In the wake of Nvidia’s exceptional 211% year-to-date growth, the tech industry has been optimistic. This growth spurt, largely attributed to the increasing demand for AI, particularly generative AI like ChatGPT and image generation services like Midjourney, has left many astounded.

However, not all industry insiders share this bullish sentiment. One of them is Samantha LaDuc, a keen observer of Nvidia’s financial activities, who raised pertinent questions regarding the firm’s recent Q2 results. She has emphasized concerns over the company’s “dubious” data center revenue growth.

Nvidia Quarterly Results Met with Skepticism

A point of contention that has drawn attention to Nvidia was the $2.3 billion line of credit extended to specialized cloud provider CoreWeave. BlackRock, one of the main lenders behind this credit, is also Nvidia’s third-largest shareholder, possessing over 115.6 million shares.

“We negotiated with them to find a schedule for how much collateral to go into it, what the depreciation schedule was going to be versus the payoff schedule. For us to go out and to borrow money against the asset base is a very cost effective way to access the debt markets,” said Michael Intrator, CEO at CoreWeave.

The most intriguing part about this line of credit is that Nvidia graphics processing units (GPUs) were used as collateral, with the capital intended for expansion to accommodate the growing AI workload.

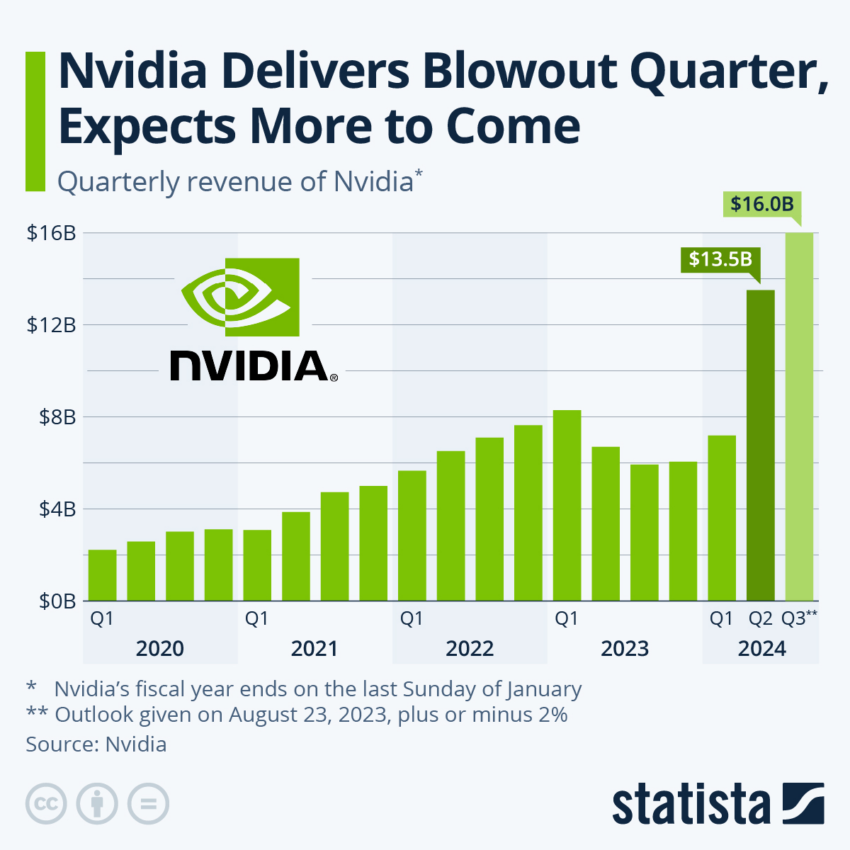

Moreover, the $2.3 billion credit aligns with Nvidia’s data center revenue in Q2. The firm reported a record of $10.3 billion, marking a 141% increase from the last quarter and a 171% rise from the same period last year.

Read more: AI Stocks: Best Artificial Intelligence Companies To Know in 2023

While these financial tactics are legal, they certainly raised eyebrows about Nvidia’s ethical practices.

“It looks suspicious as an irregular accounting method not necessarily channel stuffing, which is typically when you have the opposite. They have a lot of demand, but not enough supply. There is a lot of players involved here at every level from the ownership in Nvidia and CoreWeave. The backing of this line of credit and the size of this line of credit backing happens to match their data center earnings beat. It is all very much a closed-loop system,” LaDuc affirmed.

Such a move of collaterizing a line of credit with Nvidia’s GPUs is risky given the rapid obsolescence of tech devices. Subsequently recalling the disastrous financial strategy adopted by crypto exchange FTX.

Sam Bankman-Fried, former CEO of FTX, reportedly mingled customer funds with counterparties and executed trades without direct customer approval. More importantly, some of these leveraged transactions utilized FTT, a cryptocurrency developed by the exchange, as collateral.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The implications of Nvidia’s and CoreWeave’s entwined financial activities ripple through the financial market as FTX and Alameda Research did through the cryptocurrency market.

Indeed, Nvidia’s tremendous growth in 2023, adding $836 billion to its market capitalization, has influenced the stock market sentiment. The perceived dominance in the AI sector has propelled the entire tech sector. This inflated growth could mask the actual demand for generative AI, inadvertently creating an unstable bubble.

Experts Suggest Nvidia Could Crash

Nvidia’s astronomic ascent has garnered attention from investors and market experts alike. This bullish fervor has been so intense that many seem to have lost sight of the perils of market bubbles.

Indeed, as Nvidia’s valuation soars, concerns of a potential market bubble begin to loom large.

Rob Arnott, founder of Research Affiliates LLC, offered a somber perspective. Nvidia, having surged by 211% year-to-date, might be at the vanguard of the computer science revolution. Yet, Arnott described the stock as “a textbook story of a Big Market Delusion.”

“Nvidia’s price reflects a certitude that its GPU architecture will continue to dominate, that it will not be displaced by new entrants or internal projects at other AI firms, and that current market expectations are not excessively optimistic…. Overconfident markets paradoxically transform brilliant future business prospects into even more brilliant current stock price levels. Nvidia is today’s exemplar of that genre: a great company priced beyond perfection,” Arnott affirmed.

Arnott noted that a downfall in Nvidia’s value could precipitate a broader market collapse. The expert, known for his robust views on potential market bubbles, emphasized the risks of overlooking historical patterns.

“Even correct narratives can take longer to play out than most investors expect. Investors count the upside uncertainty about that future growth as more likely than the downside. As a wit in the 2020 dot-com bubble noted at the time, tech stocks are discounting all future growth…and the hereafter,” Arnott concluded.

Adding fuel to the narrative are recent fillings indicating Jensen Huang, CEO of Nvidia, sold a significant number of shares. He availed stock options for two batches of 29,688 shares at a rate of $4 each.

Records show that Huang exercised these options for an equivalent quantity of common shares from September 1 to September 6, spanning three distinct transactions.

Following this, Huang sold these acquired shares in three separate batches within the same duration. The sale price for these shares fluctuated between $466.13 and $497.17. Analyzing the company’s disclosures, Huang’s earnings amounted to approximately $14 million for each of these three batches, gaining about $42,828,053.

In light of the intricate financial maneuvers surrounding Nvidia, it is imperative for investors to tread with caution. As history has shown, unchecked optimism can pave the way for bubbles, with even industry giants not immune to repercussions.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.