Monero’s (XMR) price has had a good run and has the potential to continue, noting a rise beyond the resistance of $165.

However, the recent struggle to break a key barrier and increased selling pressure paint a different picture of the market.

Monero Investors Could Sell

Monero’s price at $159 is finding support above multiple crucial levels. However, the concerns are arising now. XMR’s two failed attempts at breaching the resistance at $165 are the cause of this concern.

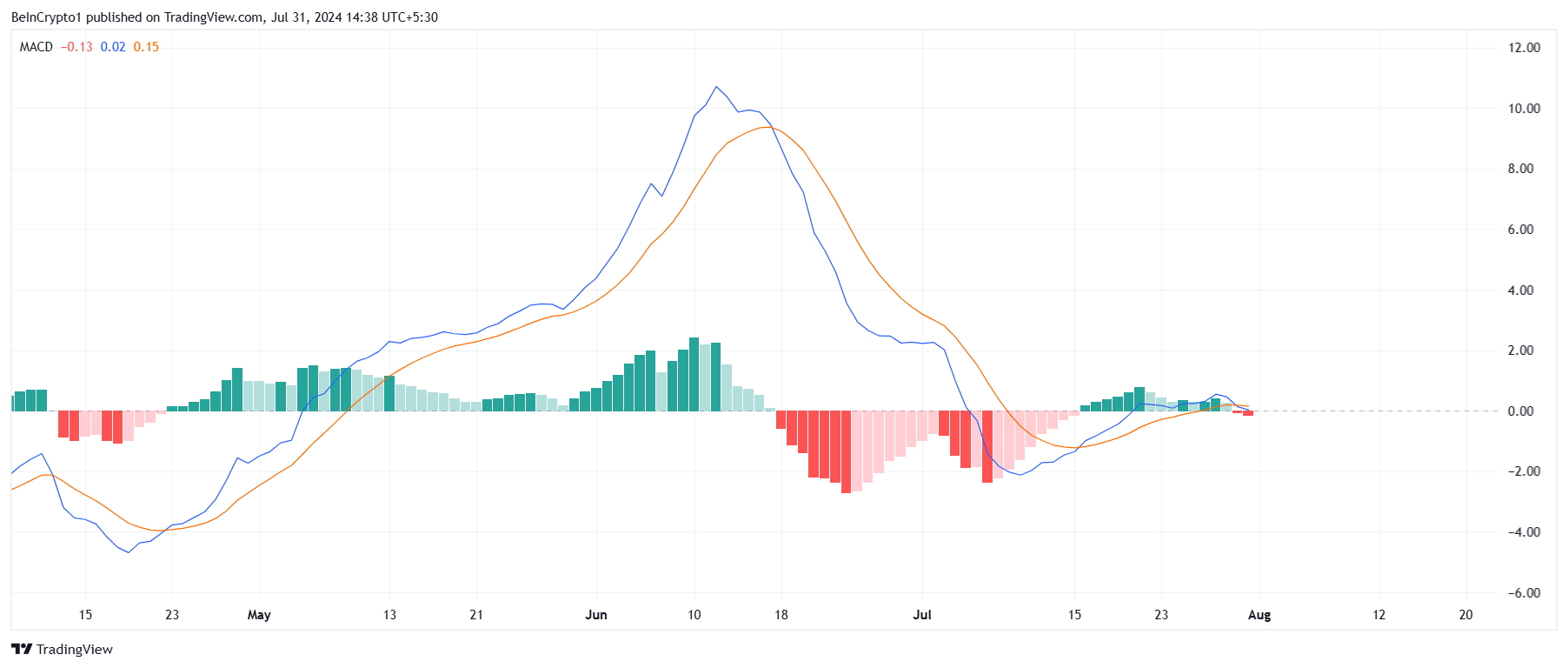

Monero’s uptrend is currently facing challenges due to increasing selling pressure, as indicated by the MACD (Moving Average Convergence Divergence).

The MACD’s bearish crossover, combined with the increasing red bars, suggests that the momentum driving the price upward is weakening. This shift in trend highlights the growing bearish sentiment among investors.

Read More: Monero: A Comprehensive Guide to What It Is and How It Works

The same signal that selling pressure is intensifying, potentially undermining the gains made during the three-month uptrend. As selling pressure mounts, it becomes more difficult for Monero to sustain its positive price movement, making the market environment less favorable for long positions.

Additionally, the Sharpe Ratio, at -1.51, a measure of risk-adjusted returns, has fallen back into negative territory. This decline indicates that Monero’s returns are no longer adequately compensating investors for the associated risks.

Overall, the combination of increasing selling pressure and a negative Sharpe Ratio suggests that Monero’s recent uptrend may be in jeopardy. This could discourage investors from investing in the asset.

XMR Price Prediction: Barrier Ahead

Monero’s price has been maintaining a three-month-long uptrend and is currently testing the trend line as support. This line coincides with support at $158, giving XMR a solid base from which to recover.

But if the aforementioned selling pressure intensifies, both the uptrend and the support line could be invalidated. Consequently, Monero’s price could hit $150 or lower zone.

Read More: How To Buy Monero (XMR) and Everything You Need to Know

However, if the uptrend remains intact, XMR could attempt another breach of the resistance at $165. A successful flip of this level into support could invalidate the bearish thesis, enabling XMR to climb towards $178.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.