On Thursday, three critical bearish incidents sent Bitcoin (BTC) price to $25,200. On-chain data explores why Bitcoin price tumbled and likely price action to anticipate in the coming weeks.

On Thursday, Bitcoin dropped briefly tumbled below $25,200, its lowest since early June. A bearish $373 million trade by Elon Musk’s SpaceX had set the initial downtrend in motion. However, two other seemingly unrelated material events have since unfolded.

Why Did Bitcoin (BTC) Price Crash to $25,000

While the current market has essentially been in a bear market for several months, these three factors could have also aided in the overall sentiment decline that led to the price dropping on Thursday.

Recent speculation indicated that Elon Musk’s SpaceX wrote down the value of Bitcoin (BTC) it owned by $373 million before selling it all off. While no evidence can back the fact that SpaceX had sold any holdings, it likely added to the FUD.

Within hours of the report, the BTC price had already started declining below the $27,500 support territory.

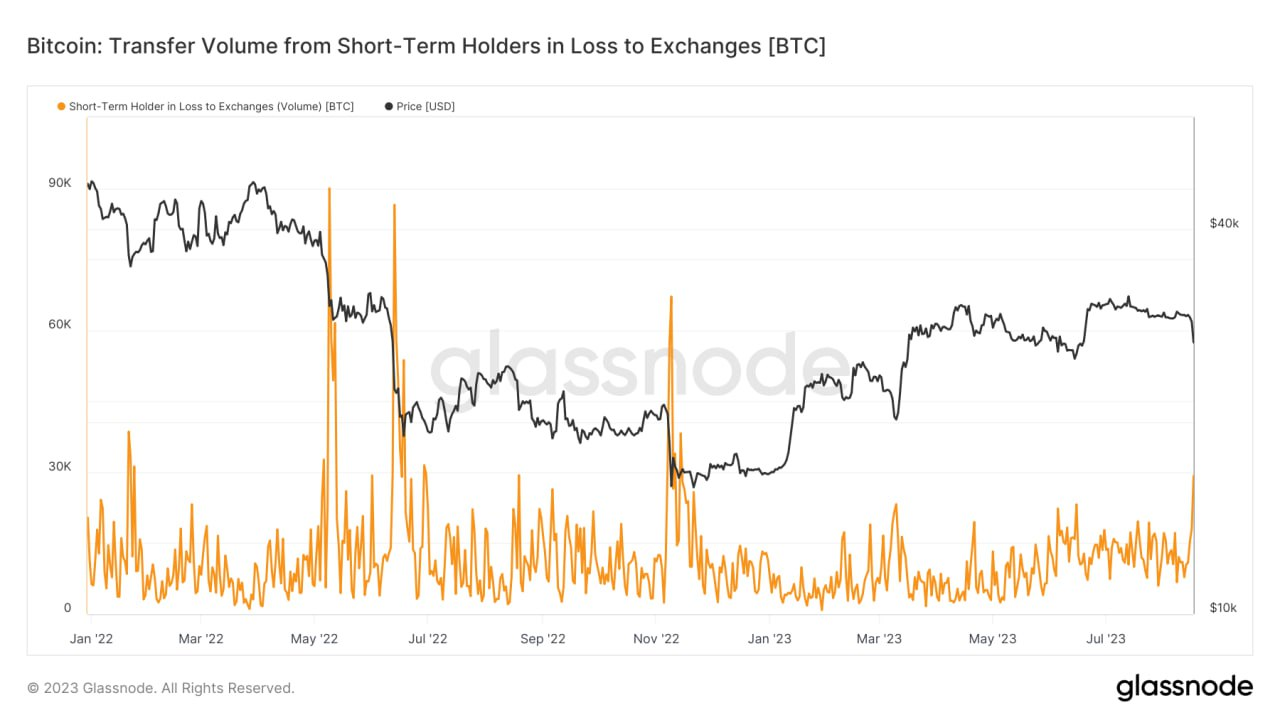

While the above events may not have directly caused the price decline, traders took the news correlated with a weakening market as a sign to derisk and sell off their Bitcoin holdings in case of a bigger price decline – Which later occurred. As seen in the chart below, short-term holders began to sell their BTC as the price declined.

The ongoing BTC sell-off saw market-wide liquidations. According to a blockchain analytics platform, Coinglass, more than $834 million crypto Long positions were liquidated within 24 hours. The chart below shows that Bitcoin traders took 40% of the heat, with more than $499 million worth of Long BTC positions nuked.

In the context of crypto margin trading, a Liquidation event is triggered when the asset’s price drops significantly, and resulting losses exceed the value of collateral or “margin” put up by the trader.

The chart above means investors who took Long/Positive positions on BTC have assumed more than $499 million in losses within the last 24 hours.

When traders’ positions are liquidated due to margin calls, they are often forced to sell their assets quickly. This influx of sell orders can lead to an oversupply of Bitcoin, potentially causing prices to drop further in the coming days.

American Institutional Investors Buying the Dip Could Offer a Lifeline

While crypto traders grappled with their losses in the futures markets, a vital on-chain data point shows US institutional investors taking advantage of the price dip.

CryptoQuant’s Coinbase Premium Index shows the percentage difference between BTC prices on Coinbase Pro and Binance spot markets.

While Binance dominates the retail spot market, Coinbase Pro is largely dominated by US-based institutional and high-net-worth traders. Hence, positive values of the Premium Index values indicate increased buying pressure among US investors trading on Coinbase.

The chart above shows the Coinbase Premium Index has broken into positive values for the first time in August. This presumably means US investors have taken advantage of the dip to acquire more BTC.

This uptrend in Coinbase Premium Index could increase retail investors’ confidence in the coming weeks.

In conclusion, the sell-off by Elon Musk’s SpaceX, shockwaves from Evergrande’s bankruptcy filing, and the $499 million Bitcoin liquidations are some of the vital reasons Bitcoin price tumbled toward $25,000.

However, the growing demand among US institutional investors could offer a lifeline to traders who got nuked and possibly trigger a mild recovery.

Looking For a New Exchange? These Are the Best Crypto Sign-Up Bonuses in 2023

BTC Price Prediction: Mild Recovery Toward the $29,000 Territory

BTC could recover slightly due to buying pressure from wealthy US institutional firms and traders looking to avoid further liquidations.

The In/Out of Money Around Price (IOMAP) data, which shows the purchase price distribution of current Bitcoin holders, also supports this premise.

As illustrated below, the 1.21 million addresses had bought 670,000 BTC at an average price of $28,000. If they anticipate further downswing, they could sell and trigger another pullback.

However, if the industry-wide headwinds subside, BTC could reach $29,000.

Still, BTC could decline toward $24,000 if the bears remain in control. However, 351,000 holders had bought 144,000 BTC at an average price of $25,400. If they remain resilient, BTC could once again rebound from that range.

However, BTC could sink toward $24,000 if those rebound efforts fail.

Interested in AI Trading? 9 Best AI Crypto Trading Bots to Maximize Your Profits

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.