The Hong-Kong-based company Crypto.com announced a token swap program on Monday. All MCO token holders have until the 2nd of November 2020 to swap their MCO for CRO.

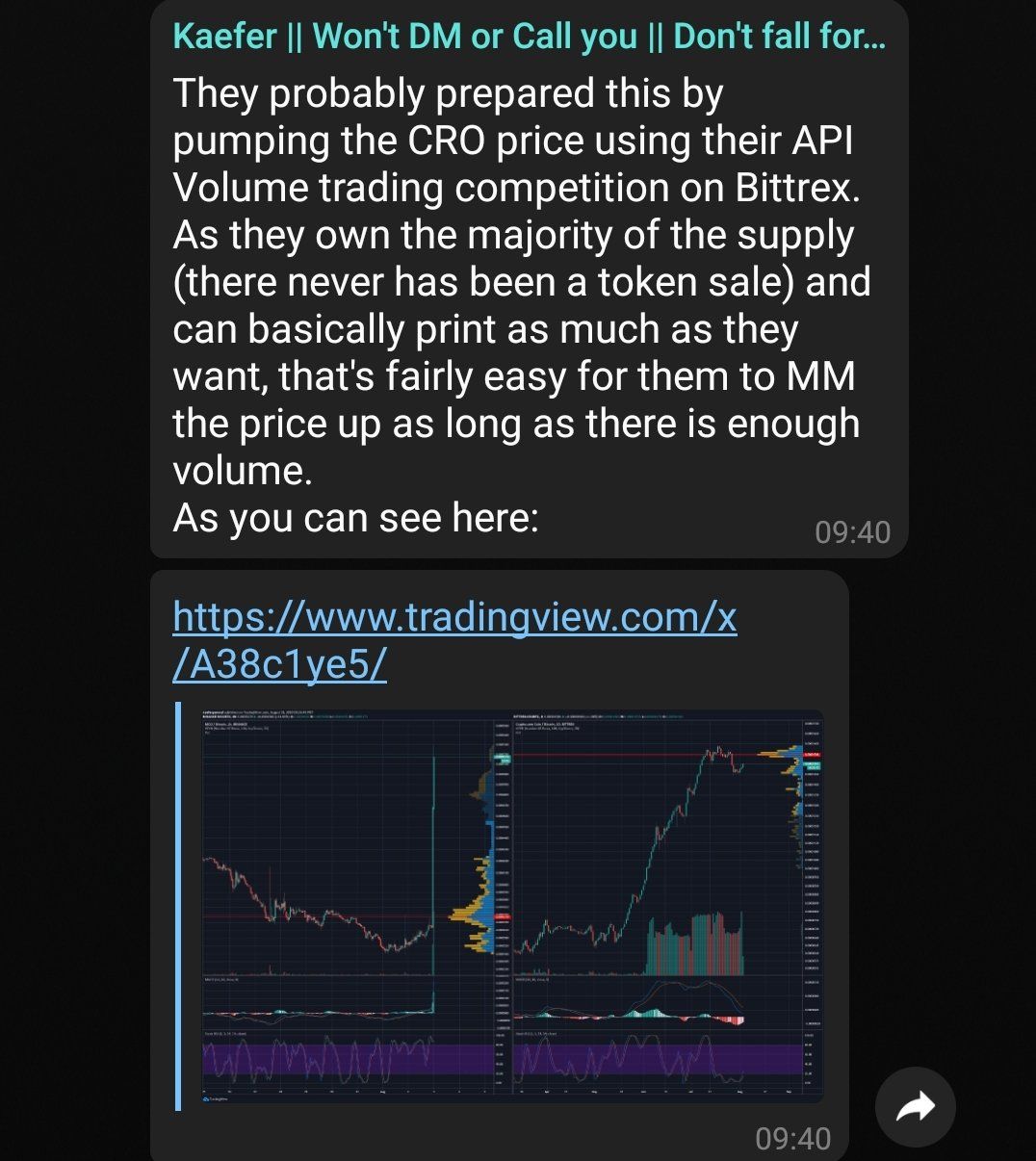

The announcement catalyzed MCO trading volume and caused the price to surge. However, several users note some red flags around the whole merging process. Is this operation legit? Is it possible that there’s been insider trading?

