Polygon (MATIC) price has gained 12% in the past week. Although it is currently having a hard time breaking above the $1 support line, on-chain data suggests that the MATIC price could hit $2 in the long run if certain bullish signals remain in place.

Polygon (MATIC) is widely regarded as the industry-leading Ethereum scaling solution. After Ethereum completed the Proof of Stake transition in April, the MATIC price initially suffered a contraction.

Investors moving their staked assets to the Ethereum mainnet contributed to the initial price drop. However, the tide turned in May, as the number of MATIC tokens locked up in smart contracts increased significantly.

If investors continue to stake assets on the Polygon network at this rate, how high can the MATIC price go?

Investors Are Increasing Their MATIC Stakes Again

After mass unstaking in April, MATIC investors have again started to stake their tokens on the Polygon network. The chart below shows that investors on the Polygon network have staked an additional 50 million tokens (0.5% of the total circulating supply) in May 2023.

The Supply in Smart Contracts metric tracks the percentage of a cryptocurrency’s circulating supply that investors have locked up across various staking protocols. When it starts to increase, it causes a temporary shortage in market supply.

If MATIC investors continue to increase their stakes at this rate, the recent MATIC price surge could evolve into a prolonged bull rally.

User Activity is on the Rise

Furthermore, the Polygon (MATIC) blockchain network has attracted increased user traction recently. While MATIC’s price has suffered a mild correction at the $0.90 resistance, active users actively deploying transactions on the network have remained healthy.

Specifically, between May 22 and May 31, the Daily Active Addresses (DAA) increased by 25% from 250,000 to 313,000 active users.

The DAA metric sums up the number of wallet addresses interacting on a blockchain network. When it begins to increase during a price downtrend, as seen above, it signals that the asset is building up momentum for an imminent recovery.

In summary, if crypto investors continue to stake MATIC and users remain active, investors can anticipate a prolonged price rally.

MATIC Price Prediction: Road to $2

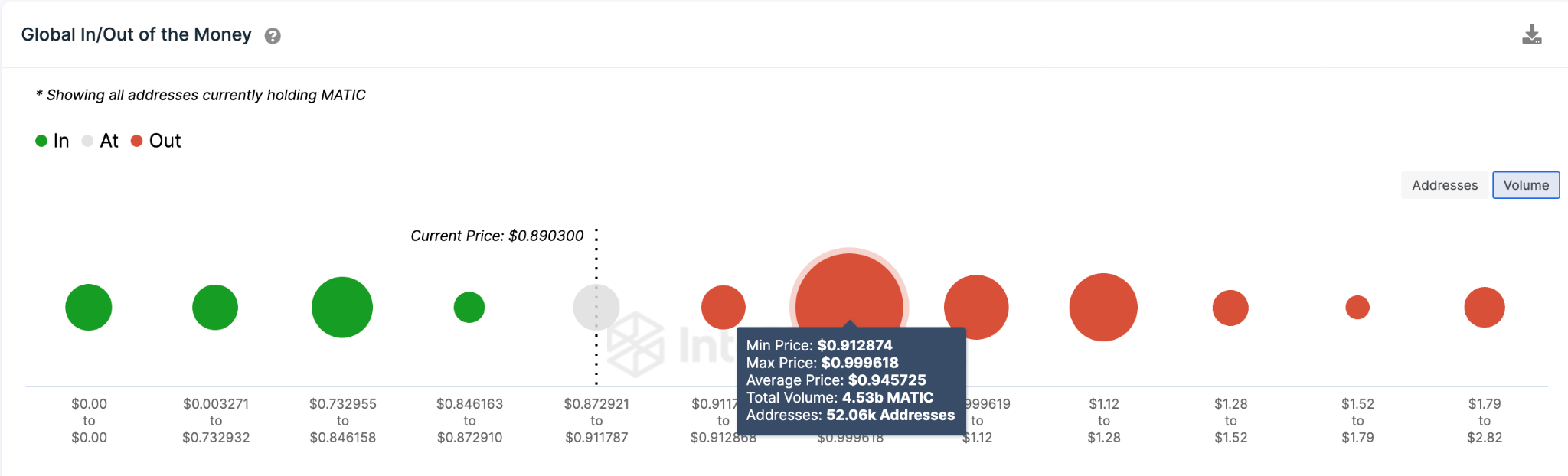

IntoTheBlock’s Global In/Out of Money (GIOM) data suggests that the next MATIC price rally could reach $2. However, for the bulls to be confident of this bullish price prediction, MATIC must first clear the initial critical resistance at $1.

But profit-taking by 52,000 investors that bought 4.53 billion tokens at the average price of $0.95 may trigger a pullback.

The bulls can garner enough steam if the positive price prediction plays out to push for the $2 target.

Still, the bears could negate the positive Polygon price prediction if MATIC retraces unexpectedly below $0.85. Although, the 20,700 investors that bought 117 million tokens at an average price of $0.86 can offer support.

If that support level breaks, it could trigger a larger drop toward $0.79.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.