The Pepe (PEPE) coin price has led the entire crypto market in gains since the beginning of April. However, a sharp fall that began on May 5 has caused a significant portion of these gains to disappear.

Despite the drop, the MEME price bounced today, possibly beginning another rally. Will this be a bullish reversal that leads to a new all-time high, or is this just a relief rally? Continue reading below in order to find out more about the PEPE price forecast.

PEPE Coin Price Cools Off After Massive Increase

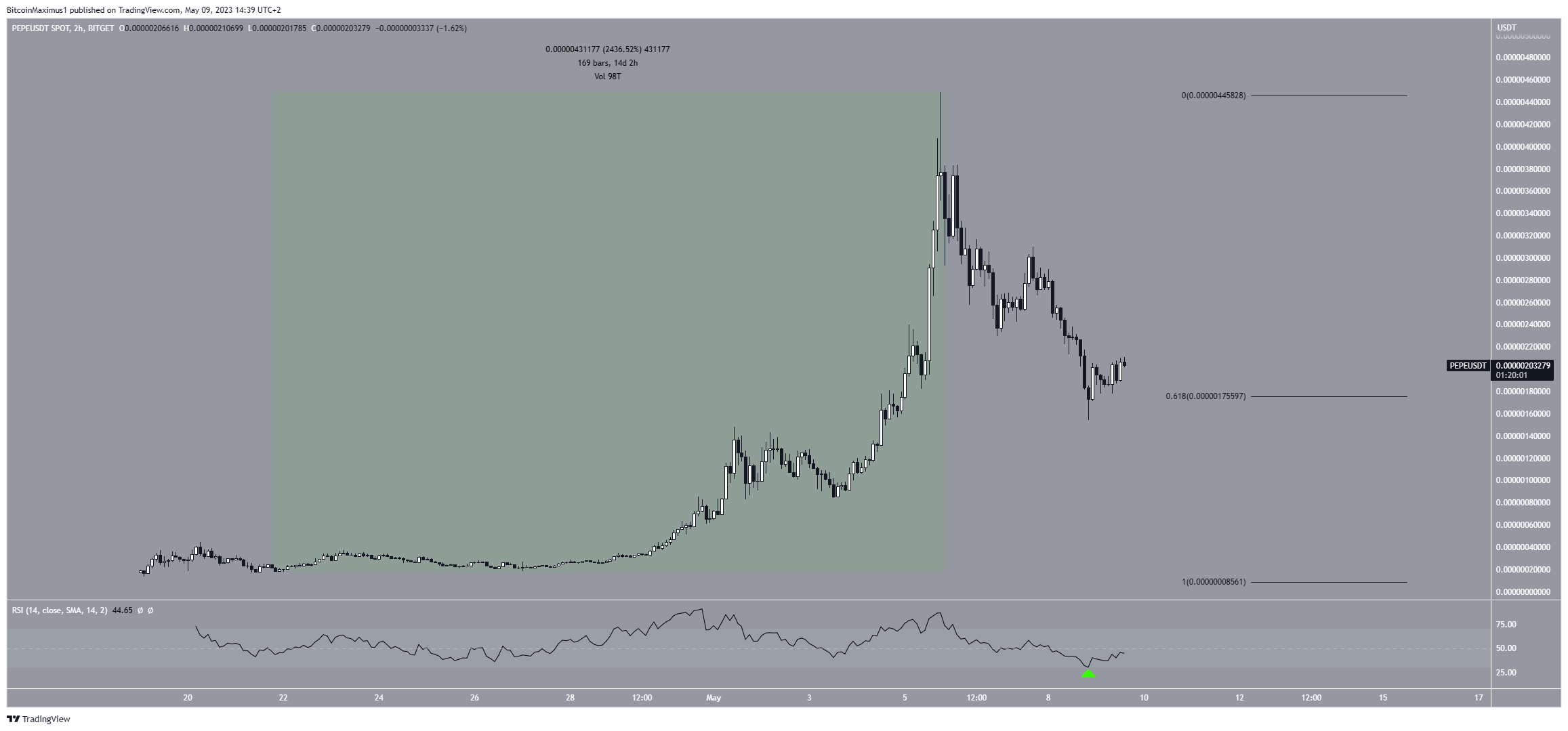

The Pepe coin has been the unequivocal leader of “meme coin season”, increasing by 2400% over 14 days. The upward movement led to a new all-time high of $0.0000044 on May 5.

However, PEPE has fallen since, leading to a minimum price of $0.0000018 on May 8, reaching the long-term 0.618 Fib retracement support level.

Fibonacci retracement levels operate on the principle that after a significant price change in one direction, the price will retrace or revisit a previous price level before resuming in its original direction.

The 0.618 Fib level often acts as the bottom if the decrease is just a correction.

The Relative Strength Index (RSI) gives mixed readings. By using the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage, but if the reading is below 50, the opposite is true. While the current reading is below 50, the indicator is moving upwards.

