Web3 faces many challenges, but they’re fixable, said Redeem co-founder, Toby Rush. In an exclusive interview with BeInCrypto, Rush shared his thoughts on the need for a better user experience, how NFTs made a poor first impression, and why we really do need clarity from regulators.

If 2021 was the year of all-time highs, and 2022 was the year of the great crypto crash, 2023’s defining characteristic has not yet emerged. While one obvious choice might be the explosion of regulation, another is the industry’s general flatlining.

Web3 Needs a Better User Experience

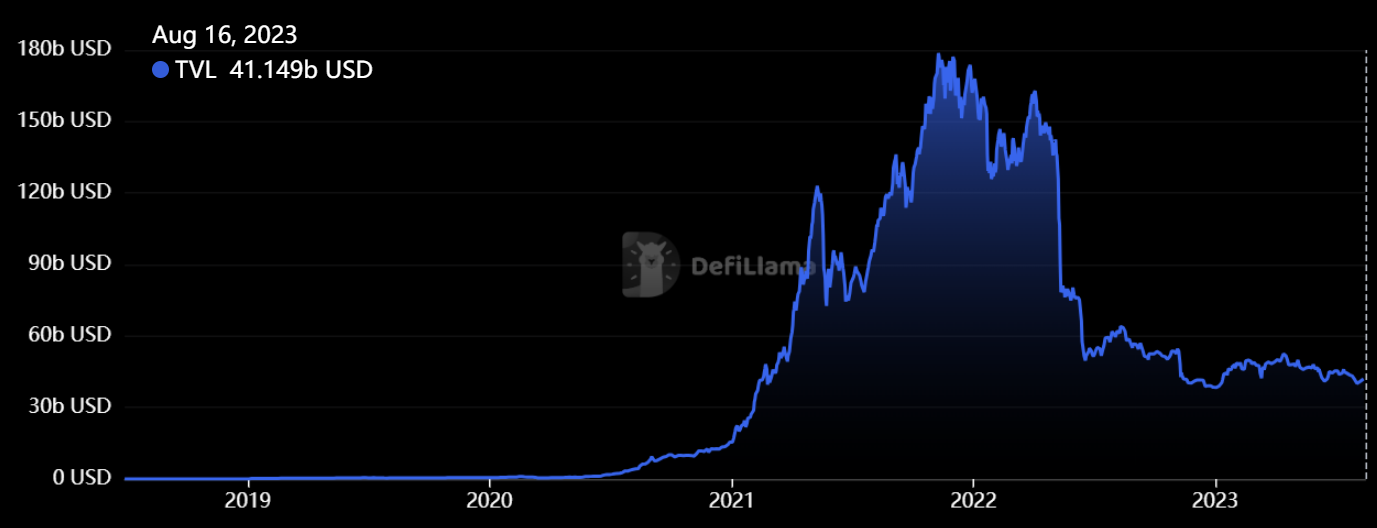

Judged by many metrics, crypto, Web3, and DeFi have failed to change the narrative in the wake of last year’s market collapse. According to DefiLlama, the total value locked (TVL) in all DeFi protocols has failed to recover from the sharp downturn.

TVL is actually 5.5% lower than the day FTX filed for bankruptcy on November 11. Non-fungible tokens (NFTs) have collapsed. And although the crypto markets in general have fared a little better, there is a sense that the pool of people partaking in Web3 has barely grown.

In Rush’s view, a huge reason for this is the poor UX, but frontend UIs in particular—the part users see and interact with. Though Web3 may often evolve, the regular user finds it hard to get into, Rush said.

This is all the more frustrating given the years of experience that tech firms have with regard to onboarding users and promoting a positive experience, he added.

But the situation is far from hopeless. For Rush, better onboarding is a critical part of the solution.

“Launching their own Web3 initiatives is only half the battle for major brands, since they also need to ensure their customers can actually use these innovative offerings. To overcome these challenges, new onboarding frameworks need to be developed and implemented that allow users to onboard to Web3 with just a couple of clicks, without having to navigate non-custodial wallets, clunky crypto interfaces, gas fees, and other overly technical aspects,” Rush said.

