Litecoin (LTC) price has once again broken above the critical $90 resistance over the weekend. Will the growing adoption rate convince other bullish stakeholders to buy into the bullish LTC price movement?

Despite the Litecoin miners‘ ongoing sell-off, LTC has now traded above $85 for 14 consecutive days. According to the underlying on-chain data, this strong performance can be attributed to the growing adoption rate across the Litecoin network.

Here’s an in-depth analysis of why strategic crypto investors are buying into the Litecoin price rally.

Litecoin Adoption Rate is on the Rise

Market participants ranging from Retail investors to large industry players have been increasingly adopting Litecoin for their cryptocurrency transactions. Indicatively, LTC Transaction Volume has almost doubled from the figures recorded last month.

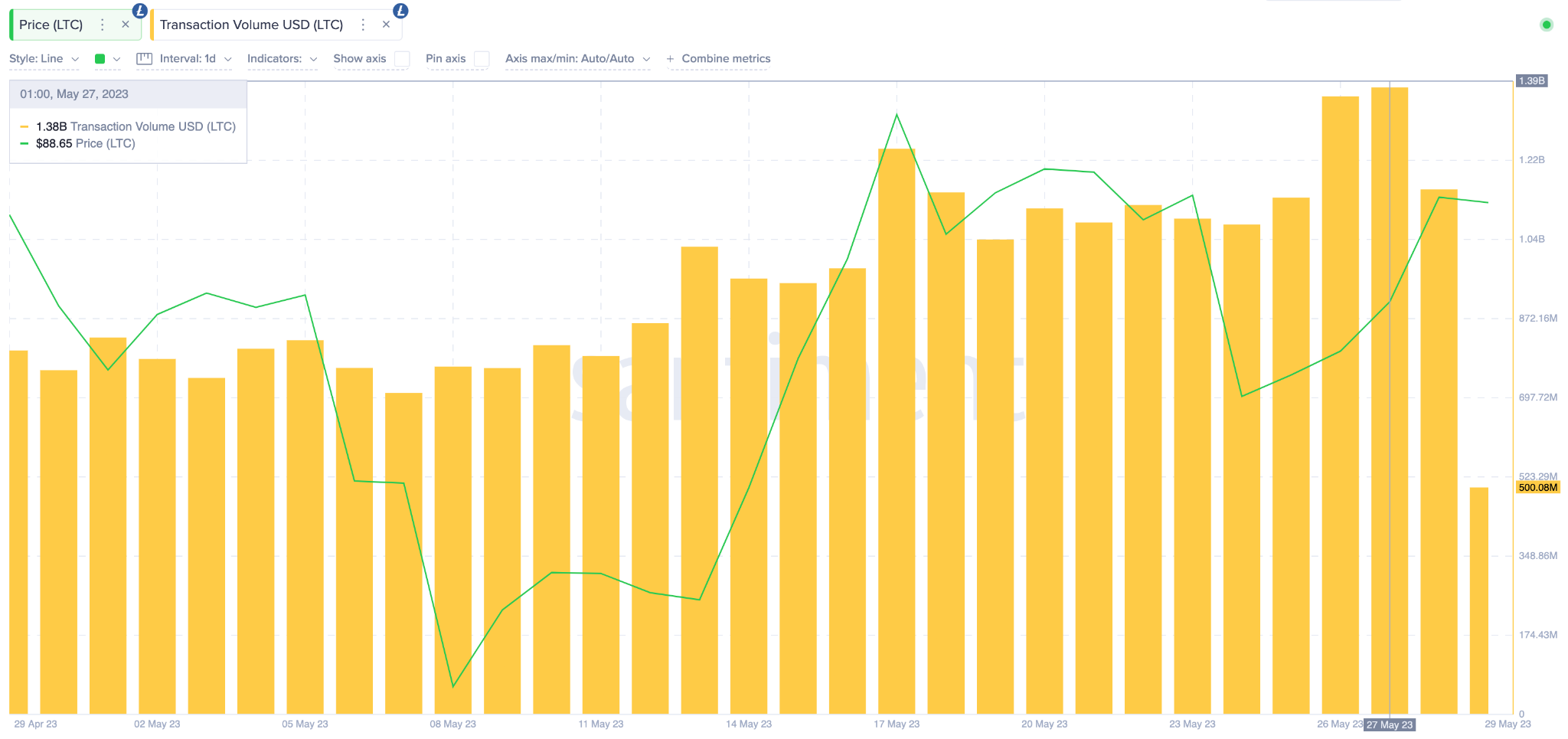

The chart below depicts how it rose 82% from $758.4 million on April 30 to a recent peak of $1.38 billion on May 27.