The Year of Crypto.com

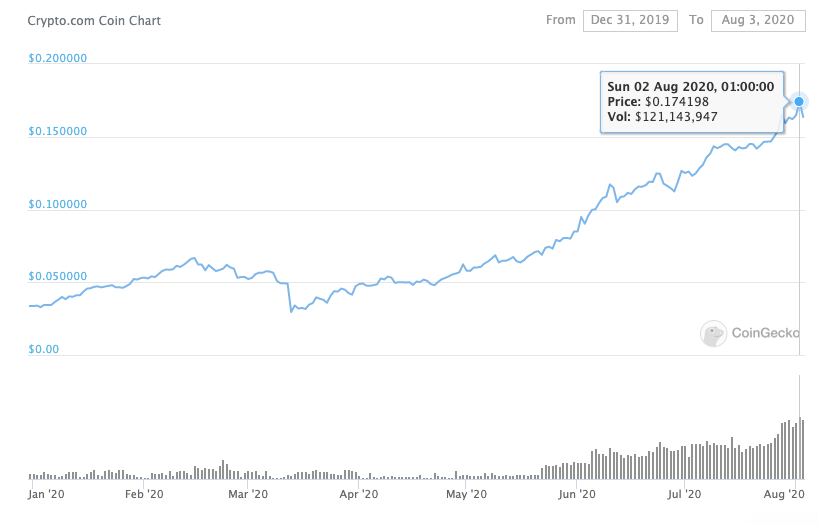

2020 is proving to be very profitable for Crypto.com. As BeInCrypto reported not long ago, the CRO token has been one of the best performers of the year. At the time of writing, CRO ranks 11 on Coingecko’s market cap list at just over $3 billion. CRO reached a new all-time high on Sunday 2 August, breaking through the $0.17 mark.

A Tale of Two Tokens

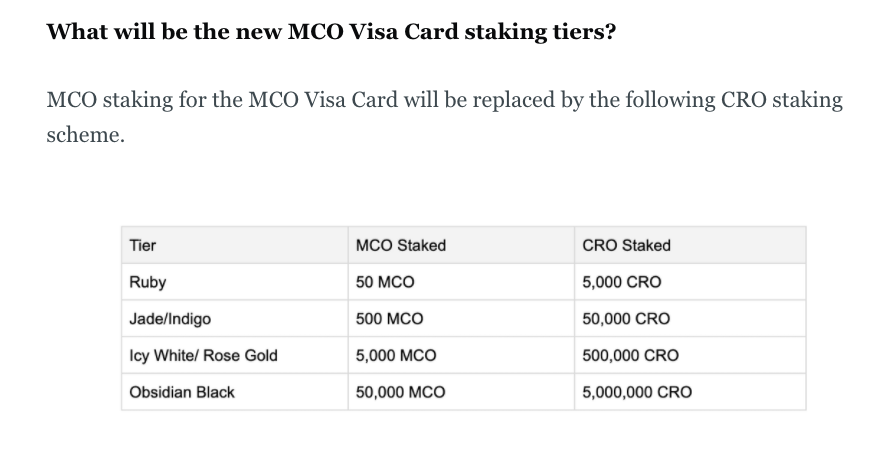

The token distribution of MCO and CRO has been a bumpy one. MCO has a maximum supply of 31,578,682 tokens, of which only half are in circulation. When Monaco rebranded to Crypto.com, they launched a second token, namely, CRO. This token has a much bigger max supply, 100,000,000,000. Less than 20% of those are currently in circulation. A small part of the CRO supply was airdropped to all MCO holders. Now MCO holders will have to move to CRO. If the move wasn’t confusing enough, Crypto.com will now be increasing the minimum token threshold required to receive one of their shiny new VISA cards.

