The Pepe (PEPE) coin price broke out from a long-term diagonal resistance line and reached a new monthly high on June 23.

The PEPE price is trading in a continuation pattern, a breakout from which will confirm that the price will head to a new monthly high.

PEPE Coin Price Clears Long-Term Resistance Line

The Pepe coin has decreased under a descending resistance line since May 13. While doing so, the price fell to a low of $0.00000081 on June 10. The price bounced afterward, validating the $0.00000088 area as support.

On June 21, the price broke out from the resistance line, confirming that it had completed its correction. PEPE reached a high of $0.0000017 before falling.

The Relative Strength Index (RSI) supports the continuing increase. With the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward, but if the reading is below 50, the opposite is true. The RSI is above 50 and increasing. At first glance, this does look like a bullish signal.

The RSI is increasing and is above 50, a sign of a bullish trend. This legitimizes the breakout’s validity and supports the increase’s continuing.

Wave Count Gives Bullish PEPE Price Prediction

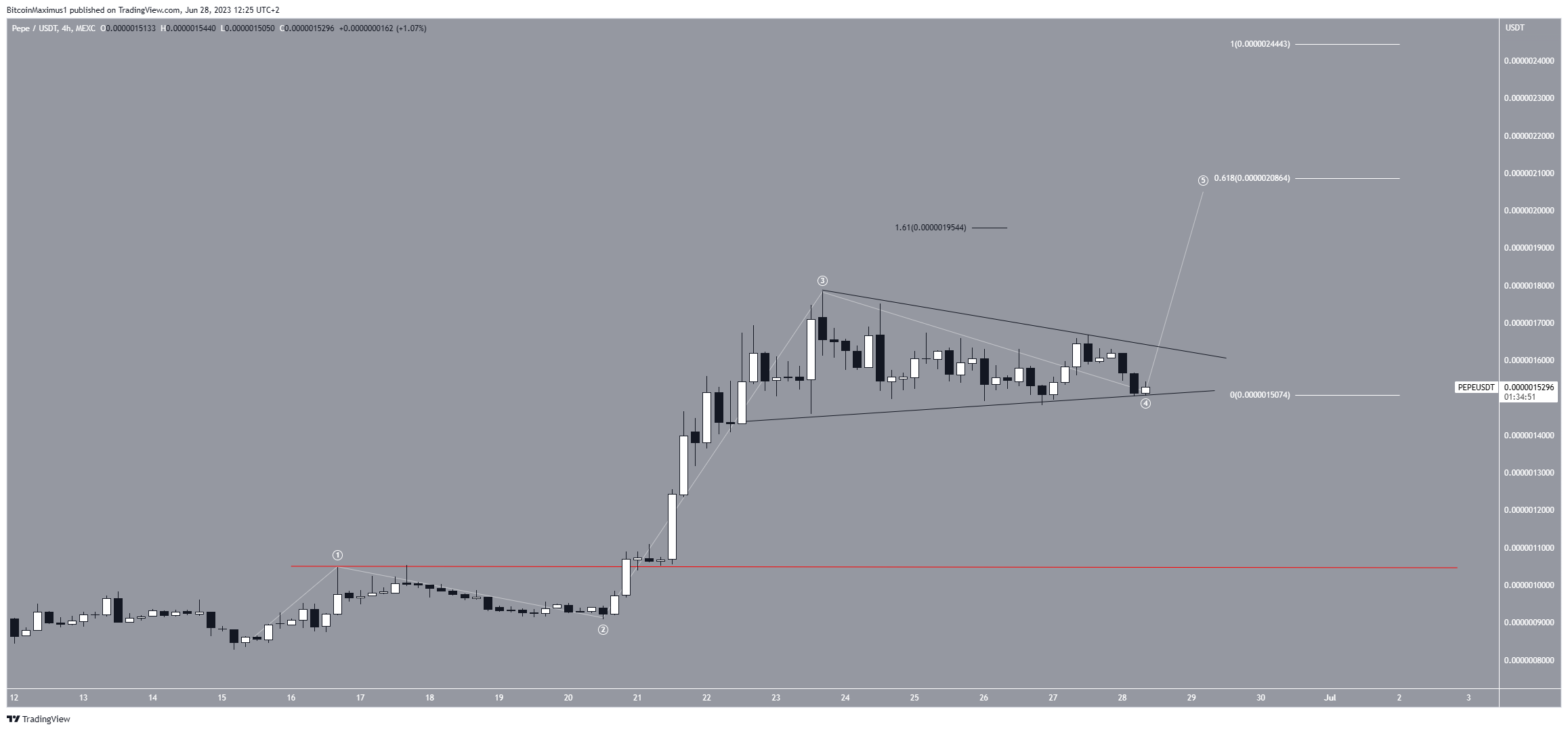

The technical analysis from the short-term four-hour chart provides a decisively bullish PEPE coin price prediction, aligning with the daily time frame. This is mainly because of Elliott Wave theory and the bullish count it outlines.

The wave count shows that the PEPE price has been mired in a five-wave upward movement since June 15 (white). If so, it is currently in wave four, which is corrective. Wave four has taken the shape of a symmetrical triangle.

If the count is correct, the PEPE price will soon break out from its triangle and reach a new high.

The most likely area for the top is between $0.0000019 and $0.0000021. The target is found using the 1.61 external retracements of wave four (black) and the 0.382 lengths of waves one and three (white). However, if wave five extends, the price can move to the next resistance at $0.0000024.

Despite this bullish PEPE price prediction, a decrease below the wave one high (red line) at $0.0000010 will invalidate this bullish forecast.

The PEPE trend would be considered bearish in that case, with more downside to $0.000005 expected.

Read More: Best Crypto Sign-Up Bonuses in 2023

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.