The Malaysian Securities Commission is warning citizens about unregistered ATMs springing up in the country. This comes as the country’s Sharia Council approved the trading of digital assets.

As cryptocurrency enters the mainstream, some issues will inevitably catch the attention of regulatory bodies. Initial Coin Offerings (ICO) is one such example. Various bodies have warned against sketchy ventures in the emerging space. The latest of these, however, comes from the Malaysian Securities Commission (SC).

In a statement issued on July 8, 2020, the commission cautioned the public against making use of crypto ATMs. According to the SC, it has not granted any entity the right to operate these machines, and the practice is therefore illegal.

SC Speaks Out Against Cryptocurrency ATMs

A cryptocurrency ATM functions like a traditional ATM but allows users to buy or sell cryptocurrencies with ease. This is done through debit and credit cards or via e-wallet links. The number of these machines is steadily rising in the region. Cryptocurrency ATMs are a form of Digital Asset Exchange (DAX). Thus to operate one legally requires registration with the SC. To date, the SC claims that they’ve issued no such licenses. The statement warned members of the public not to conduct business with unlicensed entities and individuals. The SC warned that those who do, would not fall under the protection of Malaysian securities laws. As such, they are at risk of fraud and money laundering. Furthermore, the SC urged all those who are currently operating unregistered cryptocurrency ATMs to cease immediately. Not doing so constitutes a violation of Malaysian securities law which could attract a fine of up to RM10 million, ten years in prison, or both. The statement ended with a call to action asking members of the public to alert the SC of any illegal digital asset operations. It provided a resource for those wishing to verify the validity of digital asset operators in the country. The SC also warned citizens about fraudulent digital asset schemes, which promise unusually high returns.Cryptocurrency ATMs on the Rise Worldwide

