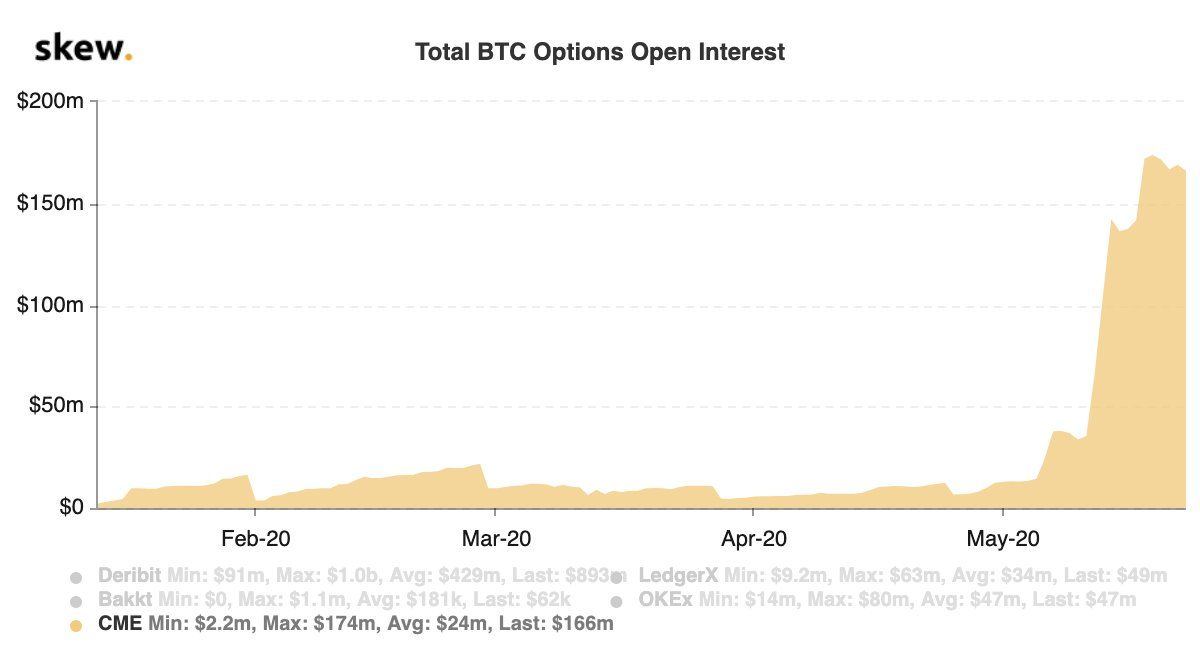

Open interest on Bitcoin futures and options had achieved all-time highs in recent weeks. However, this Friday will see a huge number of those open contracts expire.

Futures and options contracts remain open until a closure date. That date requires traders to either buy or sell the Bitcoin at the contract price. This Friday, the equivalent of 33,000 BTC in open orders will close. The volume is approximately half of all open interest in both products.

Sponsored

The closing of such massive open interest will bring the total open interest back to levels seen a month ago. Open interest on the first cryptocurrency had doubled in recent weeks, as traders bet on substantial price changes.

This represents substantial activity in the market but is not necessarily a harbinger of major price shifts. Swings in open interest have previously represented plentiful short positions.