The Bitcoin Dominance Rate (BTCD) has been rejected by a long-term resistance area at 71.5%, above which it has not consistently traded since 2017.

A short-term BTCD decline towards the support levels at 61 – 64% is likely, paving the way for an alt relief rally.

BTCD Reaches Resistance

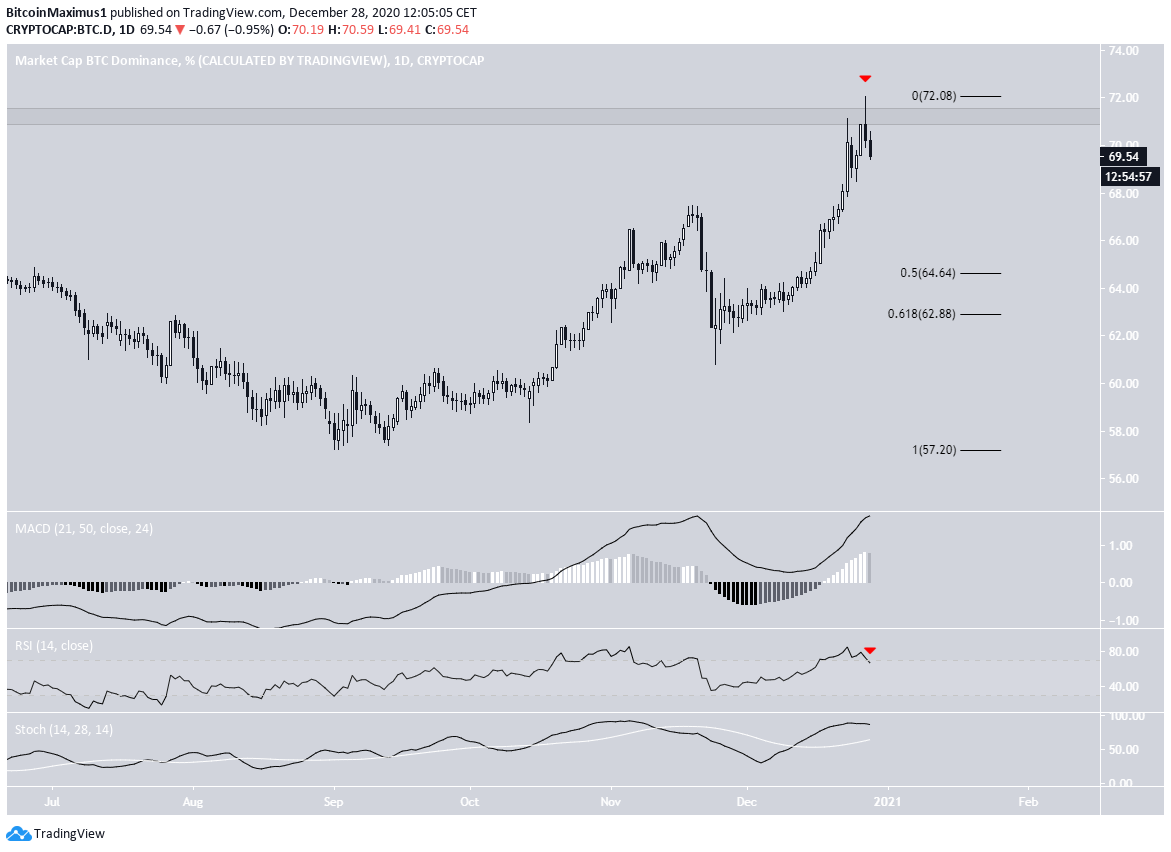

The weekly chart shows that BTCD has broken out from a descending resistance line that had previously been in place since Aug. 2019. After breaking out, BTCD continued its ascent until it reached a high of 72.05%.

The high served to validate the 71.5% area as resistance, but BTCD failed to break out. If successful in doing so, the next resistance area would be around 84%.

Despite the rejection, technical indicators are still bullish, supporting the possibility that BTCD will eventually break out.