Notably, the last time Litecoin’s Daily Transaction Volume reached these heights was more than 4 months ago, on January 17.

Quite literally, Transaction Volume sums up the dollar value of LTC transactions that occur on a given day. When it rises, it indicates growing economic activity as the underlying network gains market share.

Historically, Litecoin price has increased whenever there is a sustained spike in transactional activity. If this pattern repeats, LTC holders can anticipate more price upswing.

Litecoin Adoption Rate is Growing Faster Than Price Action

Despite recent LTC price gains, on-chain data shows that the Litecoin adoption rate has been growing much faster. While the price has grown 4% this month, transaction volumes have surged more than 82%.

This apparent undervaluation is captured by the drop in Network Value to Transaction Volume (NVT) ratio. The chart below shows how the Litecoin NVT ratio has dropped 35% from 8.67. to 5.67 between April 30 and May 29, 2023.

Typically, the NVT ratio tracks the relationship between a cryptocurrency’s market capitalization and the underlying transactional activity. When it drops persistently, as observed above, it indicates that the asset is undervalued and could.

If strategic investors buy into the positive market sentiment, Litecoin is poised for more price gains in the coming days.

In summary, the low NVT ratio and rising transaction volumes could see Litecoin witness increased demand to validate bullish LTC price predictions.

LTC Price Prediction: Bulls Gunning for $100

The overwhelming sentiment surrounding Litecoin at the moment supports the prediction that LTC price will reach $100 in the coming days.

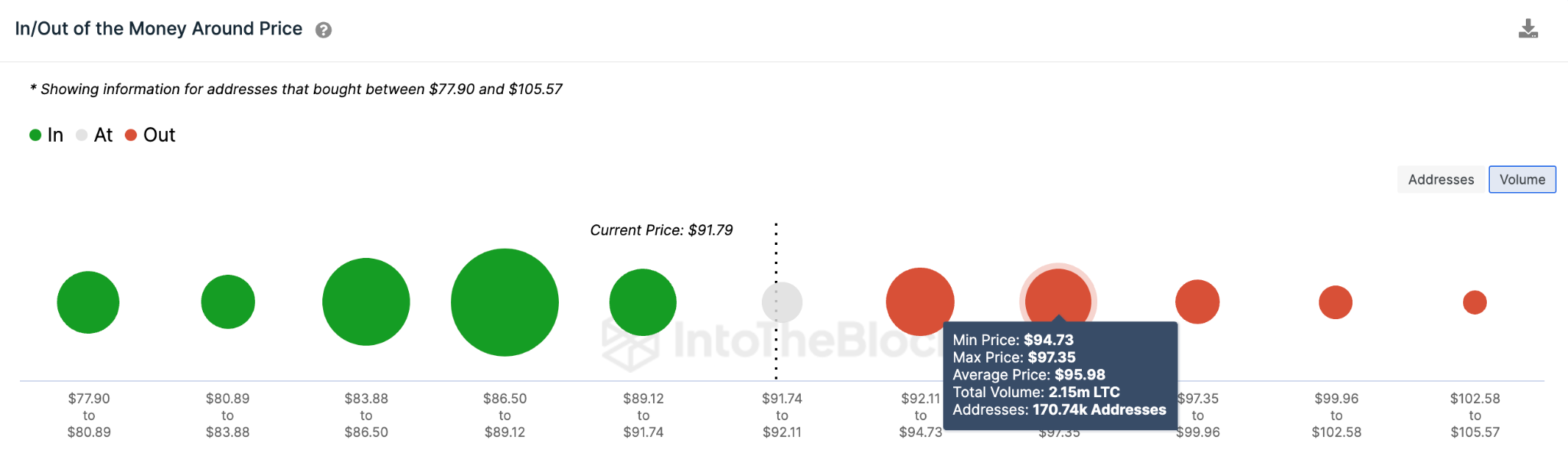

However, IntoTheBlock’s In/Out of The Money Around Price (IOMAP) data suggests that LTC will face an initial resistance of around $96.

As seen below, 170,000 investors that bought 2.15 million LTC at an average price of $96 could sell once they break even.

However, if the bullish momentum prevails, as expected, the price could climb further toward $105. With resistance levels seeing only a handful of smaller groups that bought LTC at $98, $100, and $103.

Still, the bears could negate the bullish Litecoin price prediction if LTC unexpectedly loses the critical $90. But, the 280,000 investors that purchased 2.26 million LTC at an average price of $90 will likely prevent the drop.

Although unlikely, LTC could retrace further toward $80 if that support level is breached.

However, a massive cluster of 623,000 wallets currently holds the line at an average buy of $87. With 8 million LTC being purchased here, it would be a tall order for bears to break through that support.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.