 1, the daily active address metric saw sustained growth alongside the MATIC price rise.

However, they also started to fall in tandem with prices from Dec. 1 onwards. A drop in active addresses usually signals lower market activity as bullish anticipations fade.

Network growth for MATIC is also dipping. combined with falling network growth, this doesn’t paint a very optimistic outlook for the price.

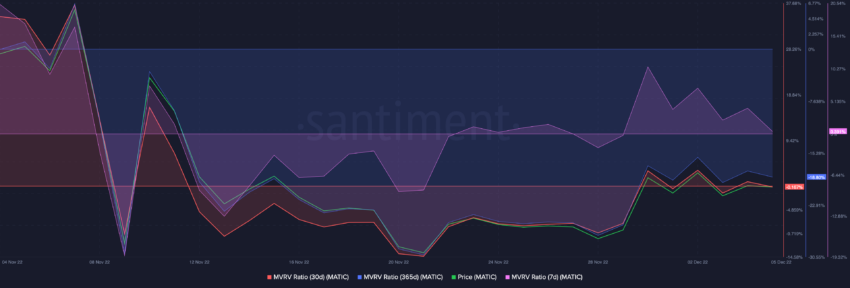

In addition, the 7-day MVRV for MATIC is heading in the negative zone. If the MATIC price continues to drop, short-term holders will be back at a loss. The 30-day and 365-day MVRV for MATIC was also in the negative, meaning that even long-term holders were back underwater.

Developers Rowing the Polygon Boat

Despite weak on-chain metrics, Polygon’s active developer count has continued to grow.

Polygon also did well in terms of daily active users in the web3 space, securing the second spot following BNB Chain. Polygon had a daily active user count of around 412,430.

However, the total value locked (TVL) in Polygon DeFi has continued to drop. Polygon TVL fell from an all-time high of $49.89 billion in June 2021 to a low of just over $1 billion at press time.

With its DeFi facet looking like a ghost town and sinking active addresses, the MATIC price could largely rely on retail euphoria and short-term volatility if it’s to gain ground.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.