The Polygon (MATIC) price has fallen since reaching a high of $0.98 on November 14.

Despite the decrease, the MATIC price regained its footing in December and is making a breakout attempt. Will it be successful?

MATIC Gets Rejected From Long-Term Resistance

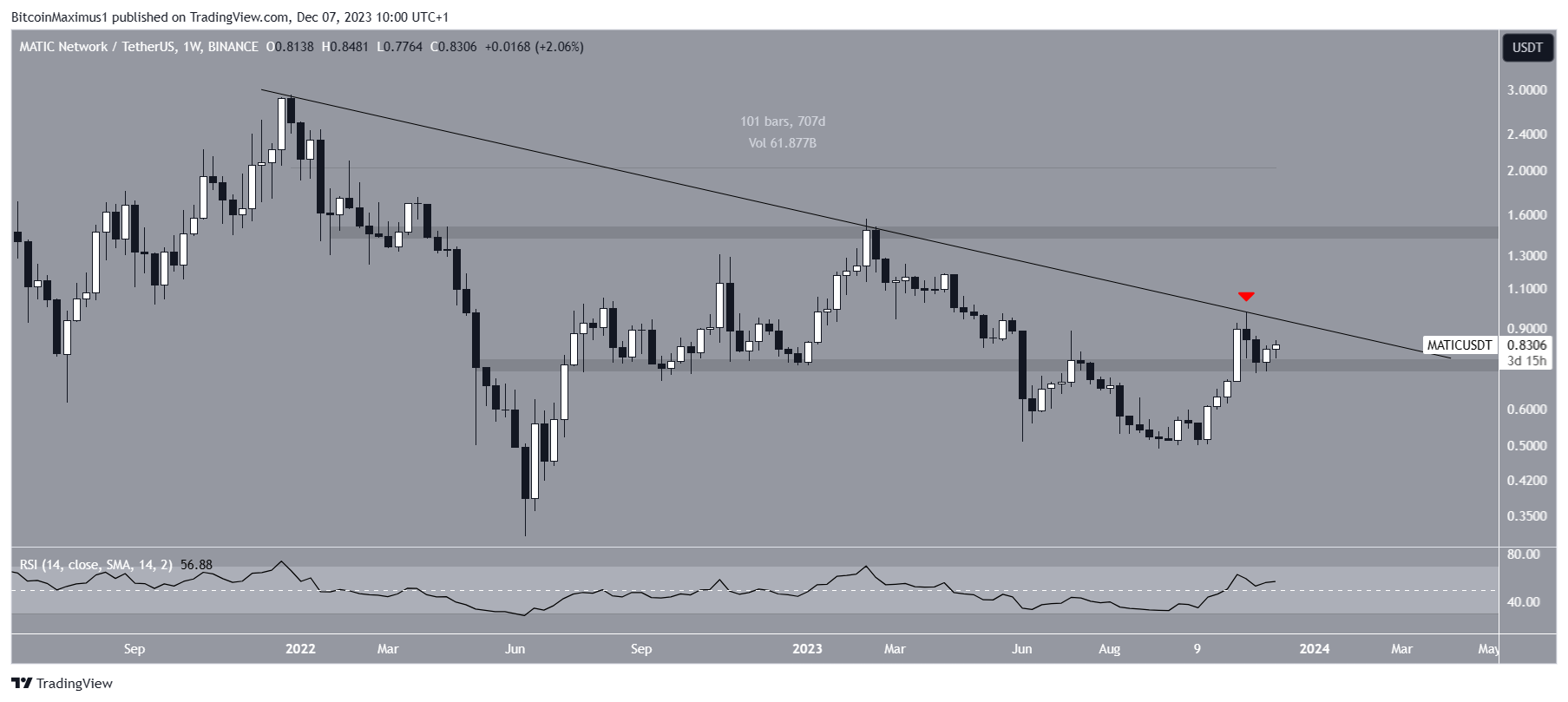

On a weekly timeframe, MATIC’s technical analysis reveals a downtrend since its peak in December 2021, marked by a descending resistance trend line in place for 707 days.

The most recent rejection (red icon) occurred three weeks ago. This took MATIC to a crucial horizontal zone, which has alternated between support and resistance since April 2022.

Traders commonly utilize the Relative Strength Index (RSI) as a momentum indicator to discern overbought or oversold conditions and make decisions on asset accumulation or selling.

An RSI above 50 in an upward trajectory signifies a prevailing advantage for bulls, while values below 50 suggest the opposite.

The weekly RSI is on the rise and positioned above 50, signaling both upward momentum and a bullish trend.