Possible Correction

The daily chart for BTCD shows that the current upward move has been ongoing since the beginning of Sept. A possible rejection could cause BTCD to drop towards 62.8 – 64.4%, the 0.5-0.618 Fib retracement levels.

Despite the daily rejection, technical indicators do not yet confirm this upward move.

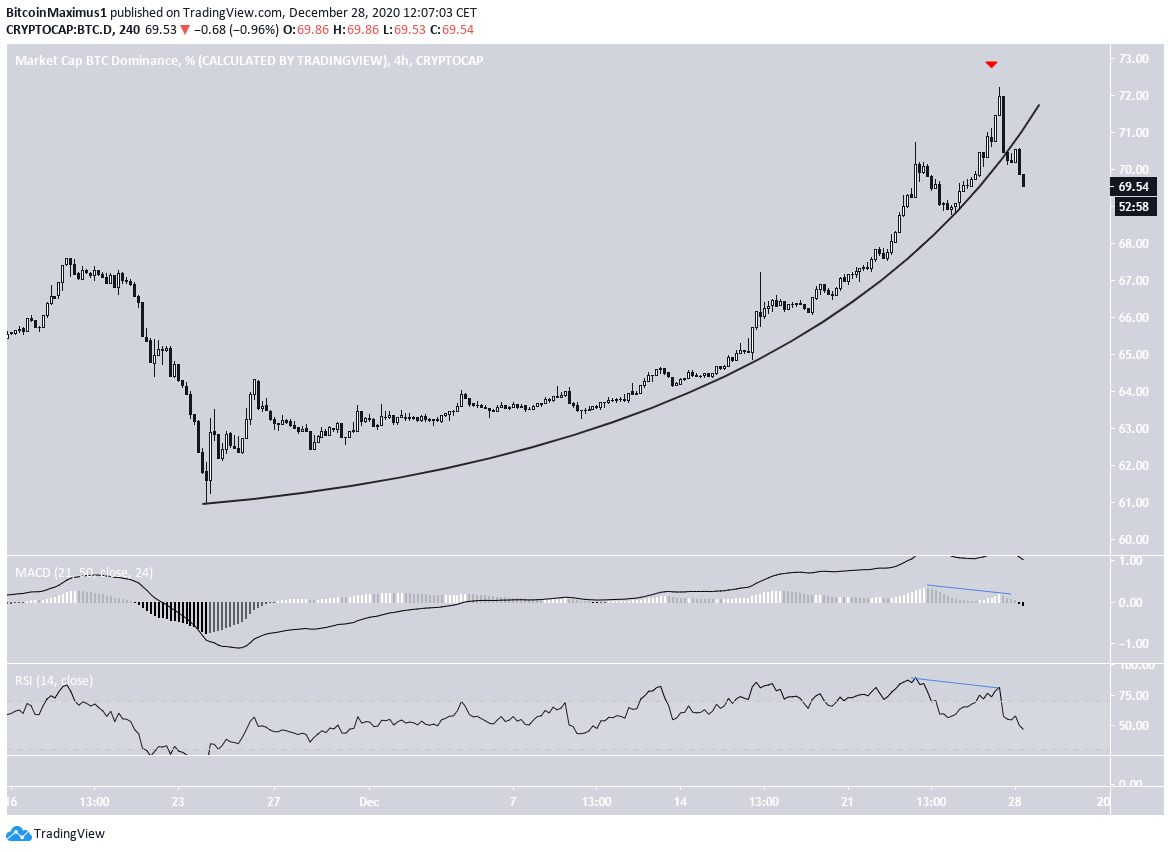

The shorter-term four-hour chart shows that a parabolic ascending support line that had been in place since Nov. 23 has been broken, suggesting that BTCD is heading lower.

Furthermore, technical indicators are bearish, further supporting the possibility of a drop towards 62 – 64%.

