Polygon (MATIC) price is down 10% in May 2023. But on-chain data now shows multiple signals of a potential bullish reversal toward $1. Will the upcoming airdrop be enough to validate the positive MATIC price prediction?

On May 10, 2023, Polygon co-founder Sandeep Nailwal made a tweet that hinted at an upcoming MATIC airdrop. Sandeep listed the Airdrop, among other ongoing deployments, to underline the adoption of the newly-launched Polygon zkEVM product.

Since that tweet, MATIC has witnessed a considerable increase in the number of active users interacting on the network. Polygon investors seem to have recently upped the ante regarding DeFi staking, while zkEVM transactions have skyrocketed to an all-time high.

Here’s how these three critical on-chain signals could potentially validate the potential $1 MATIC price prediction.

Polygon Investors are Positioning for Airdrop Gains

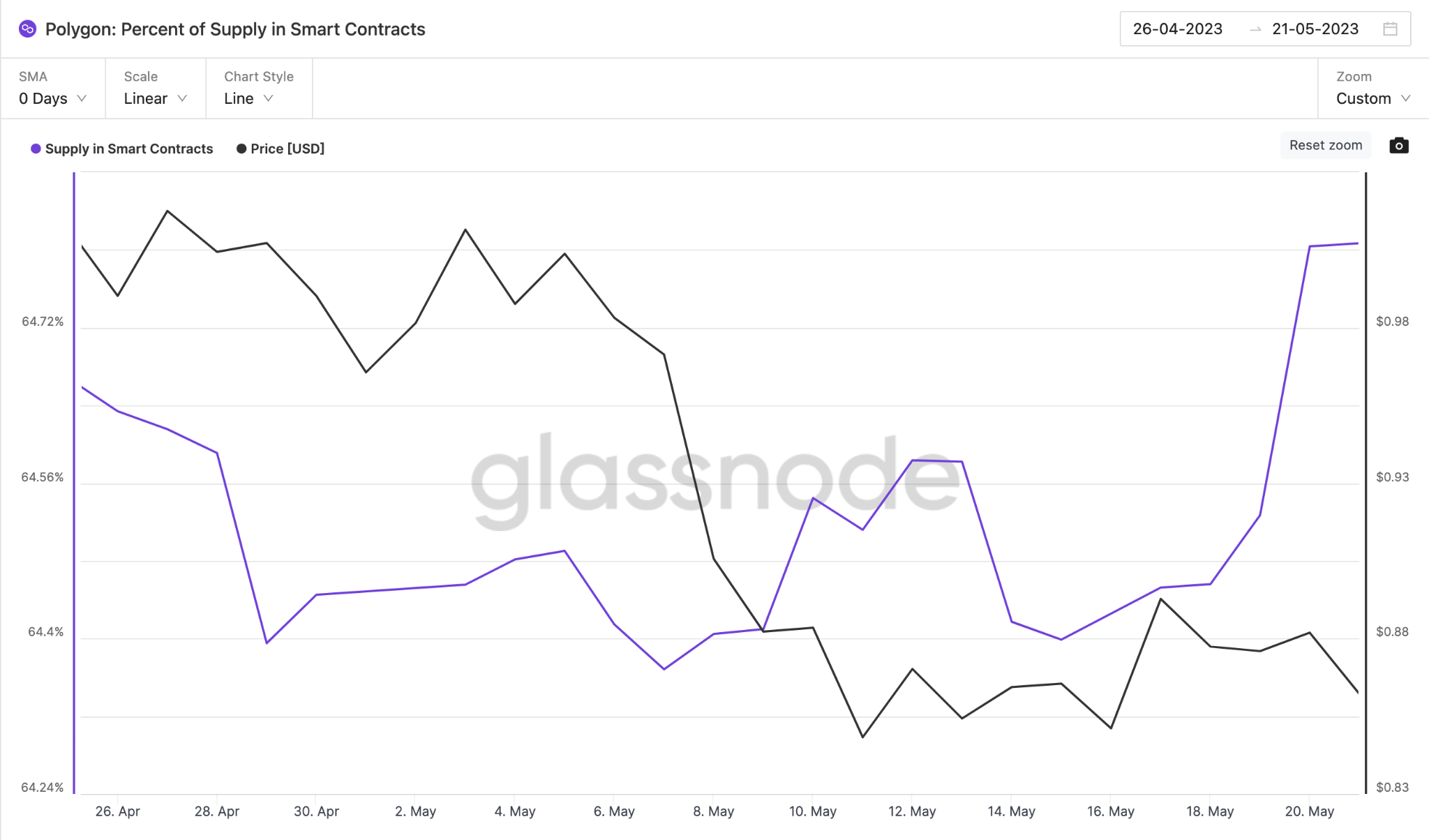

On May 15, after a massive drop-off in early May, Polygon investors began to increase their MATIC staking activity again. This could be attributed to investors positioning to tap into the potential gains from the upcoming airdrop.

