Crypto analyst Peter Brandt, known in the community for predicting Bitcoin’s (BTC) meltdown in 2018, shared a new opinion on the largest cryptocurrency by market capitalization. In a recent tweet, he hinted at BTC retesting the decline.

According to Brandt, Bitcoin is about to lose all bullish momentum following the recent correction experienced by the crypto market.

Peter Brandt Warns About Bitcoin Drop

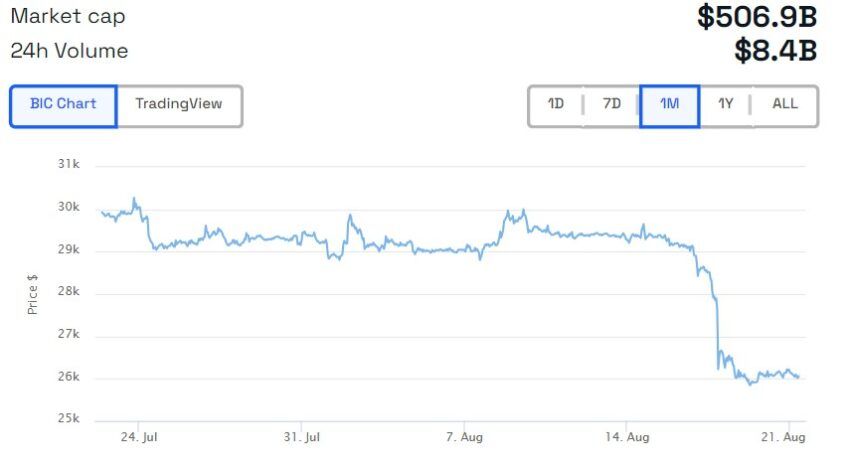

Since August 16, Bitcoin and the global cryptocurrency market have experienced a very significant drop.

According to the analyst, the largest cryptocurrency by market capitalization risks canceling its recent uptrend. Brandt noted in a tweet,

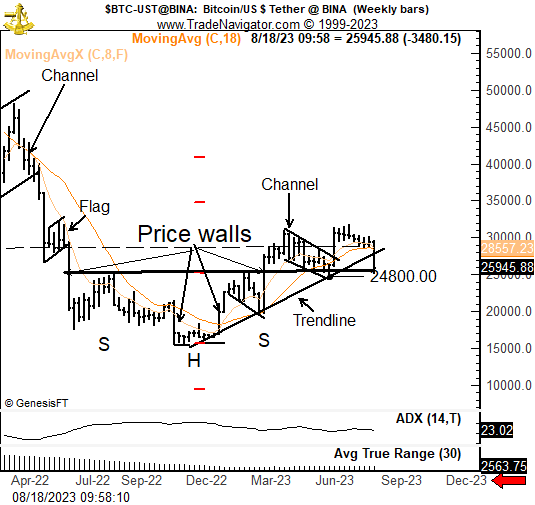

“The decline in Bitcoin $BTC is once again retesting the neckline on the underlying inverted H&S. A close below 24,800 (the low of the previous retest) would do damage to the daily and weekly graphs. But hey, what do I know? I am only a boomer who does charting.”

The renowned analyst stated that Bitcoin violated diagonal support that kept its price in an upward trend since the beginning of the year. Therefore, Brandt believes that BTC will continue to experience a downtrend unless it recovers above the critical level of support.

This means if Bitcoin’s value goes below $24,800, it would be a concerning sign for its short-term future.

Take a look at how to buy Bitcoin here: How to Buy Bitcoin with Google Pay: A Beginner’s Guide

BTC Falls 11% in a Week

Brandt also puts forward an interesting theory: “The fact that we are here again is highly suspicious.” In another post, the legendary analyst noted:

“Nate Silver, the famous statistician, wrote a book called the ‘The Signal and the Noise: Why Most Signals Fail.’ False signals occur in any and all fields of making projections, not simply limited to chart patterns.”

He signals that while charts often show patterns that suggest certain price movements, most don’t indicate accurate future price actions. He notes only 10% of these chart patterns are reliable enough to make trading decisions.

At press time, Bitcoin is trading at $26,032, according to data from BeInCrypto. It has registered a fall of over 11% in the last seven days after experiencing a flash crash four days ago. Bitcoin is around 62% down from its peak high of $69,000, achieved in November 2021.

Notably, the global Bitcoin network has an extensive network of 44,126 nodes, according to Bitnode data on Monday. The United States hosts 30.99% of these nodes, with Germany holding second place at 14.32%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.