Fintech company PayPal has announced the launch of a stablecoin, PYUSD, which will be backed by the US dollar, short-term treasuries, and similar cash equivalents.

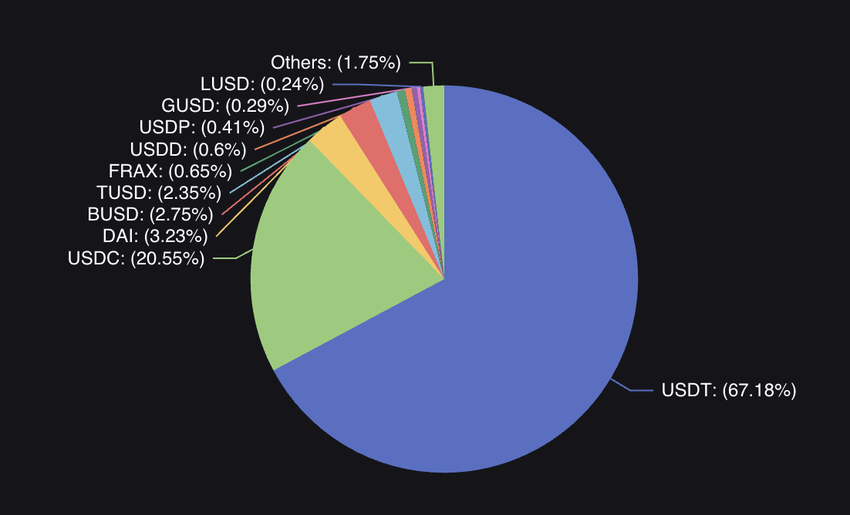

The stablecoin ecosystem has been viewed skeptically, particularly after the last year’s depegging of TerraUSD (UST). As investors are not confident about some stablecoins, the ecosystem remains largely under the duopoly of Tether (USDT) and USD Coin (USDC).

Community Fears Centralized Control

According to PayPal’s official announcement, PYUSD will be released for US customers in the upcoming weeks. Then the customers could transfer the ERC-20 stablecoin to external wallets, make peer-to-peer transactions, and convert it to other cryptocurrencies supported by the PayPal ecosystem.

However, community members are concerned about the centralized aspect of PayPal. PayPal being a centralized entity has put customers’ payments on hold, demanding certain information in various instances.

Highlighting the issue of centralized control, a community member made a sarcastic remark on PYUSD:

“You can only transfer $10 per day after you submit 10 government id’s and give them 10 valid reasons why you want to transfer.”

Regulatory Environment Progressing Towards More Clarity?

PayPal has partnered with Paxos for the issuance of PYUSD stablecoin. The same company was the issuer of Binance’s BUSD stablecoin, but it ended its relationship with the firm in February 2023.

The development came after the New York Department of Financial Services (NYFSD) ordered Paxos to stop the minting of BUSD.

Also, in February 2023, PayPal announced pausing its development of the stablecoin due to increased regulatory scrutiny. It also highlighted the uncertain regulatory environment as a risk to its business.

But now the company believes that the regulatory environment is “progressing toward more clarity.” The NYFSD will regulate PayPal’s stablecoin. Moreover, the fintech company would release monthly reports of its reserves backing the stablecoin.

After PayPal’s announcement, the Chairman of the House Financial Services Committee, Patrick McHenry, said:

“This announcement is a clear signal that stablecoins – if issued under a clear regulatory framework – hold promise as a pillar of our 21st century payments system.”

Learn more about stablecoins here.

Challenging Dominance of Major Stablecoins

According to Bloomberg, Jose Fernandez da Ponte, the head of PayPal’s blockchain and digital currencies team, believes there is a rising demand for alternative stablecoin due to the increased dominance in the market.

The pie chart below shows that Tether’s USDT has a 67.18% dominance, while Circle’s USDC has a 20.55% dominance in the market. Whereas the remaining stablecoins share the remaining 12% of the pie.

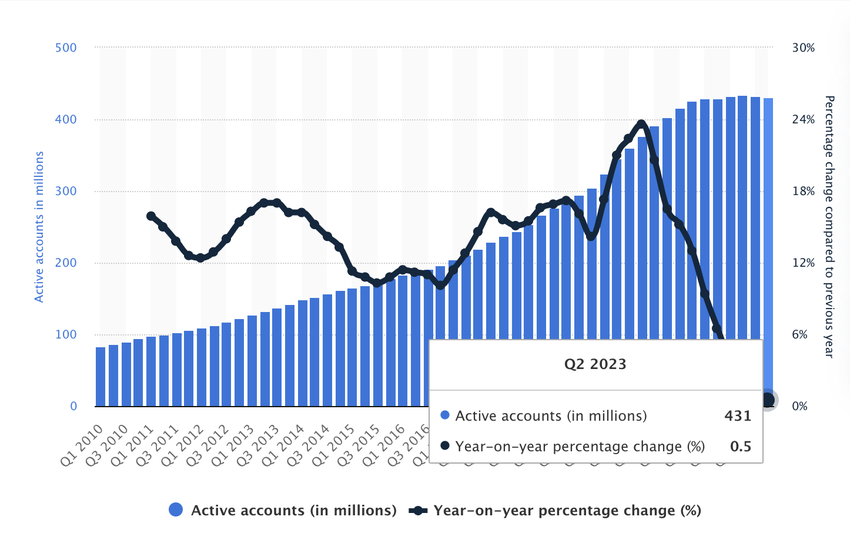

While PayPal’s PYUSD has not received a warm welcome from the crypto community, it has a chance to leverage upon the existing users of the platforms. According to Statista, PayPal had 431 million active accounts in the second quarter of 2023.

Only the upcoming period can answer if PayPal’s PYUSD manages to disrupt the duopoly of USDT and USDC.

Got something to say about PayPal PYUSD or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.