Be[in]Crypto looks at on-chain indicators for Bitcoin (BTC), more specifically the Net Realized Profit/Loss (NUPL) indicator. This is done in order to determine if the ongoing correction marks the bottom or the beginning of a prolonged bear market.

NUPL

NUPL is an on-chain indicator that shows if the market is in a state of profit or loss. In order to arrive at its values, the indicator divides relative unrealized profits with relative unrealized losses.

Values smaller than 0 show a state of loss, while those above 0 show a state of profit.

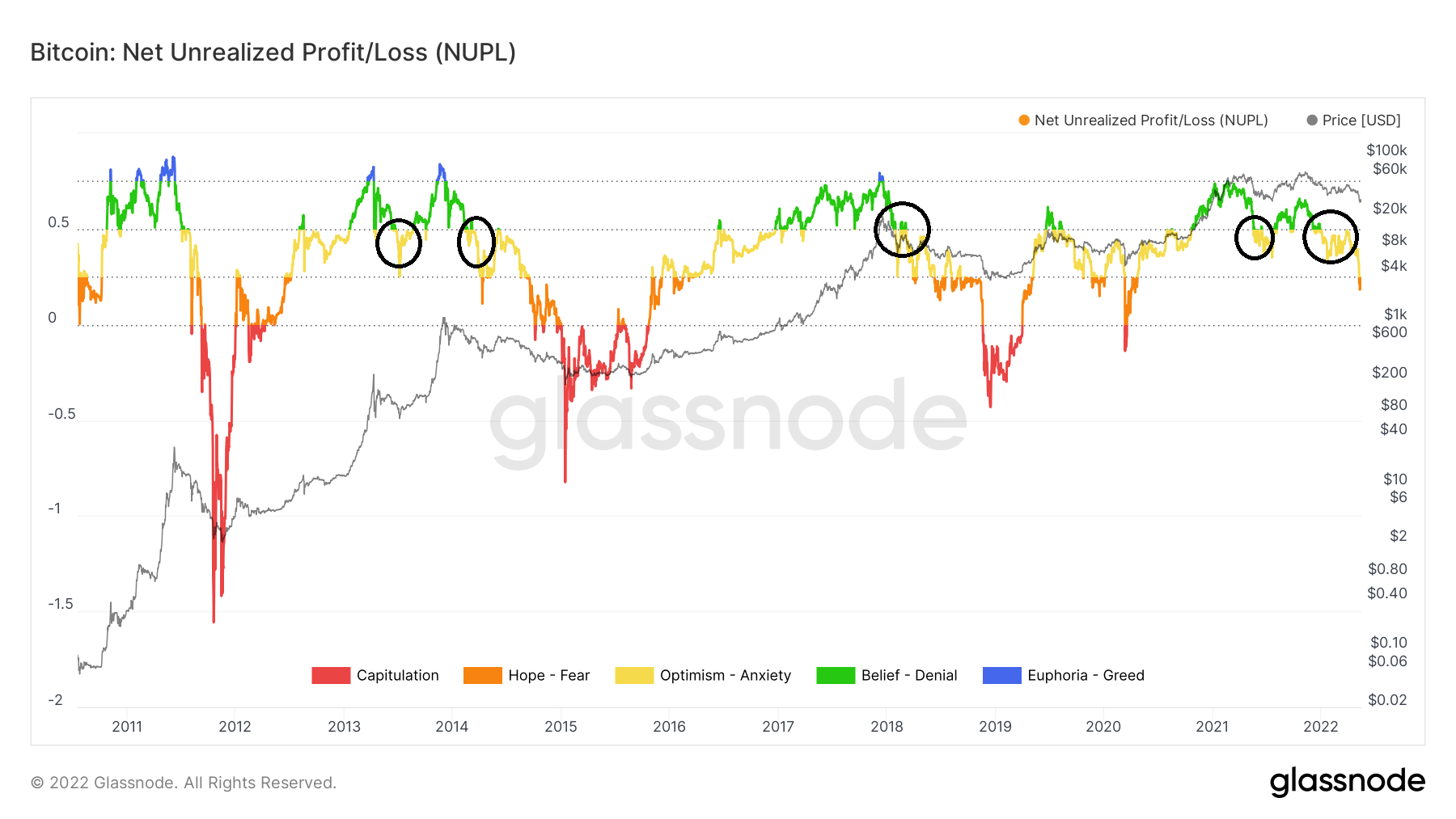

Historically, market cycle tops have been reached above 0.75 (blue), while bottoms have been reached below 0 (red).