It is also worth mentioning that Robinhood launched crypto trading in Europe, and Polygon is listed among the 26 cryptocurrencies available for trade.

What Are Analysts Saying?

Cryptocurrency traders and analysts on X give conflicting views on the future trend.

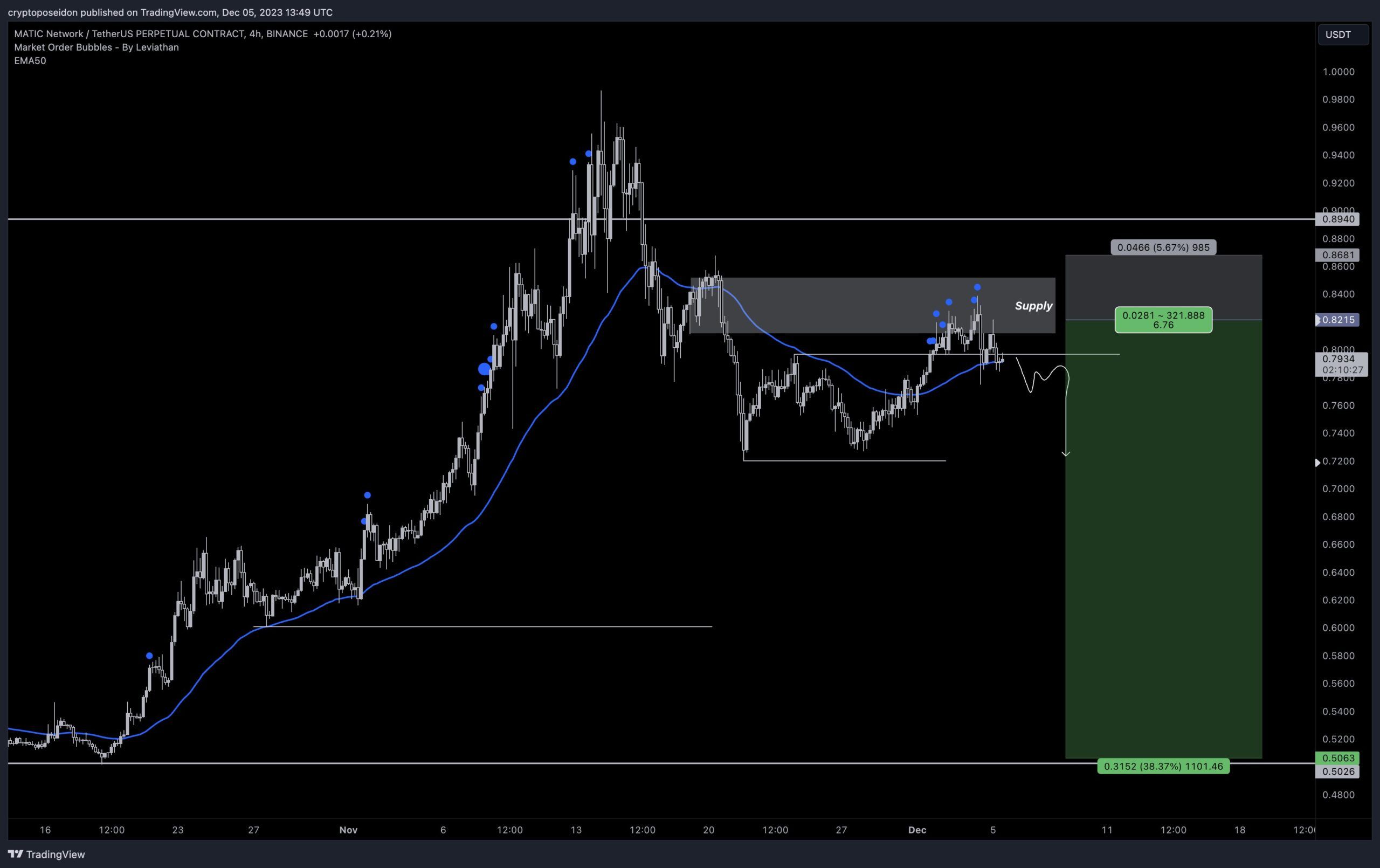

CryptoPoseidon is bearish since the price trades at resistance. He posted a potential short setup for the future MATIC price.

MoreCryptoOnline is bullish, but he has doubts about whether the short-term correction is complete. He tweeted that:

“We still need to see 5 waves off the September lows to confirm that the price is in a bull market. At the moment we are watching if 5 waves to the upside can form, and one wave is still outstanding. In the preferred scenario wave 4 is unfolding right now and $0.64 is support. It is possible that wave 4 is already complete but we need to see more price data to confirm this.”