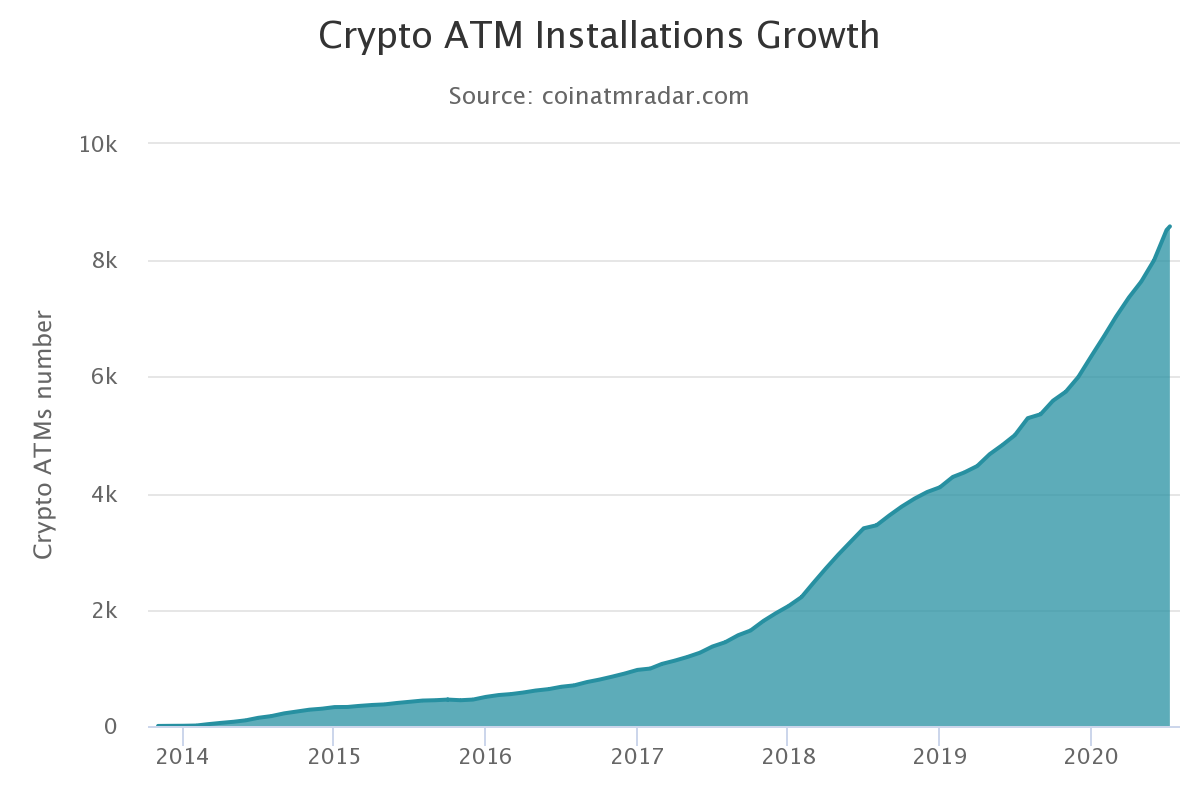

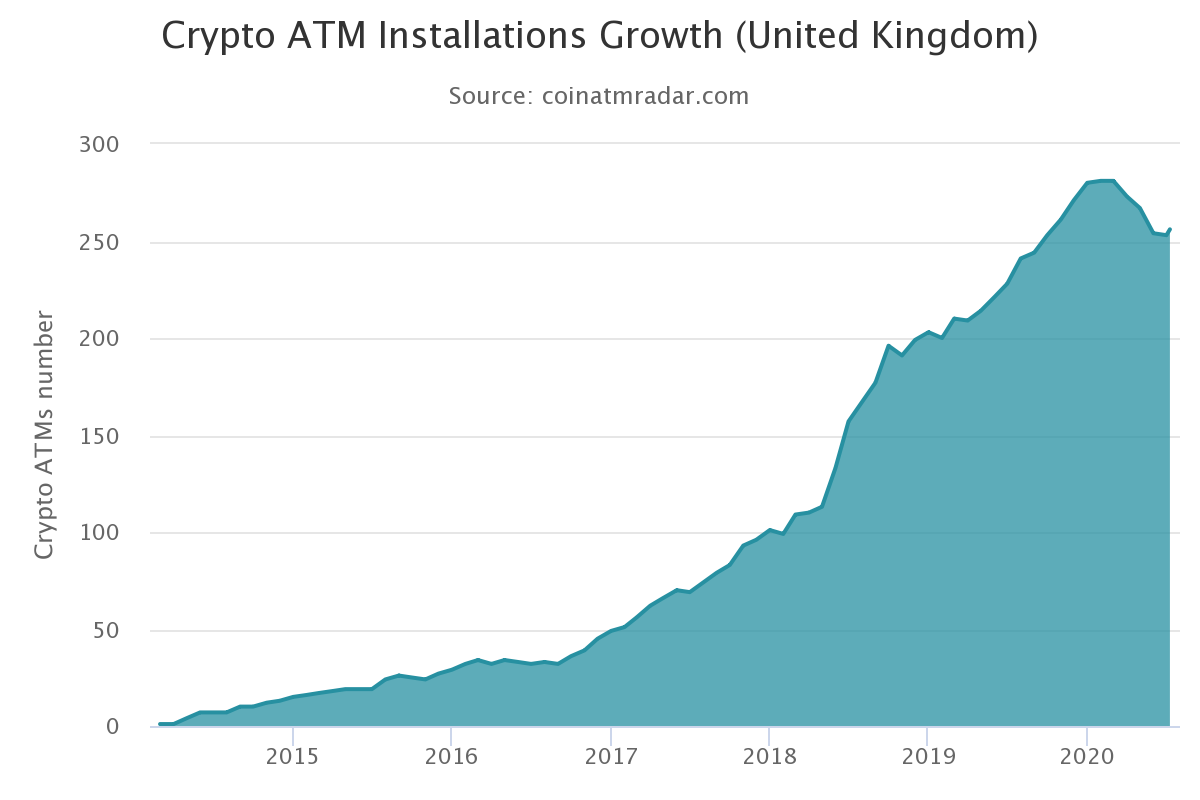

The SC statement was prompted by an increase in cryptocurrency ATMs in Malaysia. The country is not the only one seeing growth, however. Worldwide, numbers are growing at a record pace.

Malaysian Sharia Authority Council Allows Digital Assets

The digital asset industry in Malaysia is rapidly progressing. In a landmark decision, the SC’s Shariah Advisory Council recently permitted the trading of digital assets. The announcement was made in July 2002 by the commission’s chairman Datuk Syed Zaid Albar. The council is responsible for the enforcement of Islamic laws within the Malaysian financial institution. In principle, it decided that the trading of digital currencies is acceptable for Muslims. The endorsement is significant because over 60% of Malaysians are Muslim. The decision will likely boost the industry. Despite some nagging financial issues that still need to be addressed, the digital asset space within Malaysia is growing. Only time will tell what lies ahead for crypto in Southeast Asia.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored