Litecoin crossed the $100 territory briefly on April 19 before the resistance’s sell-off knocked back the price by 10%. But on-chain data reveals thousands of investors are queuing up buy-orders across various crypto exchanges. Will the bulls and strategic whales buy the dip and force the next LTC rally above $110?

Litecoin is an open-source blockchain protocol that prioritizes decentralization and low-cost payment transactions. The LTC native token started April on a positive after a mixed performance in March.

Strong resistance at $100 and industry-wide correction in the altcoin markets have seen LTC drop 10% in the last few days. But strong on-chain fundamentals and high demand from strategic investors indicate that a rebound is imminent.

Crypto Investors Queueing to Buy LTC

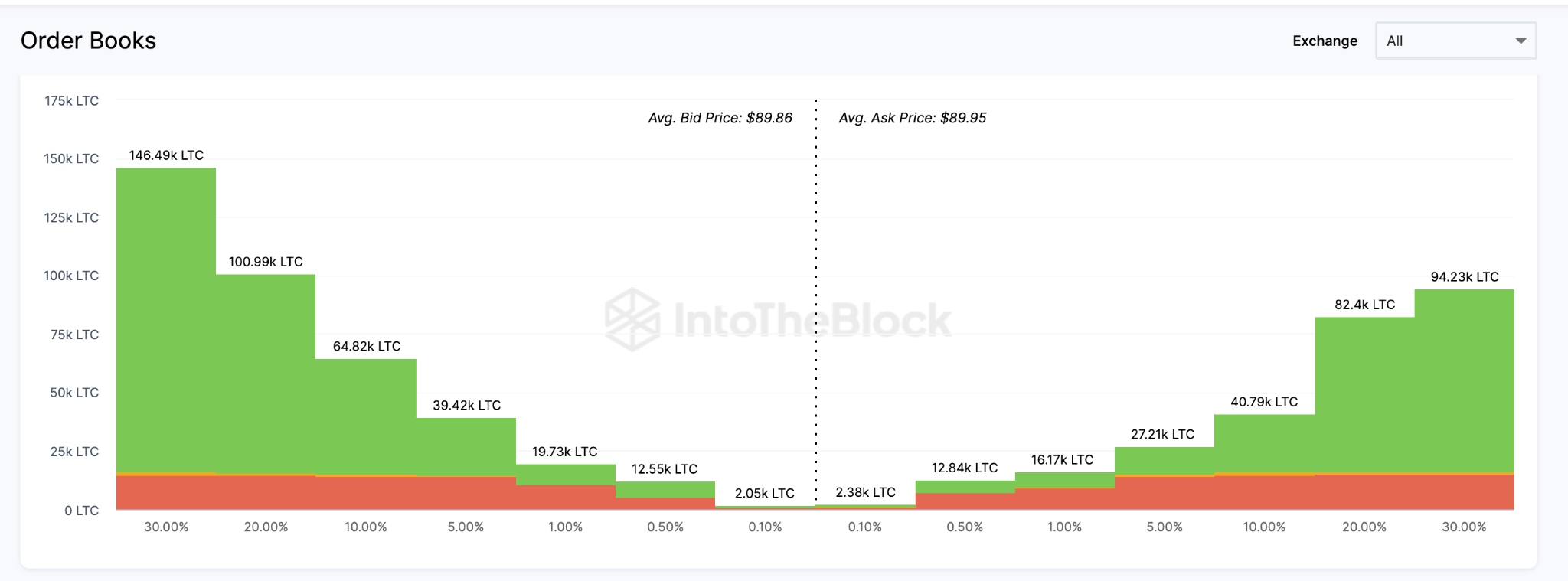

Litecoin is in high demand, according to the data gleaned from the order books of leading crypto exchanges. The current market situation shows an excess of buy-orders for Litecoin (LTC), with 385,000 coins requested by buyers while only 276,000 sell-orders are available.

