The Litecoin (LTC) price is down 14% from its recent high of $101 recorded on April 18. An outlier Miner reserve offloading event has sparked bearish concerns across the Litecoin ecosystem. How much would it impact LTC price action in the coming days?

When the Litecoin (LTC) community began a 100-day countdown to the next halving event, bullish speculators anticipated an accumulation trend among miners. But instead, on-chain data currently paints a contrary picture.

Miners Offload $170 Million Worth of Litecoin

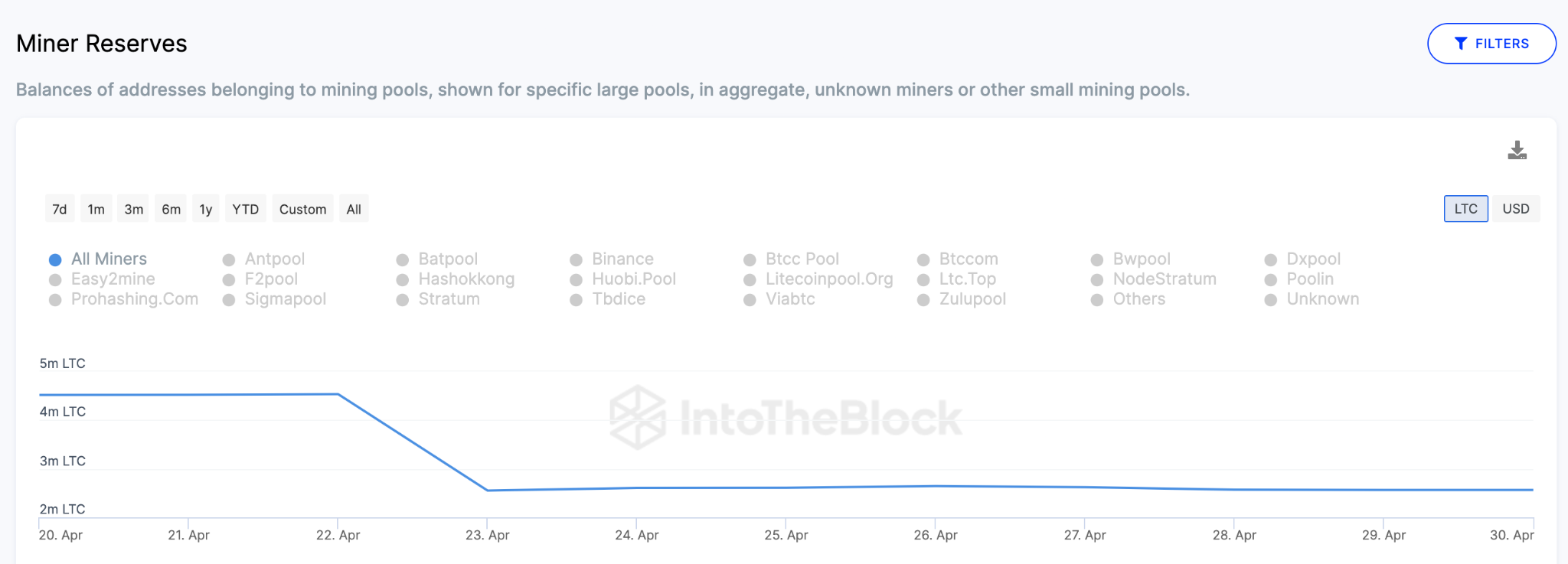

On-chain data compiled by IntoTheBlock shows that Litecoin miners depleted their reserves considerably in a shock move at the close of April.

As of May 1, LTC miner reserves stood at 2.56 million coins. But the chart below depicts how the miners reduced their balances from 4.53 million LTC to 2.55 million LTC between April 22 and 23.

Miner reserves refer to the amount of cryptocurrency that miners hold and have yet to sell. Investors often interpret a sharp decline in miner reserves as a bearish signal as it indicates that miners are selling more of their block rewards.