Altcoin Perpetual Index (ALTPERP)

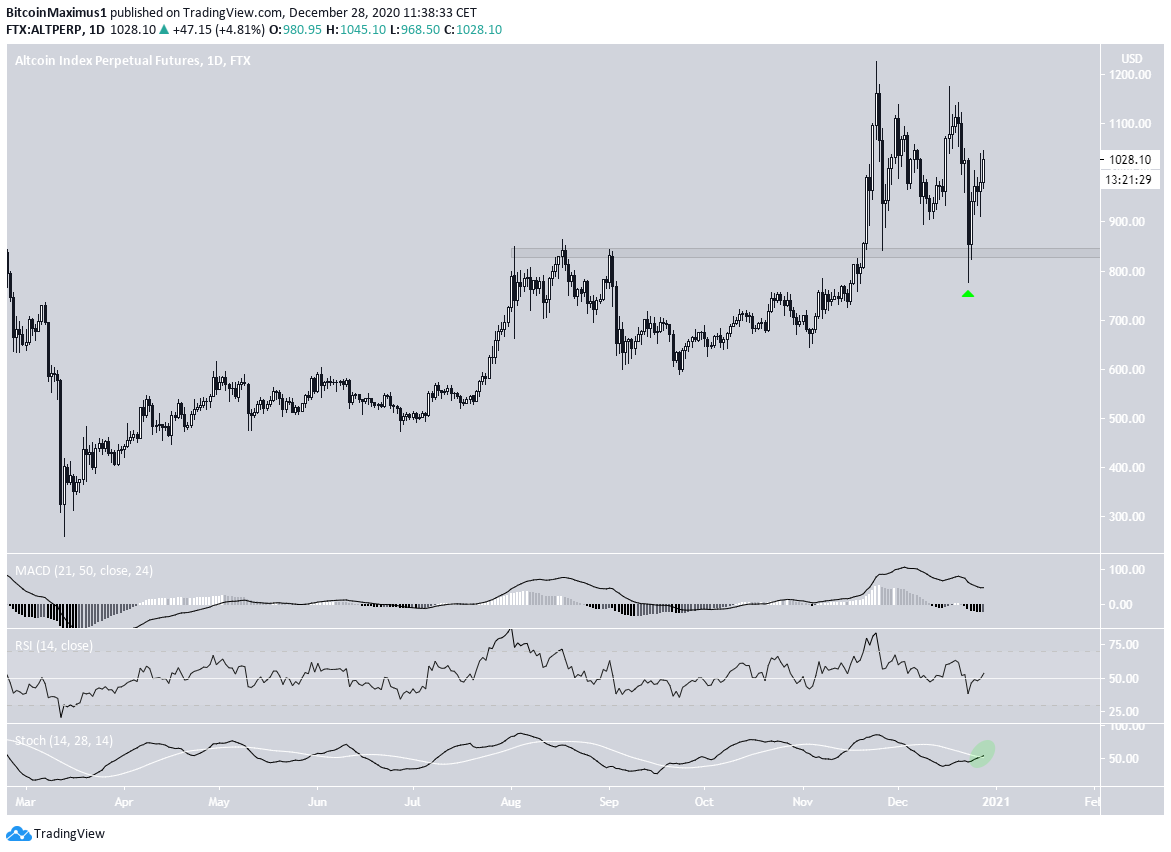

Cryptocurrency trader @TheEWguy outlined an ALTPERP chart, stating that the index has decreased considerably and is now expected to bounce.

The daily chart shows that on Dec. 23, ALTPERP declined and reached a low of $777. However, this only served to validate the $840 area as support, before ALTPERP created a long lower wick and bounced again.

Currently, it is making another attempt at reaching the Nov. 24 highs at $12,26.

Technical indicators are neutral, since while the MACD is decreasing, the RSI is right at 50. The Stochastic Oscillator has just made a bullish cross.

Furthermore, the movement since the previous Nov. 24 highs looks like a completed A-B-C corrective structure, fitting perfectly inside a parallel descending channel.

A breakout above the channel would indicate that ALTPERP is heading higher. A loss of the $900 support area would place this possibility in doubt.

BTCD Conclusion

To conclude, while it’is possible that the long-term BTCD trend is bearish, a short-term decline is expected after the rejection from the 71.5% area.

An analysis of the outlook for the Altcoin Perpetual Futures Index (ALTPERP) also supports this potential relief rally for alts.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.