Polygon’s (MATIC) price aims to recover the losses it recently endured gradually, starting with a 21% rally.

With the support of its holders, the altcoin will likely make the rise sooner than anticipated.

Polygon Investors Push for a Rise

One of the biggest influences on MATIC price action is the behavior of the investors, which is key in assuring recovery from now on. As MATIC holders make bullish moves, prices will also witness growth, and their intentions will be clearly visible in their actions.

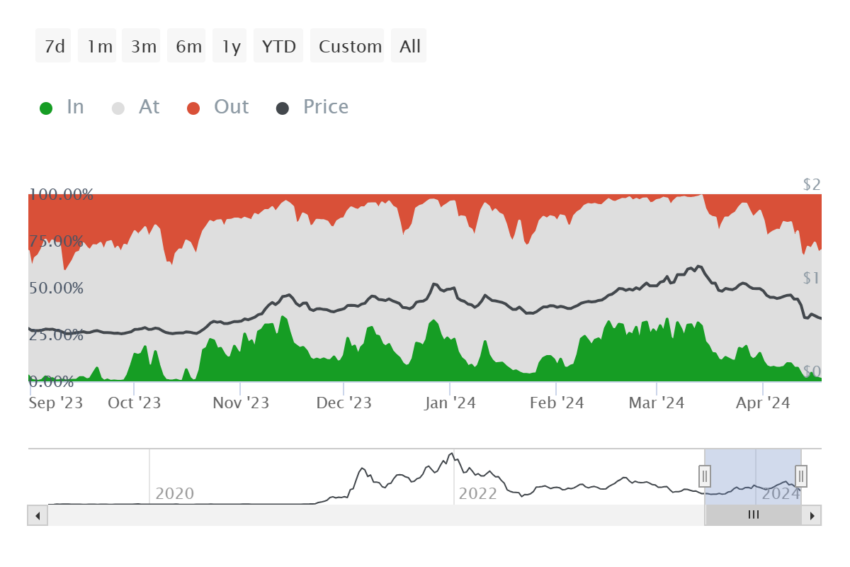

Their participation on the network shows that investors are not looking to sell now. Upon analyzing active addresses by profitability, it can be observed that less than 1% of the participants are profitable. Usually, the active addresses that are in profit tend to conduct transactions on the network with the intention of booking profit.

This is not the case now since close to 69% of the active addresses are at the money. These investors are attempting to secure profits to boost the price further.

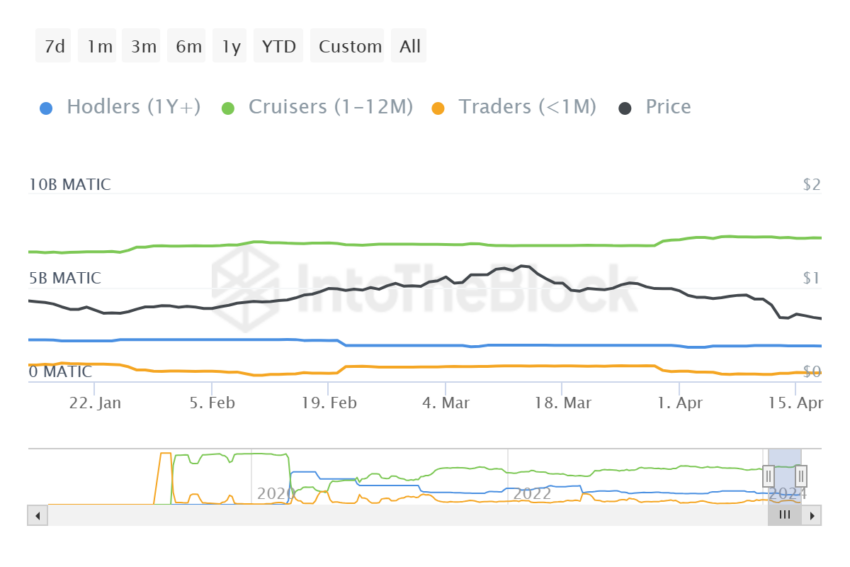

Additionally, evidence of conviction can be noted in the transfer of MATIC from short-term to mid-term holders. The former are known to hold their assets for less than a month, making them prone to selling; the latter, on the other hand, tend to refrain from moving their supply for at least a year.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

Since the beginning of this month, over 410 million MATIC worth more than $275 million has been moved into the mid-term holders’ addresses.

This shows that the Polygon native token holders have confidence that the price will eventually rise, providing them with larger profits. This conviction will be key in supporting a rally.

MATIC Price Prediction: Reclaiming $0.80

MATIC price is bouncing off the $0.65 support at the time of writing, close to breaching through the $0.70 resistance. Given the investors are pining for a price rise, the Polygon token could observe a surge toward $0.81 resistance, provided it flips $0.70 into support.

The Moving Average Convergence Divergence (MACD) indicator shows signs of rising bullishness. MACD is a technical indicator used to identify changes in momentum and potential trend reversals in a security or asset.

The formation of a potential bullish crossover suggests that MATIC price could note a reversal in the coming days. Broader market bullish cues would aid the 21% recovery.

Read More: Polygon (MATIC) Price Prediction 2024/2025/2030

However, if the $0.65 support is broken and the MATIC price falls to $0.60, it would be vulnerable to a decline to $0.53. Hitting this support would invalidate the bullish thesis, causing further losses.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.