Research Finds SUSHI Prices Way Overvalued

A newly-issued report by on-chain analytics firm Glassnode has taken a deep dive into the tokenomics of the Uniswap fork SushiSwap. In a nutshell, it stated that the platform’s inflationary model means that huge trading volumes would be required to maintain high token prices.SUSHI prices surged to top $11 three days after the DeFi clone was launched in late August. The FOMO was palpable as yield farmers flocked to the Uniswap clone offering better returns on its own liquidity pool tokens. Prices began to retreat immediately, falling to around $6.20 before the promise of a full smart contract security audit (which turned out to just be a security review) lifted SUSHI prices back to around $8.50. Three days later SUSHI had lost almost 50% of its value again. SushiSwap went through a bit of turbulence over the weekend when the owner and administrator, ‘Chef Nomi’ sold 2.5 million tokens that had been accrued through the 10% development share fund. Naturally, token prices dumped harder afterward. The subsequent handing over of the project helm to Alameda Research and derivatives exchange FTX CEO, Sam Bankman-Fried, has done little to slow the sell-off. At the time of writing, SUSHI tokens were changing hands for $2.20, a slump of 80% since its all-time high just over a week ago.The $SUSHI token has seen a spectacular rise and fall in its short lifetime.

— glassnode (@glassnode) September 8, 2020

But beyond the hype and FUD, what are the fundamentals behind the native @SushiSwap token's value?

Read the full analysis 👇https://t.co/6o2rSFy44C

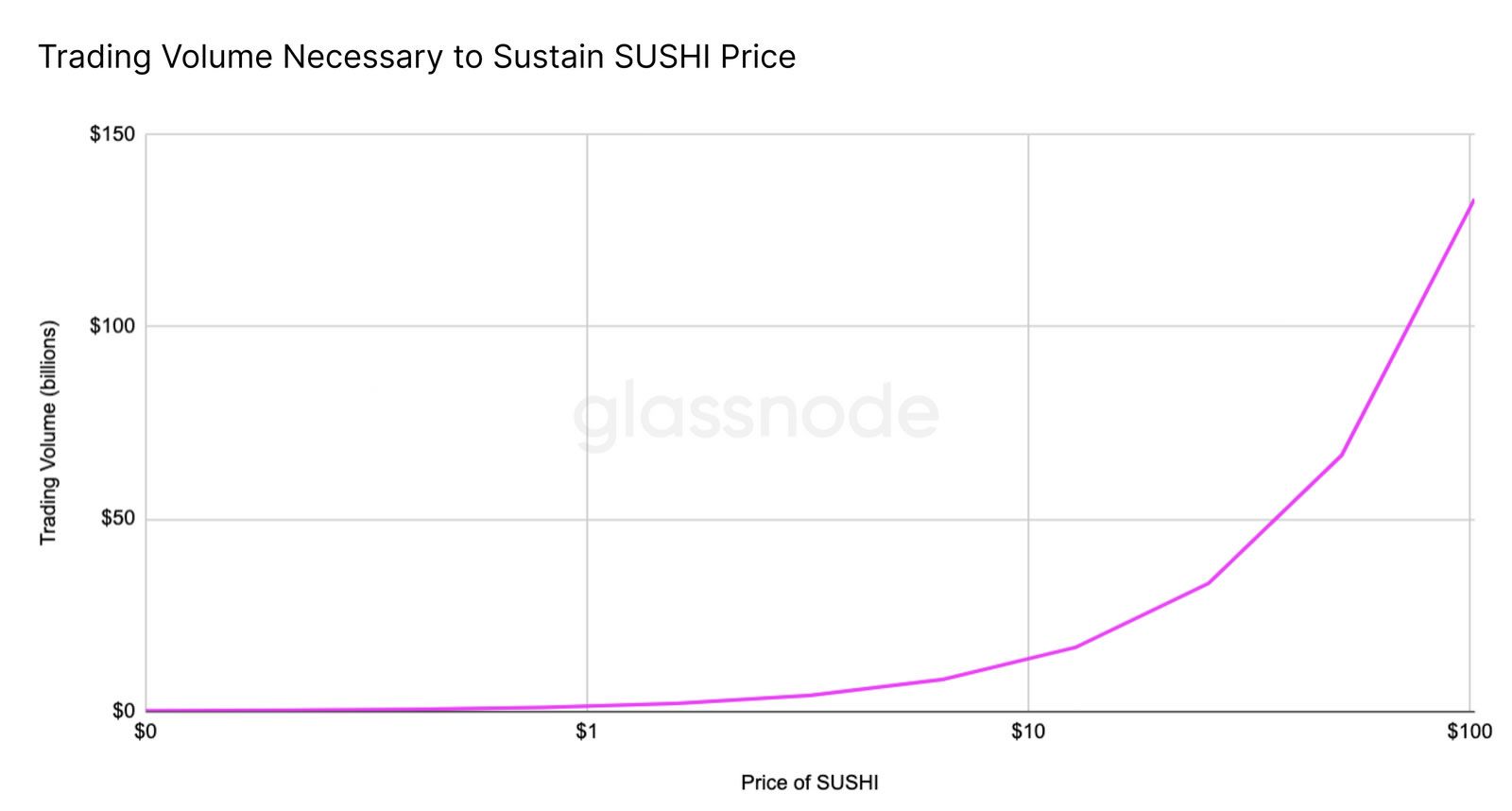

Due to hype and a lack of understanding about the token’s fundamentals, the SUSHI price will likely remain higher than this sustainable point in the near-term, causing inflation.With low trading volumes and high prices, hundreds of millions of SUSHI will be added into circulation every year she continued. These newly minted tokens will not have their value backed by money actually flowing into the system. If the opposite happens where SUSHI sees high volumes and low prices, inflation will decrease and more tokens would be bought by the protocol than are being minted each day. This would exert deflationary pressure and increase the value of each SUSHI token.

In conclusion, the report noted that unless trading volume grows extremely high, or price dips below the sustainable point, the potential for the price of SUSHI to rapidly decrease is highest right now, adding that:

In conclusion, the report noted that unless trading volume grows extremely high, or price dips below the sustainable point, the potential for the price of SUSHI to rapidly decrease is highest right now, adding that:

It will often be more profitable for investors to sell half of their SUSHI into ETH and become a liquidity provider rather than holding the full value in SUSHI and redeeming the 0.05% reward amount.

SushiSwap Migration Imminent

The latest development in the SushiSwap saga is the imminent migration away from Uniswap and onto its own platform. This will also entail the transitioning to multi-signature wallets for governance, presumably controlled by SUSHI whales, or ‘the community’ as the new boss puts it:A million SUSHI will be doled out for those who continue to provide liquidity through migration, Bankman-Fried stated. The protocol still has over a billion dollars in total value locked, which is roughly 75% of Uniswap’s pool tokens according to the Zippo dashboard.1) The Sushi migration is coming up in 10 hours!https://t.co/jxonLFwLJL

— SBF (@SBF_FTX) September 9, 2020

Here's a vote for the reward for those who migrate; currently at 1mm, but will increase to 2mm if this passes:https://t.co/AMJVUDYvdD

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.