Between May 15 and May 22, 37 million MATIC tokens (0.4% of total circulation supply) have been staked across various DeFi smart contracts.

Supply in Smart Contracts tracks the percentage of a cryptocurrencies’ circulating supply that investors have locked up in various DeFi protocols. When it starts to increase, it causes a momentary shrinkage in market supply.

If investors continue to stake at this rate, it could cause MATIC’s price to rise rapidly as the supply reduces relative to demand.

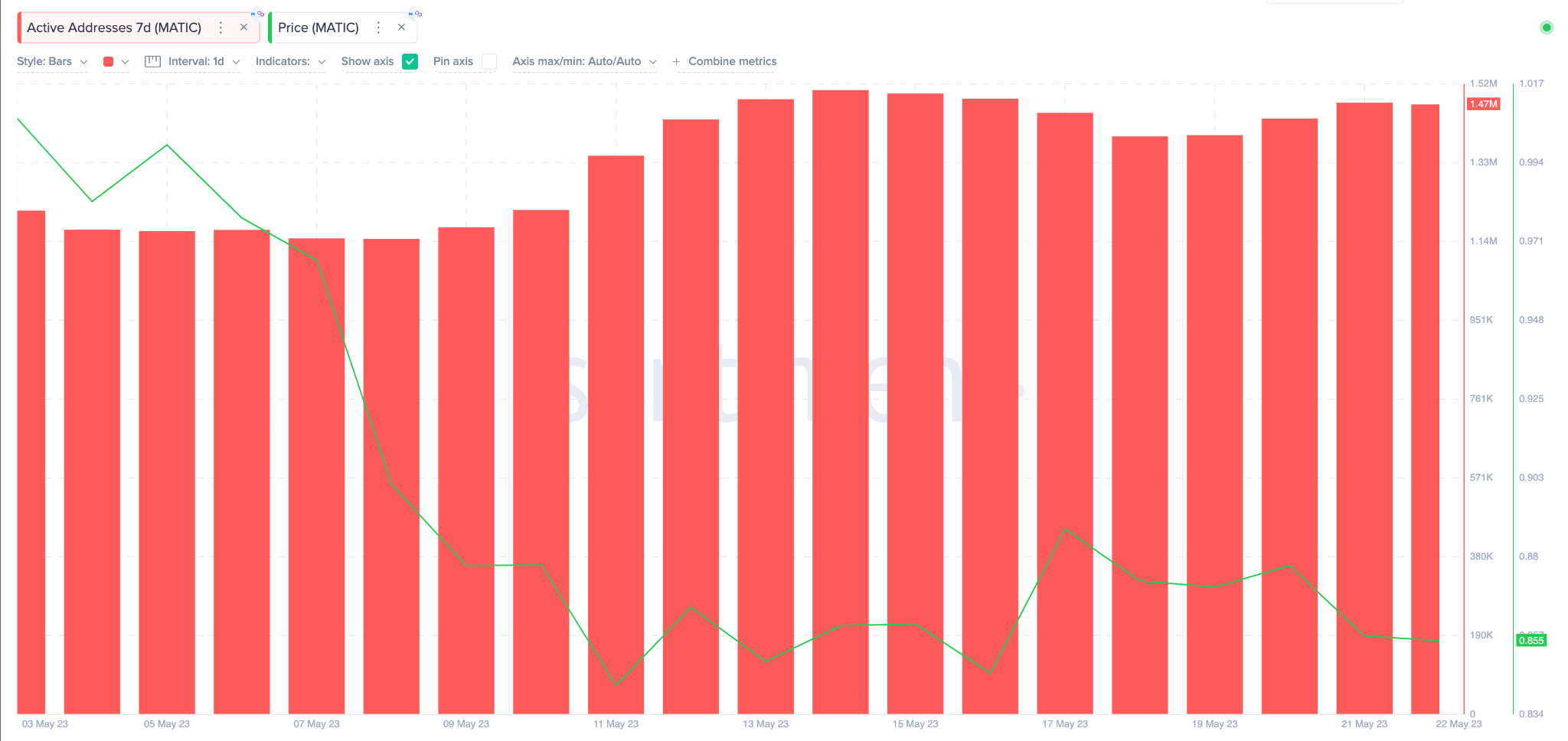

Polygon Has Witnessed an Influx of Users

Polygon (MATIC) blockchain has attracted increased user traction due to a flurry of new products and underlying technology enhancement.