At current market prices of $88, the coins offloaded by the miners are worth $174 million approximately. Holders can anticipate an impending price decline if the demand for LTC does not keep up with the increased market supply from the miners.

Crypto Whales Are Sitting on the Sidelines

Interestingly, Litecoin whales holding between 1,000 to 100,000 coins appear to be taking a hawkish position as miners flood the market. The chart below shows how the whales began to sell, just as the miners flooded the market on April 23.

Between April 23 and April 28, they reduced their balances by 340,000 coins worth approximately $30 million at the current market value of $88.

Whales are large investors, typically holding at least $100,000 worth of a crypto. Due to their huge financial power, their buy/sell patterns can considerably impact an asset’s price.

As of May 1, the whales as mentioned above, have not made any significant moves. Instead, they have held their balances close to 22.37 million LTC for the last 5 trading days.

Summing up, unless the whales move to acquire some of the excess supply issued by the miners, investors can expect the LTC price to decline in the coming days.

LTC Price Prediction: A Bearish Reversal to $80 Seems Likely

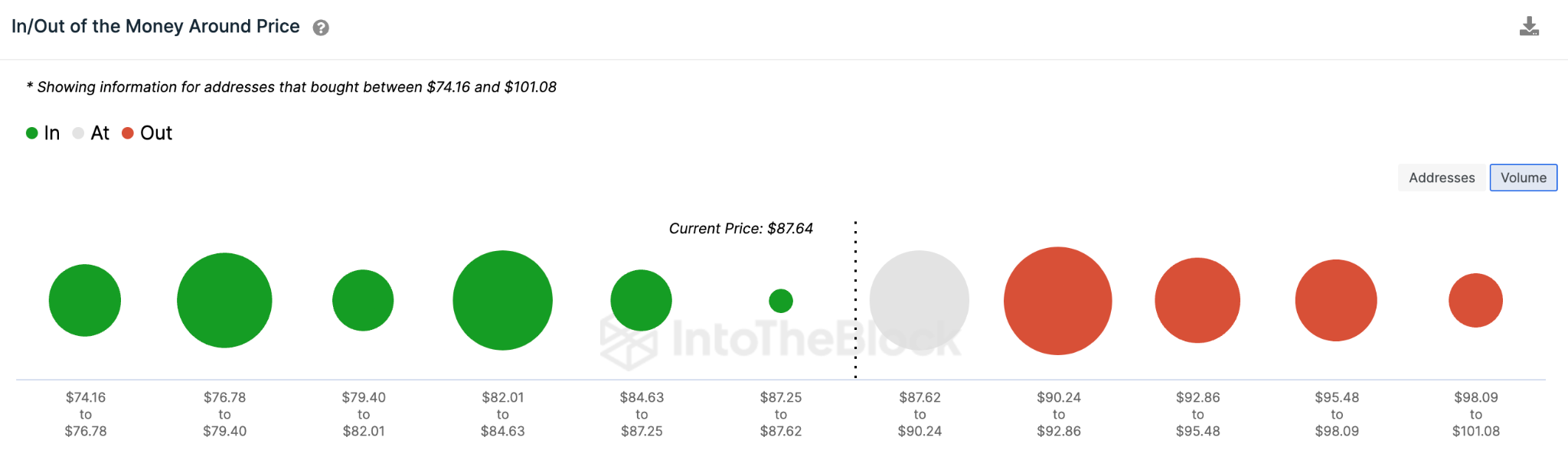

Looking at the Global In/Out of Money Around Price data, Litecoin price looks likely to drop below $80. Although a cluster of 116,000 wallets holding 370 million could offer considerable support around the $83 mark.

However, if the bearish outlook plays out as expected, the LTC price could slump until it reaches a more significant support level at $77.

Still, if the bulls push the LTC price above $90, they can invalidate this bearish narrative. But first, they would have to overcome the potential sell-pressure from 255,000 addresses holding 3.7 million Litecoin.

If they successfully breach that $90 resistance, then LTC holders can anticipate a price rally toward the recent local peak of $101.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.