The Optimism (OP) price is on the verge of making a potential comeback after noting a 30% correction over the last few days.

This recovery will be triggered by development on Tuesday, but OP will still need to cross some barriers before this recovery can be solidified.

Optimism Fault Proofs Test Begins

Optimism development firm OP Labs announced on Tuesday that it would be beginning fault-proof testing on Ethereum’s Sepolia testnet. This is the second iteration of fault-proof testing after already being deployed on the Goerli testnet last year.

Fault proofs are a necessary upgrade to the existing security measures in Optimism. Presently, rollups are not able to secure themselves and are watched over by the “security council”. This impedes the true definition of decentralized, which can be fixed with the deployment of fault proofs.

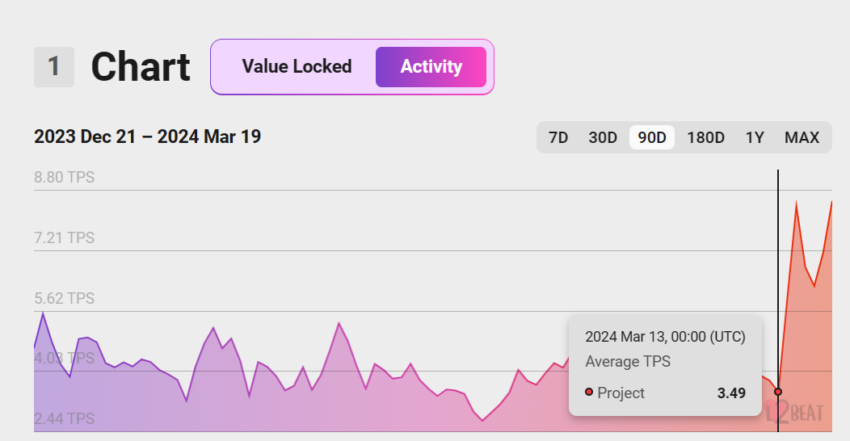

The testnet deployment was met with positive reception, as evinced by the green candlestick from Tuesday. Furthermore, the Optimism network has been noting a surge in the average transactions conducted.

Read More: What Is Optimism?

The transactions per second (TPS) have risen from 3.49 to 8.51, marking a 143% increase over the span of a week. This signifies that Optimism is noting much higher activity, likely due to the anticipation of the deployment.

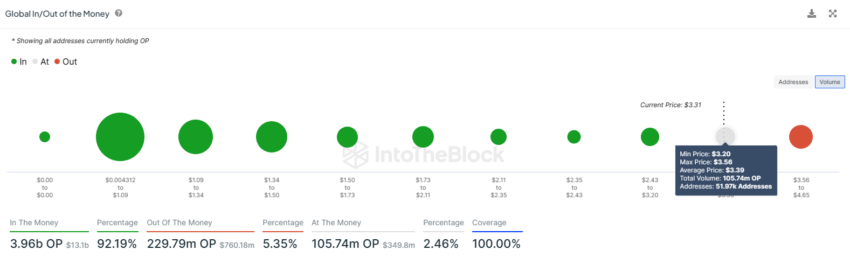

Should this optimism be sustained, it would prove to be helpful in pushing the price higher. As is, investors are pining for an increase since 105 million OP worth over $364 million is at the cusp of becoming profitable. This supply was bought between $3.20 and $3.56 and became loss-bearing following the 30% correction this month.

Since Optimism’s price, trading at $3.46, is less than 5% away from reaching $3.56, investors will likely refrain from selling. This would keep the bullish momentum alive.

OP Price Prediction: Another Big Event Is Set to Take Place

If Optimism price can maintain $3.30 as a support floor, the bearish momentum will shift to an uptrend. The Average Directional Index (ADX) is still above the 25.0 threshold. The ADX is a technical analysis indicator used to measure the strength of a trend. It ranges from 0 to 100, with higher values indicating a stronger trend, whether it’s bullish or bearish.

This suggests that when the uptrend initiates, it will find the strength to push the price back up toward $4.00.

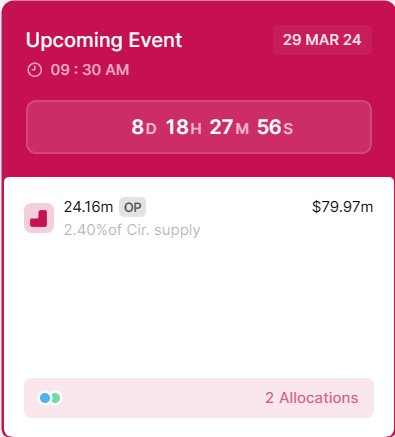

However, a major token unlock is set to take place on March 29. About 24 million OP worth nearly $80 million will be unlocked, and when nearly 2.4% of the circulating supply enters the market, Optimism’s price could be negatively impacted.

A decline to $3.30 is possible, and falling through it will send OP to $2.82, coinciding with the 200-day Exponential Moving Average (EMA), which will invalidate the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.