While the MATIC price is yet to break out, the number of users actively deploying transactions on the network has increased significantly.

Specifically, between May 10 and May 22, the Active Addresses (7d) increased by 22% from 1.21 million to 1.47 million active addresses.

The Active Addresses (7d) metric takes a seven-day average of the unique wallet addresses interacting on a network. And when it begins to increase during a price downtrend, as seen above, it signals an impending price recovery.

In summary, holders can anticipate a bullish price reversal if crypto investors continue to stake in MATIC and users remain active.

MATIC Price Forecast: Operation $1 Recovery

The bullish on-chain signals suggest MATIC could reclaim the $1 milestone in the coming days.

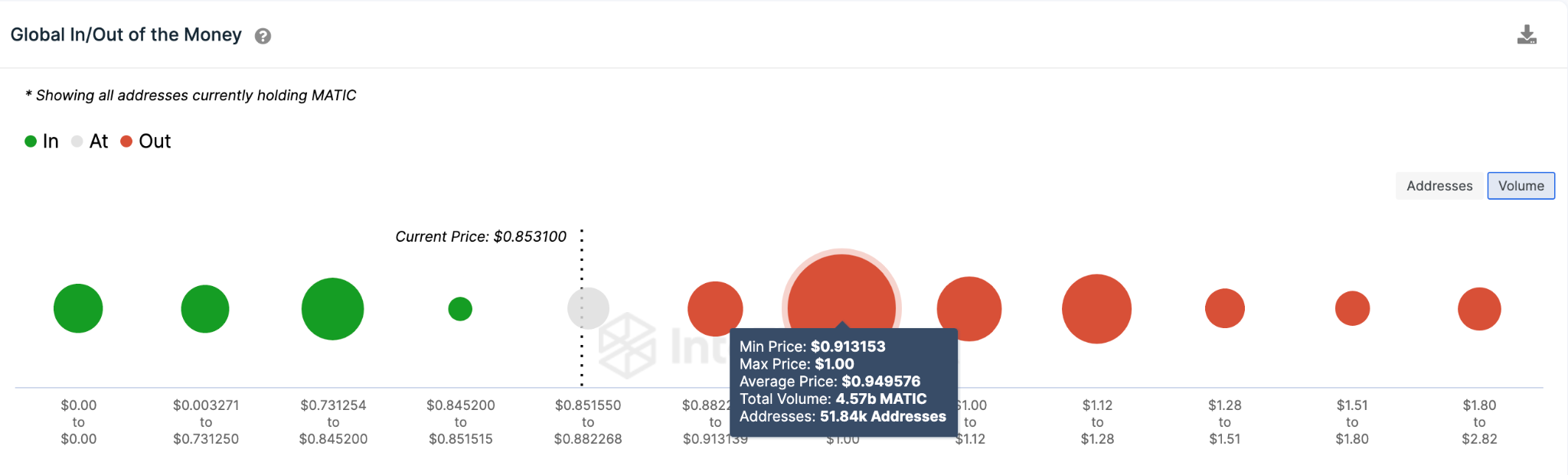

However, IntoTheBlock’s IOMAP chart below shows that about 52,000 investors purchased 4.5 billion MATIC at an average price of $0.95. This can form resistance if holders decide to sell at their break-even price.

This cluster currently represents the biggest potential roadblock and a key resistance level for MATIC.

However, if there is strong bullish momentum, as predicted, it can serve as a demand zone. Since historically, $0.95 is a level where people like to buy, MATIC can break out and rally toward $1.

Still, if the $0.95 level forms a resistance, the bears can invalidate the bullish MATIC price prediction. However, the 60,500 investors that bought 929 million at the average price of $0.80 can offer some support.

But failure to hold that key support level could cause MATIC to drop further toward $0.73