Current breakdown

An interesting relationship between NUPL and the BTC market cycle comes with the movement above and below the 0.5 line. Crosses below the line (black circles).

Previous breakouts are usually a sign that a bearish trend has begun, and NUPL comes from the 0.5 line. Historically, once NUPL crosses above it, the next significant cross below suggests that the bearish market cycle has begun.

While this has so far occurred on every single cycle, sometimes two breakdowns are required in order to begin the bearish market cycle.

A more decisive and accurate signal comes from the decrease below 0.25.

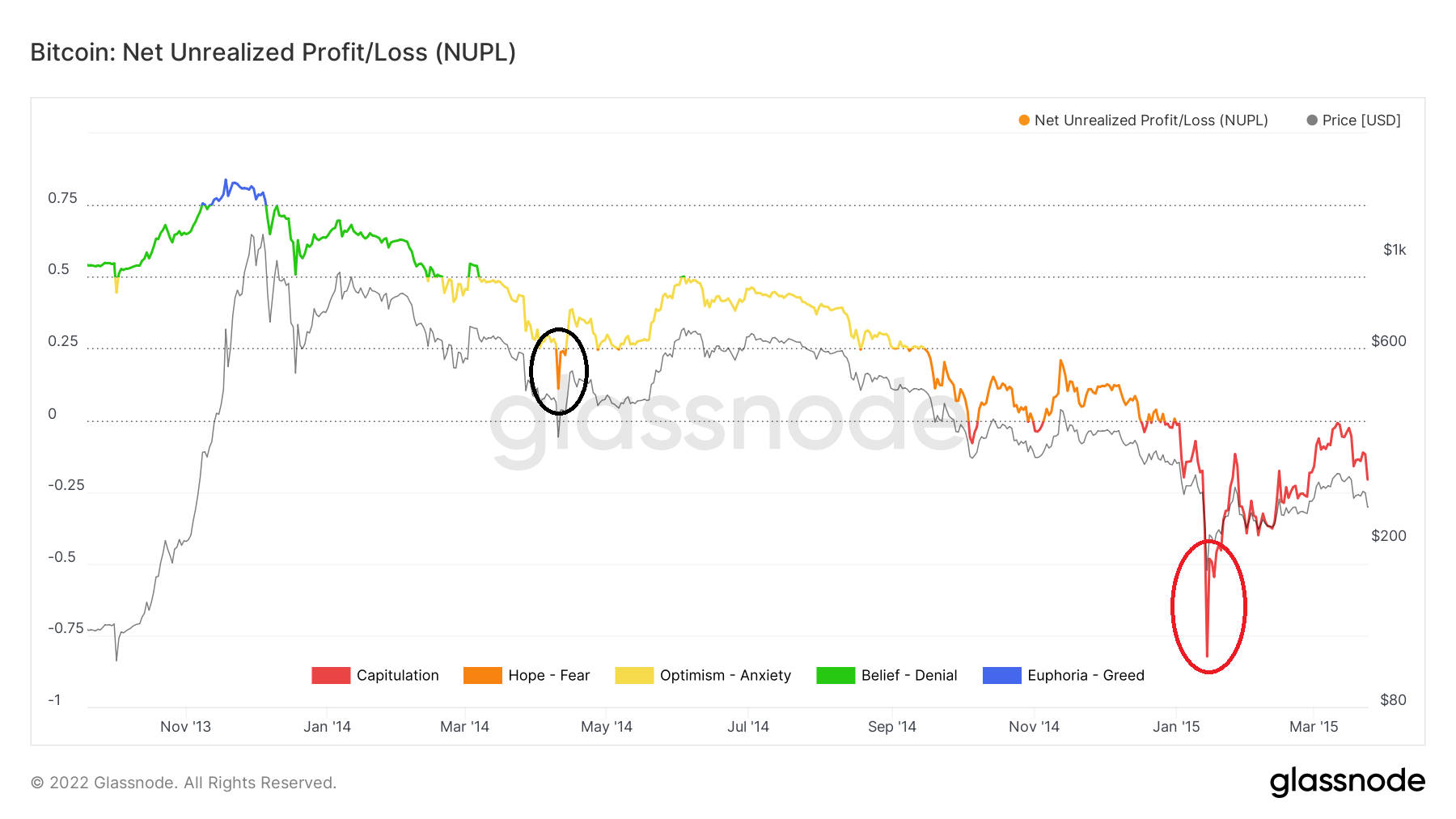

In April 2014, NUPL decreased below 0.25 for the first time (black circle) since the bull market began. What followed afterward was a very considerable bounce, in which BTC increased from $350 to $650.