The Exchange Market Depth chart in the image above shows the aggregate price distribution of market orders placed on various exchanges by crypto investors.

This mismatch between market supply and demand is a bullish signal indicating that buyers may be willing to pay a premium price to acquire Litecoin. As a result, LTC prices could experience an upward trend in the coming days.

Strategic Whales Accumulate 43K LTC – Bullish Signal?

Real-time data tracking the wallet Crypto Whales that hold balances of 100,000 to 1 million LTC shows that they have started buying again. Interestingly, this group of whales had been selling since Litecoin first crossed $90 in January 2023.

The chart below shows how they have recently added 43,000 coins worth approximately $4 million in seven consecutive days of accumulation between April 15 and April 21.

Largely, this signals that institutional and high-net-worth investors are growing confident and positioning for positive future price movements. Also, it is important to note that this particular whale cohort’s past buy/sell pattern has been closely correlated with LTC price.

If this pattern repeats, Litecoin will likely experience some price gains in the coming days.

LTC Price Prediction: $110 Resistance Could Soon Give Way

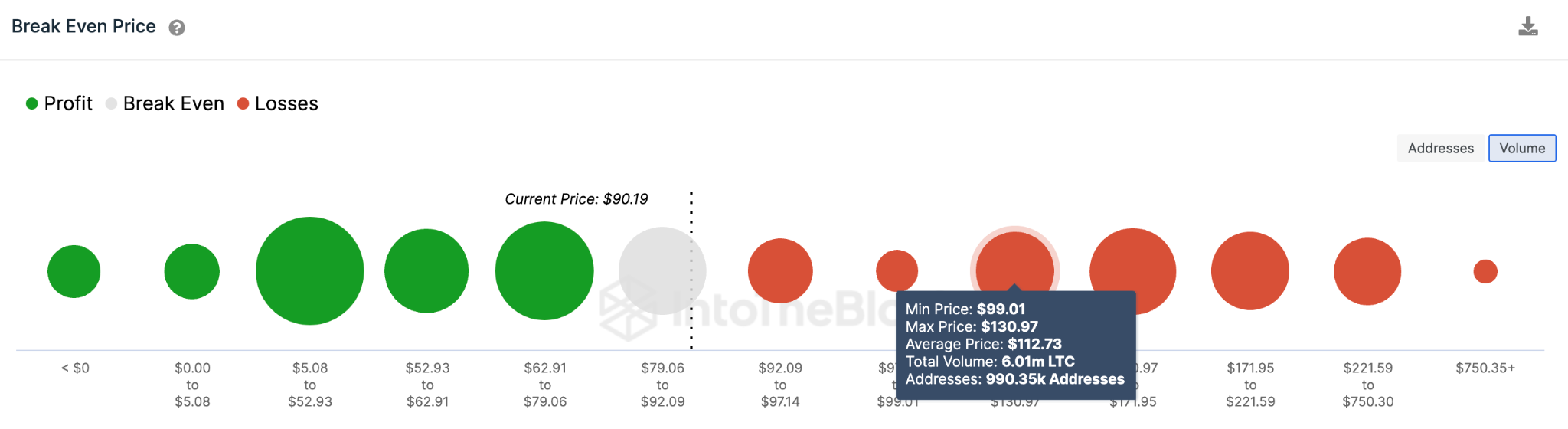

Litecoin’s recent rally was rejected at around $101, but the break-even price distribution of holders suggests that the next one will be as high as $112.

However, LTC first has to clear the initial resistance around $94. But the 450,000 addresses holding a total of 3.45 million coins could look to sell once they break even.

If the bullish momentum can overpower that resistance, then LTC could move as high as $112. Around that zone, there’s a more significant sell-wall of 990,000 addresses holding 6 million coins.

Still, the bears may stay in control if LTC slips below $86. But a bullish response from 614,000 holders with 8.27 million coins is expected to prevent that. If the $86 support level does not hold, the Litecoin price could retest $70.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.