Rough week in DeFi land with 6 assets dipping more than 50% + over the last 7 days

— Messari (@MessariCrypto) September 8, 2020

Where are we going next? pic.twitter.com/3vJiqb4xhr

Grading on a Curve

Curve (CRV), an exchange liquidity pool built on Ethereum for stablecoin trading, saw the worst of it. CRV suffered nearly 60% declines, giving the skeptics fodder for an argument that DeFi is just another 2017 altcoin bubble waiting to pop. CRV is one of the DeFi tokens that cryptocurrency exchange Binance listed, which has come back to bite the trading platform. In addition, Binance also listed SUSHI days after the project launched. The move placed a target on the back of the giant exchange, considering that SushiSwap investors got swindled by the project’s founder. The SushiCoin debacle, which took place during 5 – 6 Sept., saw the founder sell their SUSHI stake and hand over the project to someone else. Nevertheless, the coin actually managed to eke out gains of around 33% in the last seven days. Another high-flying wonder project, yearn.finance (YFI), shed about one-third of its value, erasing gains from investors during the same period.WeChat Users Search for DeFi

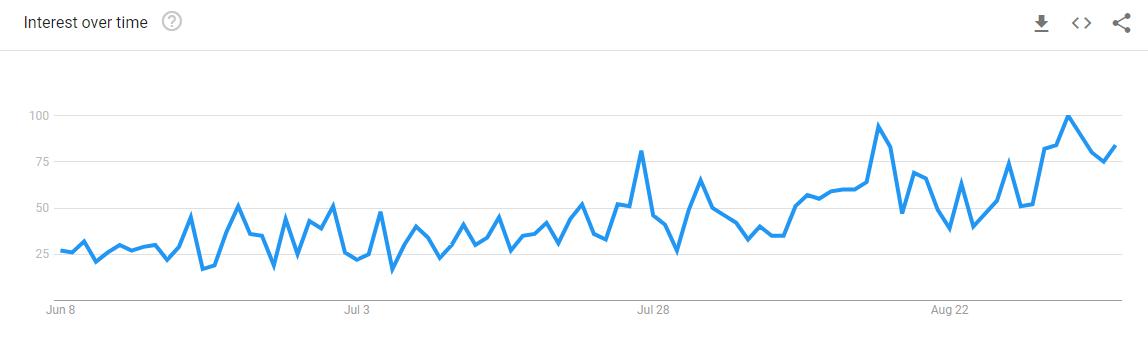

Sophisticated investors are largely waiting on the sidelines until there’s more clarity on DeFi’s network mechanics. Nevertheless, the uncertainty is not scaring away WeChat users. Cole Kennelly, the organizer of DeFi NYC, tweeted some stats about WeChat trends as it relates to the industry. He noted that searches hover at all-time high levels with nearly 1 million unique searches in early September.Google Trends show similar interest, with DeFi searches since mid-July on a jagged but upward trajectory.The number of WeChat searches for #DeFi is at record levels.

— Cole Kennelly (@ColeGotTweets) September 7, 2020

Almost 1 million unique searches on September 2. 👀 pic.twitter.com/3cndAmmGa8

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.