However, what followed afterward was a significant decrease that led to the $172 bottom in Jan 2015. The bottom was combined with a NUPL reading of -0.82 (red circle).

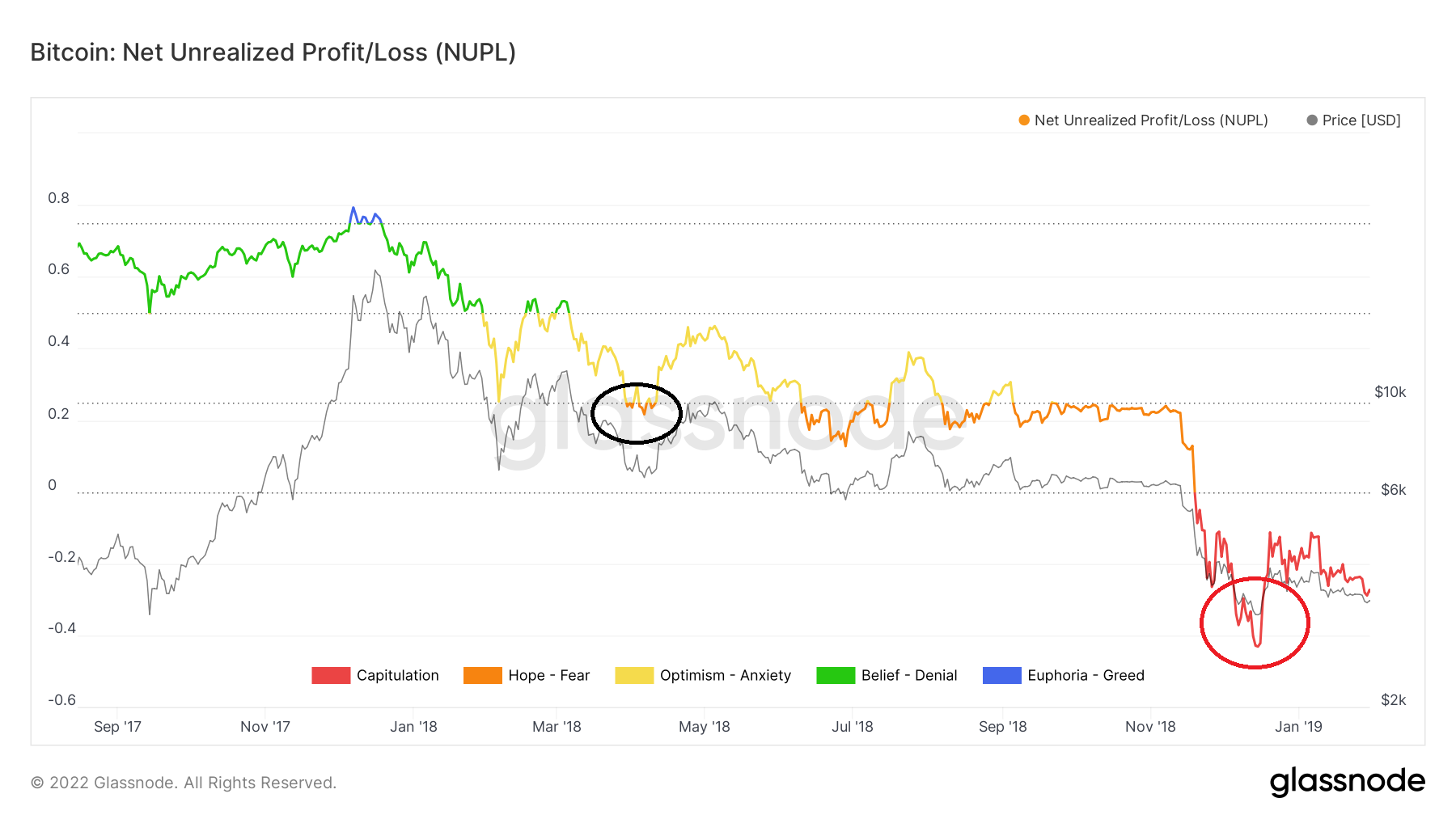

In 2018, NUPL decreased below 0.25 for the first time in April 2018 (black circle). Similarly to 2014, a significant bounce followed which caused the price to increase from $6,800 to $9,800. But, another downward movement followed which took BTC to a low of $3,237 on Dec. 2018. The low was combined with a NUPL value of -0.42 (red circle).