The Token Swap

According to the MCO Swap Program, MCO holders can use the Crypto.com app to swap their MCO for CRO. The announcement appears somewhat loaded with business jargon, though, without really explaining the need for the swap:There will be no change to this core functionality, but we are expanding MCO functionality and representing it in a new way. Specifically, the swap program will involve combining the current functionalities of MCO, with CRO’s utility and technology, in a “one-stop-shop” token to enable a streamlined Crypto.com ecosystem. The swap program will also serve to leverage the advanced capabilities of the Crypto.com Chain, in preparation of its upcoming Mainnet launch.Some Twitter users highlight that after the swap, the company will hold the majority of the tokens. Indeed, since CRO runs on a private blockchain, Crypto.com could likely print as many CROs as they want.

The token swap will take place from August 3 to November 2, 2020. After that date, MCO won’t work, and Crypto.com will likely phase out the token.Ehm ok @cryptocom.. GG?! What the heck are you doing?

— CR1337 (@cryptonator1337) August 3, 2020

This just got shared in my TG (https://t.co/YEv2fWE4f9)$MCO $CRO pic.twitter.com/mfWCzknnsK

A Deep Look at the Numbers

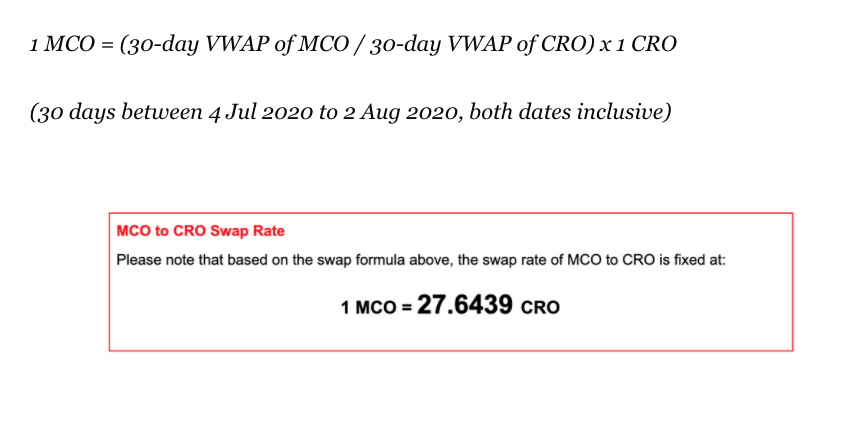

The swap rate will be as it follows:

Market Reacts to the Bonus

What do you think happened to the price of MCO right after the announcement?

If your MCO is held outside of the Crypto.com App, including on the Crypto.com Exchange, you must transfer it into the Crypto.com App in order to complete the MCO swap process.This will increase the number of new accounts, as MCO holders are forced to sign up for the Crypto.com app. The project further announced that they would burn all their MCO holdings, sending them to the famous 0x00000 address.

Before the end of the swap process, 15,793,852.04 MCO that is held by MCO Technology GmbH will be burned by sending to the following burn address: 0x0000000000000000000000000000000000000000Although this sounds good on paper, it holds little meaning since the creators hold a much bigger chunk of the CRO supply than they did with MCO.

How Will This Swap Play Out?

The community will have to wait and see. Is the merging of tokens a new trend or is it merely a way to attract additional capital? To their credit, Crypto.com offers one of the most user-friendly interfaces around, and they’ve won the trust of thousands of users. Many community members have, however, demanded a move towards just one token on the private blockchain.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Tony Toro

Tony has worked for several financial companies in London during the last seven years, gaining experience in traditional finances and trading. Passionate about direct democracy, digital rights and privacy, he has been involved with cryptocurrency since 2013.

Tony has worked for several financial companies in London during the last seven years, gaining experience in traditional finances and trading. Passionate about direct democracy, digital rights and privacy, he has been involved with cryptocurrency since 2013.

READ FULL BIO

Sponsored

Sponsored