Additionally, it bounced after reaching a new all-time low oversold reading of 25 (green icon). As a result, the indicator does not confirm if the digital asset is in a bullish or bearish trend.

PEPE Price Prediction: Is a Bounce Imminent?

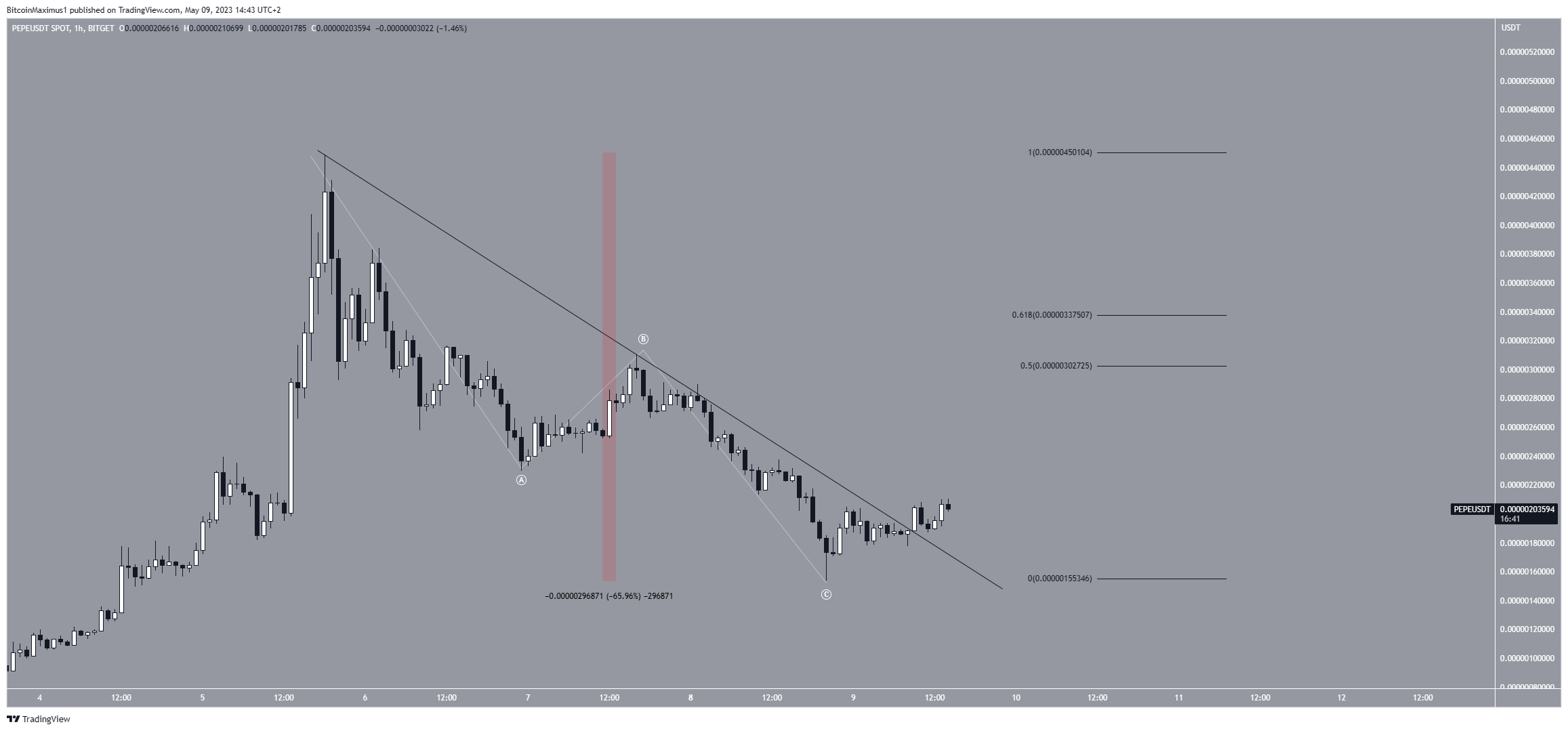

The technical analysis from the short-term 30-minute chart provides a more bullish PEPE coin price prediction. This is because of both the Elliott Wave theory and the price action.

The wave count shows a possible completed A-B-C corrective structure (white). The fact that the downward movement ended right at the 0.618 Fib retracement support level fits with the correction being done.

Next, the price broke out from a descending resistance line that had existed since the all-time high. This further fits with the possibility that the PEPE Price correction is done and a rally has begun.

If that is the case, the price will increase toward the 0.5-0.618 Fib retracement resistance area at $0.0000030-$0.0000034.

The reaction once it gets there will likely determine if the increase is a relief rally or a new upward movement that will take the price to another all-time high.

However, a decrease below the May 8 low will invalidate this bullish PEPE price forecast.

In that case, the PEPE price correction could falter and fall to the next closest support at $0.0000010.

For BeInCrypto’s latest crypto market analysis, click here.