MATIC Price Prediction: Breakout or Breakdown?

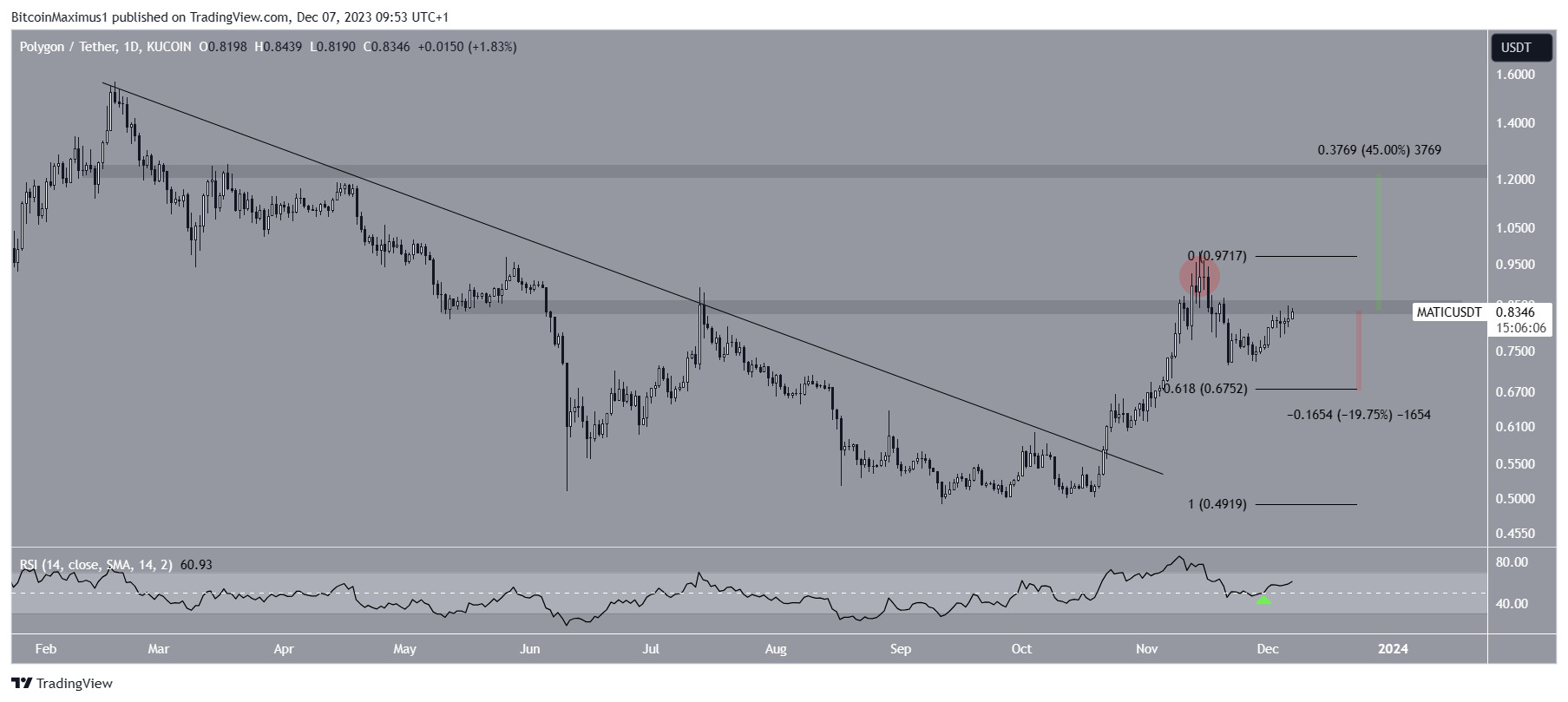

While the daily time frame also gives some conflicting signs, it is still leaning bullish. This is because of the price action and RSI.

The price action shows that MATIC broke out from a descending resistance trend line on October 22, leading to a high of $0.98 on November 14.

However, the price could not sustain the increase and fell below the $0.85 area shortly afterward, suggesting that the previous increase was a deviation (red circle).

Nevertheless, the MATIC price regained its footing and is attempting to break out from the $0.85 resistance area again. This attempt is supported by the daily RSI, which bounced at 50 (green icon) and is increasing.

If MATIC breaks out above $0.85, it can increase by 45% and reach the next resistance at $1.25.

Despite this bullish MATIC price prediction, a rejection from the $0.85 area can lead to a 20% decrease to the 0.618 Fib retracement support level at $0.67.

For BeInCrypto’s latest crypto market analysis, click here.