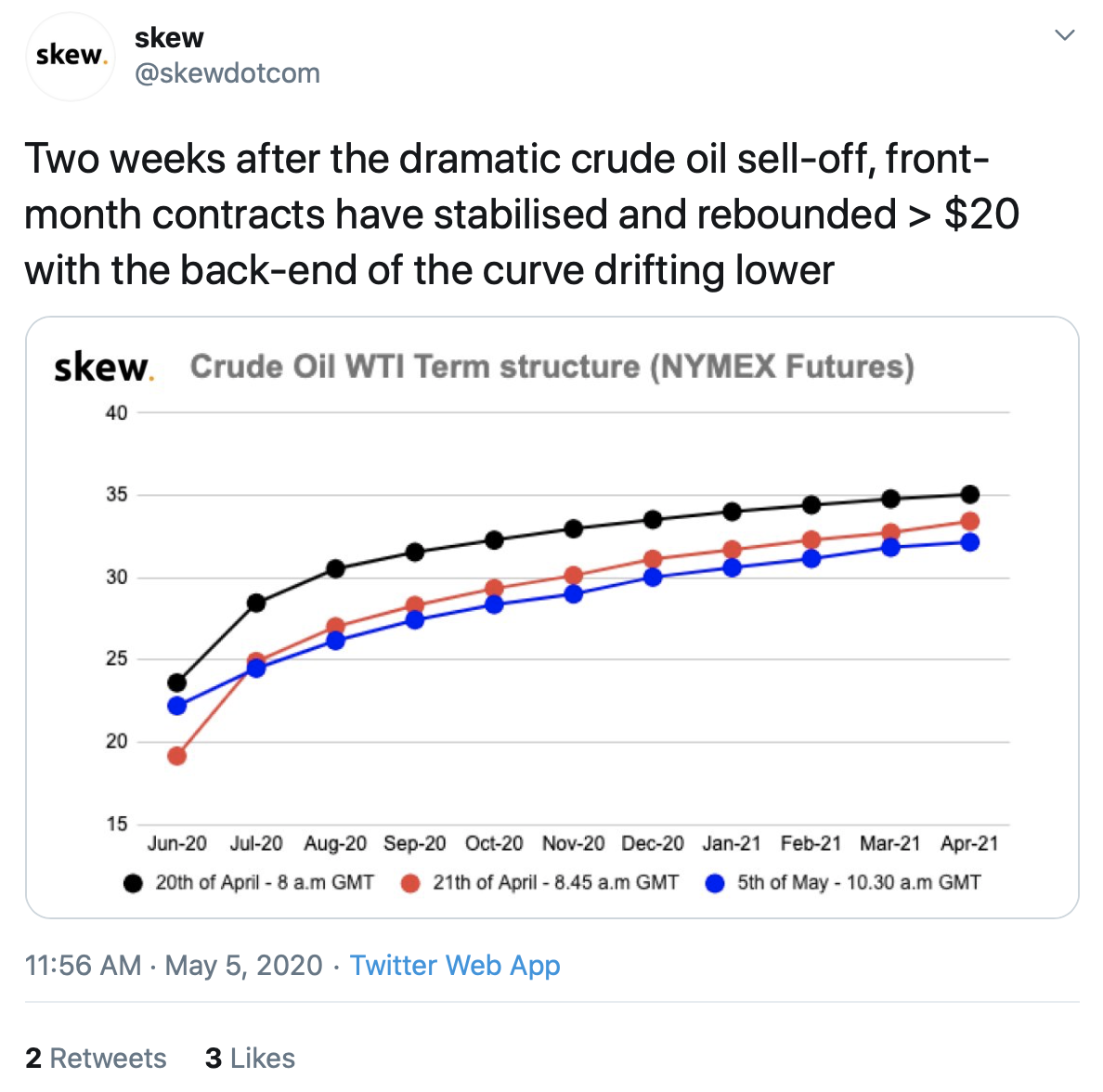

Although oil prices were in free fall just a few weeks ago, most futures contracts seem to have stabilized. June futures are now trading well above $20.

Could the worst of the oil price collapse be over? Analysts are feeling optimistic as oil futures continue to tick higher.

Oil Futures Rise

In April, people were shocked to see oil futures drop negative for the first time in history. Oversupply had crippled the sector, and there was an unprecedented excess of oil. At one point, a single Bitcoin could purchase over 7,000 barrels of oil.

It was difficult then to anticipate what could happen next. June futures for oil continued to drop and traded for as low as $13 on April 28. There were expectations that the crisis in oil would eventually hit other supply chains, especially the farming sector.

For now, however, the situation has improved. As skew (@skewdotcom) writes, the dramatic crude sell-off in April seems to be over and there has been a rebound. Although oil prices are still expected to be under $35 going as far out as April 2021, expectations for this upcoming summer are getting better. At the time of writing, June futures are pricing oil at around $22.50.

It remains to be seen whether this rebound will last, but it is a promising sign for a sector on the verge of collapse just weeks ago.

Is the Worst Behind Us?

The current rally in oil is optimistic and based on the expectation that demand for oil will improve this summer. However, there’s little indication that will actually happen. There are fears of another, deadlier round of COVID-19 in the fall.

There’s also no guarantee that the world will continue its old consumption habits even as lockdown measures are lifted. As one analyst told CNBC recently, opening the economy may be a ‘sell the news’ event.

Oil is the lifeblood of the global economy; so naturally, if depressed demand persists, then oil will suffer further. For now, futures are rising based on optimistic expectations. However, the outlook is incredibly uncertain. The IMF still predicts a V-shaped recovery, but they also admit that we will experience the worst economic crisis since 1929. The reality is, many seem to be both pessimistic and optimistic at the same time—and eventually, we will have to contend with what’s to come.