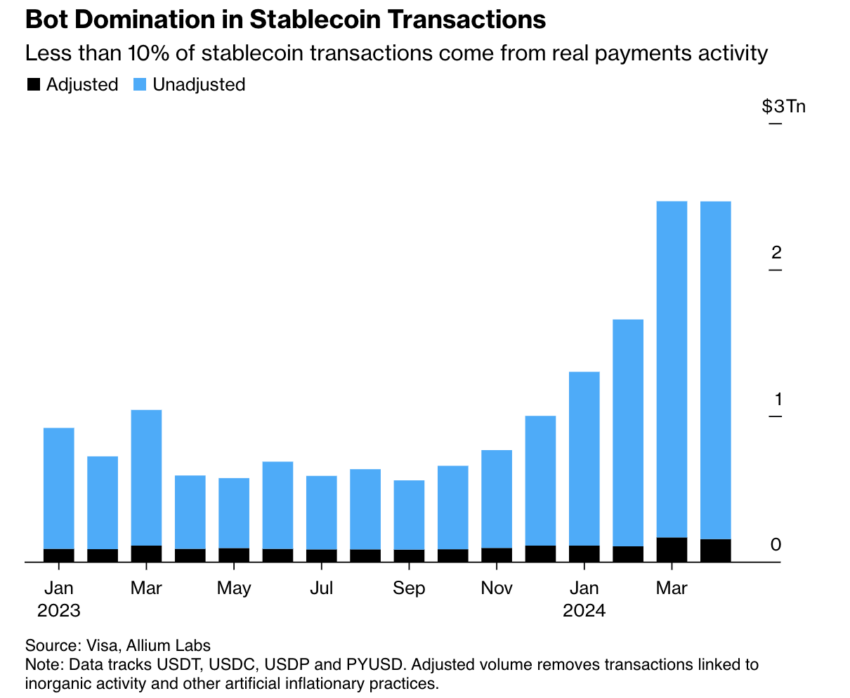

Visa and Allium Labs dashboard disclosed that only 10% of stablecoin transactions in April were authentic. This finding suggests that stablecoins are still far from becoming a widely accepted payment method.

The analysis utilized a specialized dashboard that excludes transactions by bots and large traders to focus solely on genuine user activities.

Are Only Bots and Traders Using Stablecoins?

Out of an astounding $2.2 trillion in total transactions, just $149 billion represented organic payments. Stablecoins are digital currencies anchored to stable assets like the dollar. Crypto enthusiasts believe they are potential game-changers for the $150 trillion payments industry.

However, Visa’s recent data paints a different picture.

Notably, fintech giants like PayPal and Stripe are delving into stablecoins, encouraged by recent technical enhancements. For instance, PayPal launched its stablecoin, PYUSD. While Stripe has begun allowing merchants to accept stablecoins for online transactions, indicating strides toward adoption.

Read more: A Guide to the Best Stablecoins in 2024

The path for stablecoins in the payments industry is still in its early stages. Pranav Sood, the executive general manager for EMEA at Airwallex, remarked on the findings.

“Stablecoins are still in a very nascent moment in their evolution as a payment instrument. That’s not to say that they don’t have long-term potential, because I think they do. But the short-term and the mid-term focus needs to be on making sure that existing rails work much better,” Sood said.

The stablecoin volume overestimation often results from transaction double-counting across various platforms, explained Cuy Sheffield, Visa’s head of crypto. For example, converting $100 of USDC to PYUSD on a platform like Uniswap could lead to $200 being recorded as the transaction volume.

Despite the infrastructure development and growing interest in stablecoins, consumer demand remains tepid. Many potential users find the technology complex and not user-friendly, representing a significant adoption barrier. Remarkably, checks are still used for a significant portion of business payments in the US, indicating a slow shift to newer technologies.

Meanwhile, Tether reported a record net profit of $4.52 billion for the first quarter of 2024. These financial achievements help Tether maintain the stability and reliability of USDT.

However, a significant aspect of Visa’s report is the shift in market dynamics between stablecoins. USDC has overtaken USDT in terms of transaction volume.

Read more: What is a Stablecoin and How do They Work?

“It is true that USDT is the long-reigning leader of stablecoin sector, and the records profits earned by Q1 2024 do little to alter this position, but the reality is more nuanced than headlines might convey. The transaction volume do not reflect this dominance,” a Forbes report mentioned.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.