Account Abstraction Is on the Way

Luckily, change is coming. At this year’s Ethereum Community Conference (EthCC) in Paris, account abstraction was the talk of the town.

The ERC-4337 upgrade, which allows for account abstraction, will one day pave the way for users to treat their wallets and Web3 accounts like an email or app login. Hopefully, before long, users will see a lot less of complicated seed phrases and private keys. Rush continued:

“By allowing people to create their own decentralized identities using just phone numbers — which are globally unique, easy to remember, and already connected to major social networks — brands can open up previously untenable possibilities, enabling users to onboard safely, collect digital assets, and easily redeem their utility while being secured with the power of blockchain,” said Rush.

In order to gain traction, companies have to use existing behavior and mental models, said Rush. By building on what already works, companies and projects will be better able to integrate decentralized products into users’ lives.

Learn more about ERC-4337 and account abstraction with our handy guide: ERC-4337: A Complete Guide To Account Abstraction

NFTs Made a Terrible First Impression

Although, complicated UX is only part of the mountain Web3 has to climb. One class of digital assets—NFTs—has become something of a byword for “expensive JPEGs” to the general public. That’s if they know about them at all.

In truth, NFTs remain a fringe technology for a small group of enthusiasts. But was their arrival part of the reason why they fared so poorly? Redeem’s co-founder certainly thinks so.

When the new class of digital assets arrived on the scene, traditional media were, for the most part, interested only in their speculative value. Then, later on, many of the same media balked at how NFTs were seen only in terms of their profit-making powers.

“When an asset becomes widely recognizable purely due to its speculative qualities, it is only natural that people expect it to continue acting this way. This model, however, couldn’t last forever, and as the initial hype started to fade away, disillusioned users were quick to proclaim that ‘NFTs are a scam’ because they no longer bring their holders unreasonable profits,” Rush said.

“As the sector matured, however, it became clear that NFTs can offer countless use cases and can be leveraged to disrupt numerous industries, from video games and supply chains to ticketing and loyalty programs. Unfortunately, the ‘speculation stigma’ still lingers, but I believe this attitude will quickly change as more and more major brands incorporate Web3 features into their offerings.”

Rush believes that while certain NFT use cases are niche, they are gaining traction. For instance, the traditional ticketing industry could benefit by issuing event tickets as NFTs, reducing fraud, and offering modifiable, rewarding experiences.

Major brands like Formula 1 and GQ are leveraging NFTs for personalized rewards and loyalty programs.

We Need Regulatory Clarity, Says Redeem Co-Founder

When asked if there is one law he would change or abolish affecting digital assets, Rush had a most interesting answer.

One of his biggest concerns around regulation is the concept of “reactive enforcement.” Or, the way that regulatory bodies pursue supposed non-compliance with legal action, without much communication beforehand.

In Rush’s view, blockchain-related assets occupy a “gray zone” in many countries, including America. Initiatives such as Markets in Crypto Assets (MiCA) in Europe have so far failed to clarify the rules of the road and provide transparency, he said.

“As such, we don’t really need to abolish any particular laws or regulations, but should rather focus on creating a clear regulatory clarity that leaves no room for doubt or equivocation for governments and enterprises, ultimately making the industry healthier in the long run,” said Rush.

Clarity around regulations is something the industry has been crying out for, particularly in the United States. On April 24, Coinbase even brought a legal case against the Securities and Exchange Commission (SEC) to force its hand.

The company had been the subject of a Wells notice from the SEC in March—a formal warning that enforcement action was coming down the track. Unsurprisingly, Gary Gensler, the agency’s head, thought there was more than enough clarity for crypto firms to stay in compliance.

“We’ve had clarity for years,” Gensler told CNBC’s The Squawkbox on June 6, the same week he sued Coinbase for violating securities laws.

Most in the industry would disagree.