The Optimism (OP) price is making a slow move upward, but this is creating uncertainty among investors.

The lack of conviction has resulted in whale selling and a bearish development among the most important cohort.

Optimism Investors See Downside

Optimism’s price rise might slow down as investors continue to move their holdings on the network. Two major cohorts, the whales and the long-term holders, are exhibiting bearishness, which could affect the price soon.

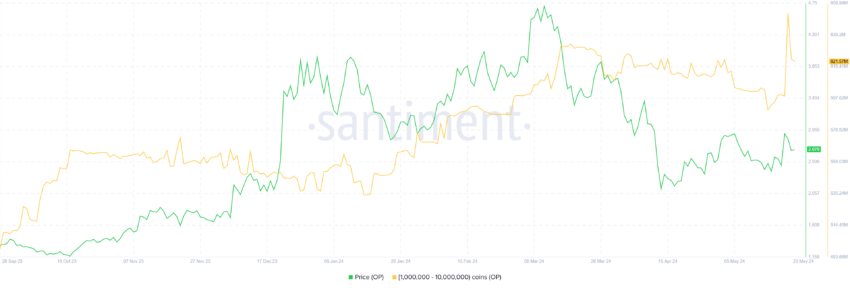

The addresses holding between 1 million and 10 million OP recently bought more than 52 million OP within a day. However, the next day, they sold 30 million OP worth about $78 million. This shows that the large wallet holder’s accumulation was not out of conviction but likely a profit-taking move.

In addition, the long-term holders (LTH) also recently sold a huge chunk of their holdings. These investors are known to hold their supply for more than a year, and their move tends to be a bearish sign.

The impact of their actions can be assessed using the age consumed metric. It shows the total volume moved multiplied by the days since the last move. This provides insight into the sentiment of long-term holders.

Read More: What Is Optimism?

Spikes in this metric hint at rising bearishness among LTHs, who are likely looking to sell their holdings. OP observed the largest spike since September 2023, raising concerns surrounding future price action.

OP Price Prediction: Consolidation Ahead?

Optimism’s price has been in an uptrend for the past month and a half, bringing the altcoin to $2.68 at the time of writing. However, in this duration, OP has attempted to breach the $2.99 resistance twice, failing both times.

The altcoin also cemented $2.33 as a crucial support floor, and in the future, these will be the limits of consolidation. Bearish cues will keep Optimism’s price moving sideways.

Read More: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

However, a breakout or breakdown could change this sentiment. The chances of a breakout are higher than those of a breakdown.

A move above $2.99 will enable OP to breach $3.17 and head towards $3.59, which would also invalidate the bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.