When will BTC bottom?

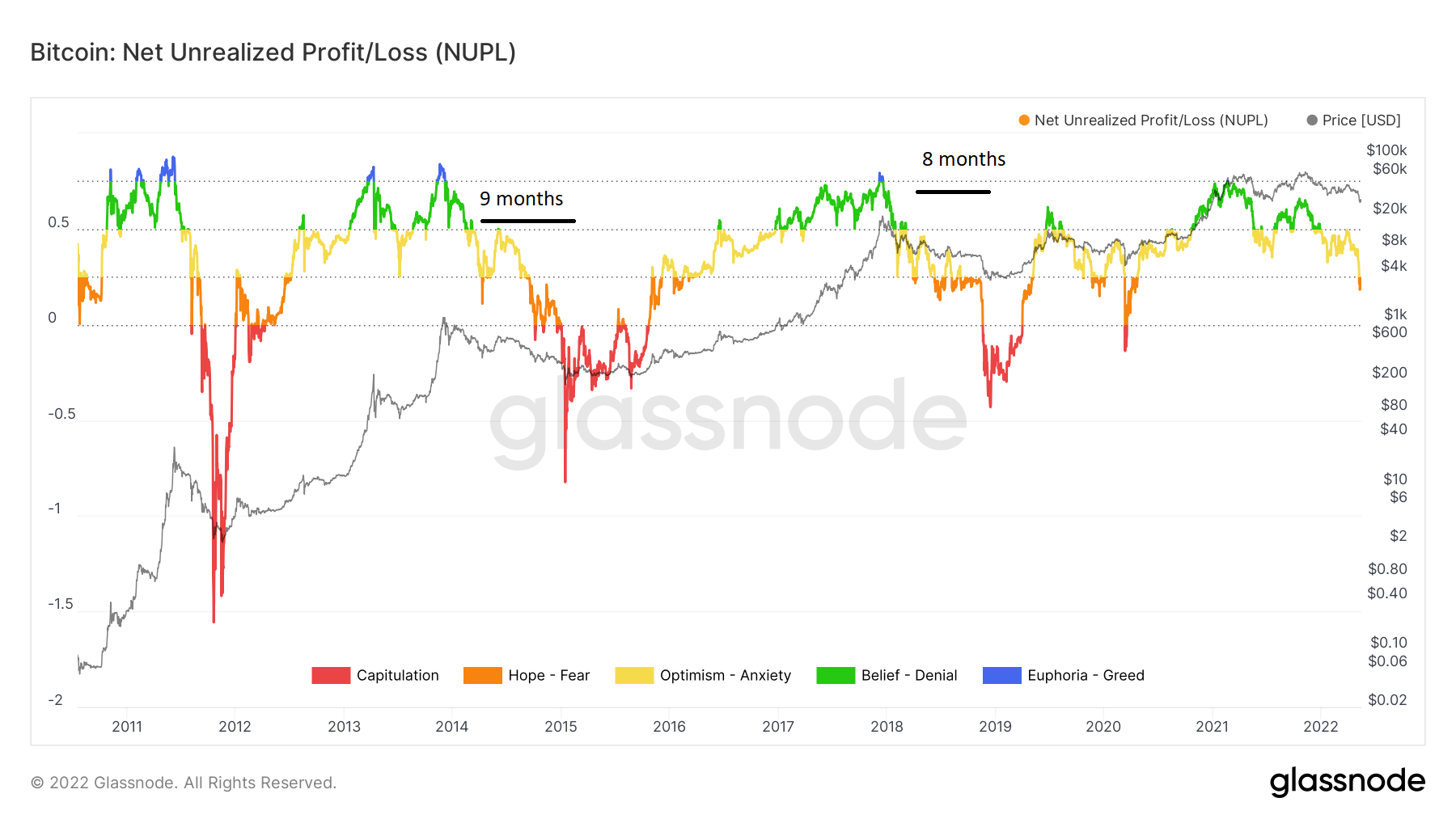

In 2014, the bottom was reached nine months after NUPL decreased below 0.25. In 2018, the bottom was reached eight months after NUPL first crossed below 0.25.

Therefore, considering that NUPL first decreased below 0.25 in May 2022, if the previous history is followed, it would lead to a BTC low sometime in Feb. 2023.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here